Region:Europe

Author(s):Shubham

Product Code:KRAA0852

Pages:84

Published On:August 2025

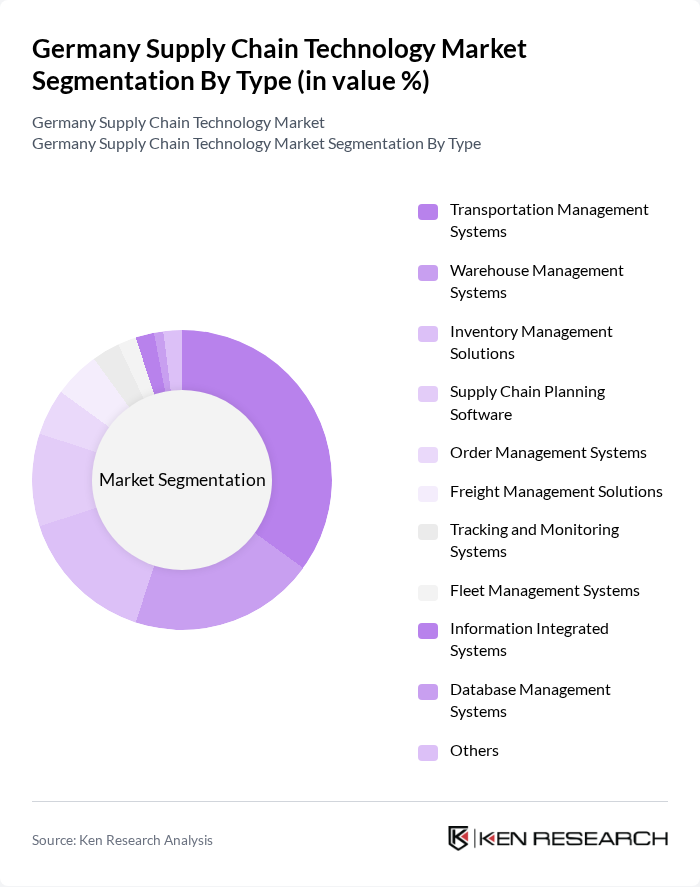

By Type:The segmentation by type includes various solutions that cater to different aspects of supply chain management. The subsegments are as follows:

The Transportation Management Systems (TMS) segment is currently leading the market due to the increasing need for efficient logistics and transportation solutions. Companies are investing in TMS to optimize their shipping processes, reduce costs, and improve delivery times. The rise of e-commerce has further accelerated the demand for TMS, as businesses seek to enhance their logistics capabilities to meet customer expectations. Additionally, advancements in technology, such as AI and machine learning, are driving innovation in this segment, making it a key focus for supply chain technology providers .

By End-User:The segmentation by end-user includes various industries that utilize supply chain technology solutions. The subsegments are as follows:

The Retail sector is the dominant end-user of supply chain technology solutions, driven by the rapid growth of e-commerce and the need for efficient inventory management. Retailers are increasingly adopting advanced technologies to streamline their supply chains, enhance customer experience, and respond quickly to market changes. The integration of supply chain solutions allows retailers to optimize their operations, reduce costs, and improve service levels, making it a critical area for investment and innovation in the supply chain technology market .

The Germany Supply Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Siemens AG, Oracle Corporation, IBM Corporation, Blue Yonder (formerly JDA Software), Infor, Manhattan Associates, Kinaxis, Coupa Software, Descartes Systems Group, Transporeon (a Trimble company), FourKites, Siemens Digital Logistics, Körber Supply Chain, INFORM GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany supply chain technology market appears promising, driven by ongoing advancements in automation and digitalization. Companies are increasingly prioritizing end-to-end visibility and real-time analytics to enhance operational efficiency. Furthermore, the integration of AI and machine learning is expected to revolutionize supply chain processes, enabling predictive analytics and smarter decision-making. As businesses adapt to evolving consumer demands, the focus on sustainability and resilience will shape the market landscape, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Systems Warehouse Management Systems Inventory Management Solutions Supply Chain Planning Software Order Management Systems Freight Management Solutions Tracking and Monitoring Systems Fleet Management Systems Information Integrated Systems Database Management Systems Others |

| By End-User | Retail Manufacturing Healthcare Automotive Food and Beverage E-commerce Logistics Service Providers Pharmaceuticals Others |

| By Component | Software Hardware Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Road Rail Air Sea |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions |

| By Application | Supply Chain Visibility Demand Forecasting Risk Management Performance Measurement Real-Time Analytics Route Optimization Sustainability/Green Logistics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Supply Chain Technology | 60 | Supply Chain Managers, IT Directors |

| Retail Logistics Innovations | 50 | Operations Managers, E-commerce Directors |

| Pharmaceutical Distribution Systems | 40 | Logistics Coordinators, Compliance Officers |

| Manufacturing Process Optimization | 55 | Production Managers, Supply Chain Analysts |

| Technology Adoption in Warehousing | 45 | Warehouse Managers, Technology Officers |

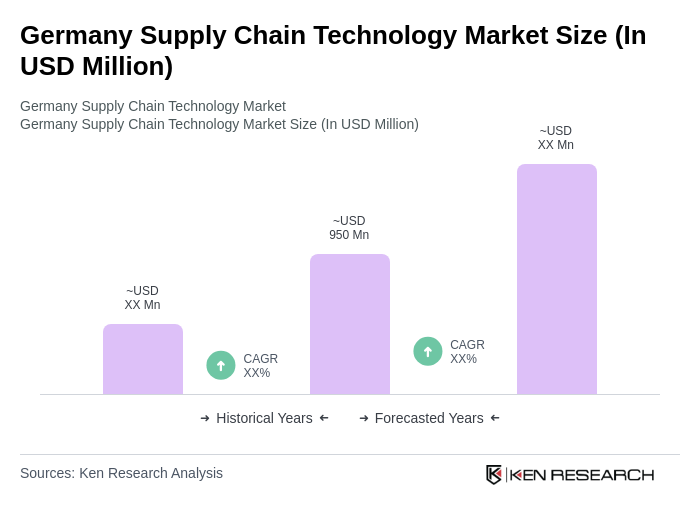

The Germany Supply Chain Technology Market is valued at approximately USD 950 million, driven by the increasing demand for automation, real-time data analytics, and enhanced operational efficiency across various industries, particularly in logistics and e-commerce.