Region:Asia

Author(s):Geetanshi

Product Code:KRAA1963

Pages:95

Published On:August 2025

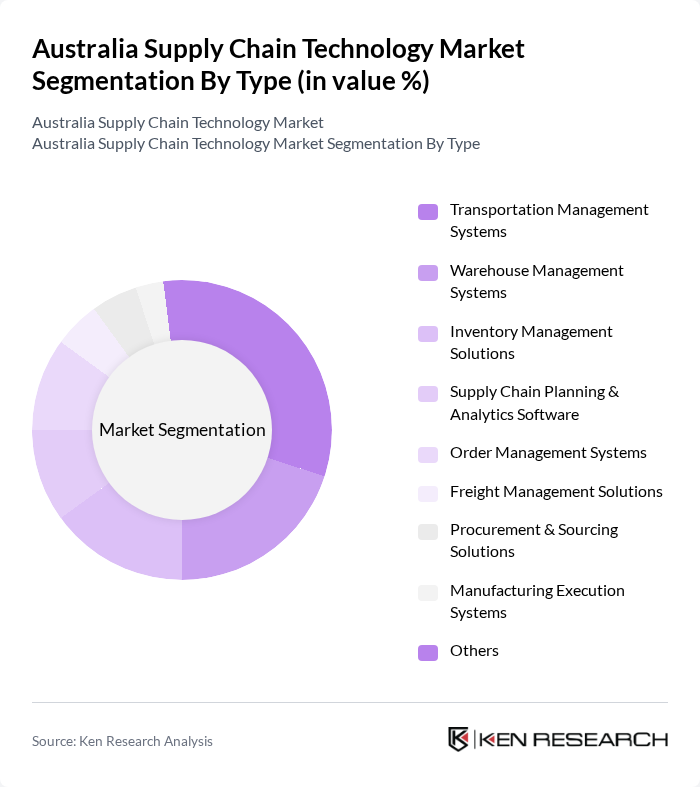

By Type:The market is segmented into various types, including Transportation Management Systems, Warehouse Management Systems, Inventory Management Solutions, Supply Chain Planning & Analytics Software, Order Management Systems, Freight Management Solutions, Procurement & Sourcing Solutions, Manufacturing Execution Systems, and Others. Among these, Transportation Management Systems are currently leading the market due to the increasing need for efficient logistics and transportation solutions. Businesses are focusing on optimizing their supply chain operations, which drives the demand for advanced transportation management solutions. The adoption of Order Management Systems and Warehouse Management Systems is also accelerating as companies seek smarter fulfillment and scalable operations .

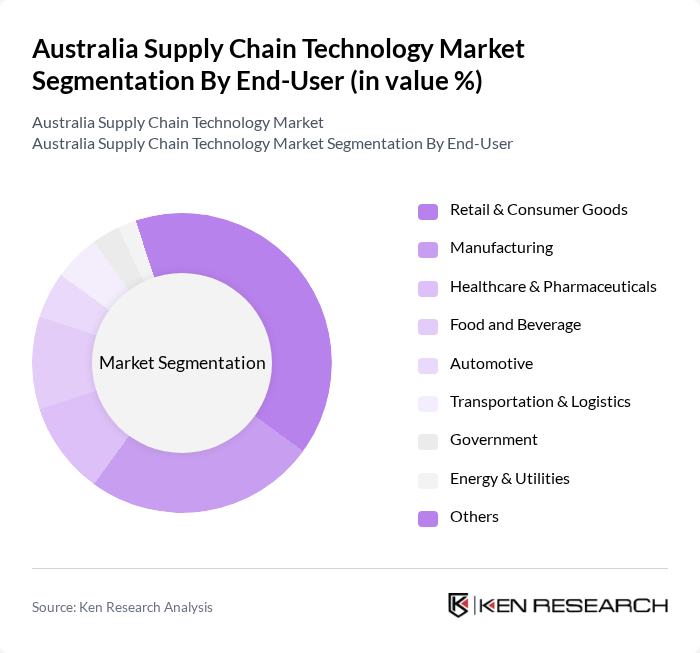

By End-User:The end-user segmentation includes Retail & Consumer Goods, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, Transportation & Logistics, Government, Energy & Utilities, and Others. The Retail & Consumer Goods sector is the dominant end-user, driven by the increasing demand for efficient supply chain solutions to manage inventory and logistics effectively. The rise of e-commerce and the need for real-time inventory precision have further accelerated the adoption of advanced supply chain technologies in this sector .

