Region:Asia

Author(s):Shubham

Product Code:KRAA0988

Pages:91

Published On:August 2025

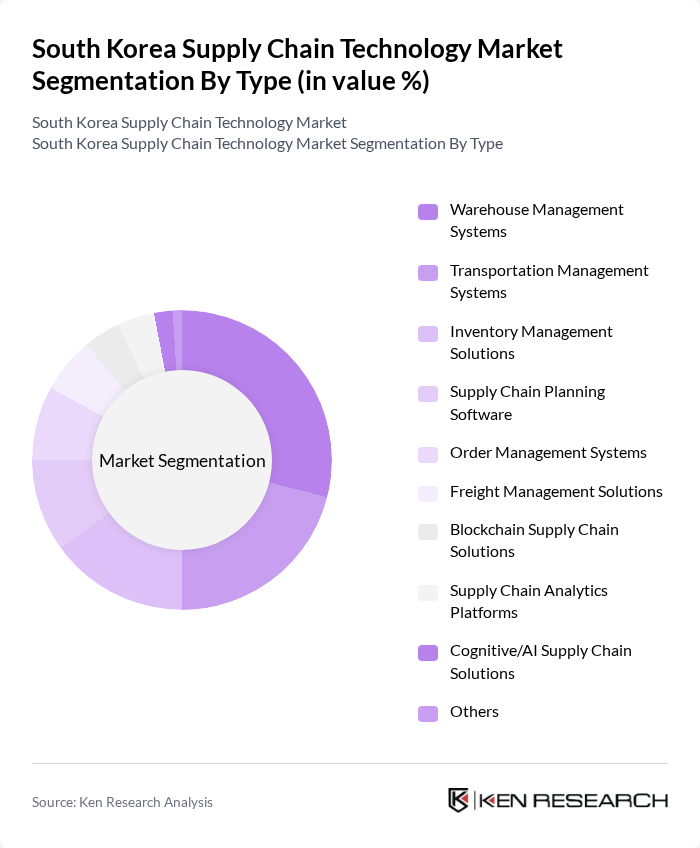

By Type:The market is segmented into various types, including Warehouse Management Systems, Transportation Management Systems, Inventory Management Solutions, Supply Chain Planning Software, Order Management Systems, Freight Management Solutions, Blockchain Supply Chain Solutions, Supply Chain Analytics Platforms, Cognitive/AI Supply Chain Solutions, and Others. Among these, Warehouse Management Systems are currently leading the market due to the increasing need for efficient inventory management and order fulfillment processes. The rise of e-commerce has further accelerated the demand for these systems, as businesses seek to optimize their warehousing operations .

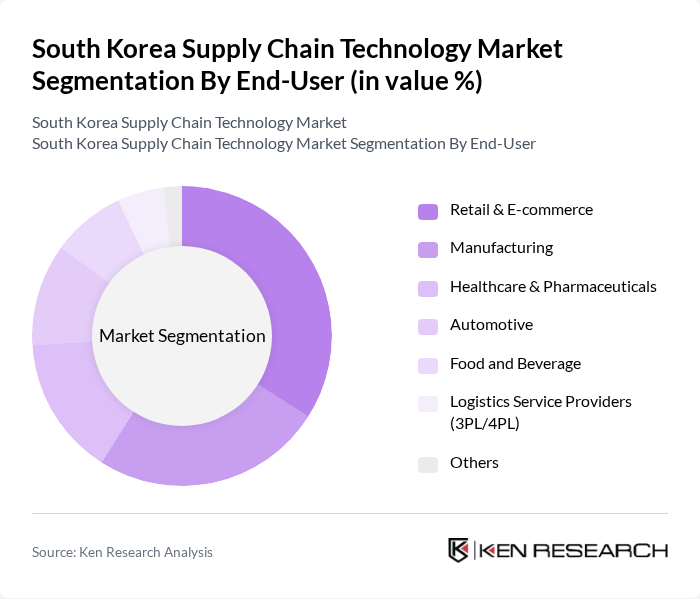

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food and Beverage, Logistics Service Providers (3PL/4PL), and Others. The Retail & E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the need for efficient supply chain solutions to manage high volumes of orders and returns. This sector's increasing reliance on technology to enhance customer experience and streamline operations has solidified its leading position in the market .

The South Korea Supply Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung SDS, LG CNS, SK Holdings, Hyundai Glovis, CJ Logistics, Lotte Global Logistics, Hanjin Transportation, Pantos Logistics, Daewoo Logistics, Hanon Systems, GS Caltex, KT Corporation, Naver Corporation, Coupang, POSCO International, CJ OliveNetworks, SAP Korea, Oracle Korea, IBM Korea, Cello Square (by Samsung SDS) contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean supply chain technology market is poised for transformative growth, driven by advancements in automation and digitalization. As companies increasingly adopt AI and IoT solutions, operational efficiencies will improve, leading to enhanced customer experiences. Furthermore, the government's commitment to smart logistics will likely foster innovation. However, addressing workforce challenges and investment barriers will be crucial for sustaining this momentum. Overall, the market is expected to evolve rapidly, adapting to changing consumer demands and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehouse Management Systems Transportation Management Systems Inventory Management Solutions Supply Chain Planning Software Order Management Systems Freight Management Solutions Blockchain Supply Chain Solutions Supply Chain Analytics Platforms Cognitive/AI Supply Chain Solutions Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food and Beverage Logistics Service Providers (3PL/4PL) Others |

| By Component | Software Hardware Services |

| By Deployment Mode | On-Premise Cloud-Based |

| By Distribution Mode | B2B B2C |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Technology | 100 | Supply Chain Managers, IT Directors |

| Logistics and Transportation Solutions | 80 | Logistics Coordinators, Operations Managers |

| Retail Supply Chain Innovations | 60 | Retail Operations Heads, E-commerce Managers |

| Technology Adoption in SMEs | 50 | Small Business Owners, Technology Officers |

| Government and Policy Impact on Supply Chains | 40 | Policy Makers, Industry Analysts |

The South Korea Supply Chain Technology Market is valued at approximately USD 8.9 billion, reflecting a significant growth trend driven by the adoption of advanced technologies like AI, IoT, and blockchain, enhancing operational efficiency and transparency in supply chains.