The Australia Supply Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Blue Yonder (formerly JDA Software Group, Inc.), Manhattan Associates, Inc., Infor, Inc., Kinaxis Inc., IBM Corporation, Coupa Software Incorporated, Descartes Systems Group Inc., E2open, LLC, Logility, Inc., FourKites, Inc., Project44, Inc., Toll Group, Linfox Pty Ltd, Australia Post, WiseTech Global Limited, Zebra Technologies Corporation, Dematic Pty Ltd, Microlistics Pty Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian supply chain technology market appears promising, driven by ongoing advancements in automation and data analytics. As businesses increasingly adopt real-time data solutions, the focus will shift towards enhancing supply chain visibility and collaboration. Moreover, the integration of artificial intelligence and machine learning will play a pivotal role in optimizing operations, enabling companies to respond swiftly to market changes and consumer demands, thereby fostering a more agile supply chain ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Systems Warehouse Management Systems Inventory Management Solutions Supply Chain Planning & Analytics Software Order Management Systems Freight Management Solutions Procurement & Sourcing Solutions Manufacturing Execution Systems Others |

| By End-User | Retail & Consumer Goods Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Transportation & Logistics Government Energy & Utilities Others |

| By Component | Software Hardware Services (Professional & Managed) |

| By Deployment Mode | Cloud On-premises |

| By Enterprise Size | Small & Medium Enterprises (SMEs) Large Enterprises |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | B2B B2C |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| By Region | New South Wales & ACT Victoria & Tasmania Queensland Northern Territory & South Australia Western Australia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Technology Adoption | 100 | Supply Chain Managers, IT Directors |

| Manufacturing Process Automation | 60 | Operations Managers, Production Supervisors |

| Logistics and Transportation Innovations | 50 | Logistics Coordinators, Fleet Managers |

| Warehouse Management Systems | 40 | Warehouse Managers, Inventory Control Specialists |

| Supply Chain Sustainability Initiatives | 40 | Sustainability Managers, Compliance Managers |

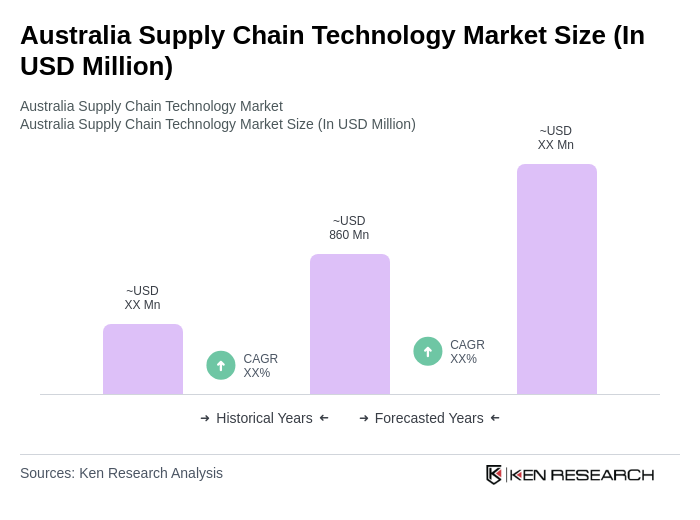

The Australia Supply Chain Technology Market is valued at approximately USD 860 million, reflecting significant growth driven by the adoption of advanced technologies such as AI, IoT, and blockchain, which enhance operational efficiency and transparency in supply chains.