Region:Middle East

Author(s):Shubham

Product Code:KRAA1141

Pages:95

Published On:August 2025

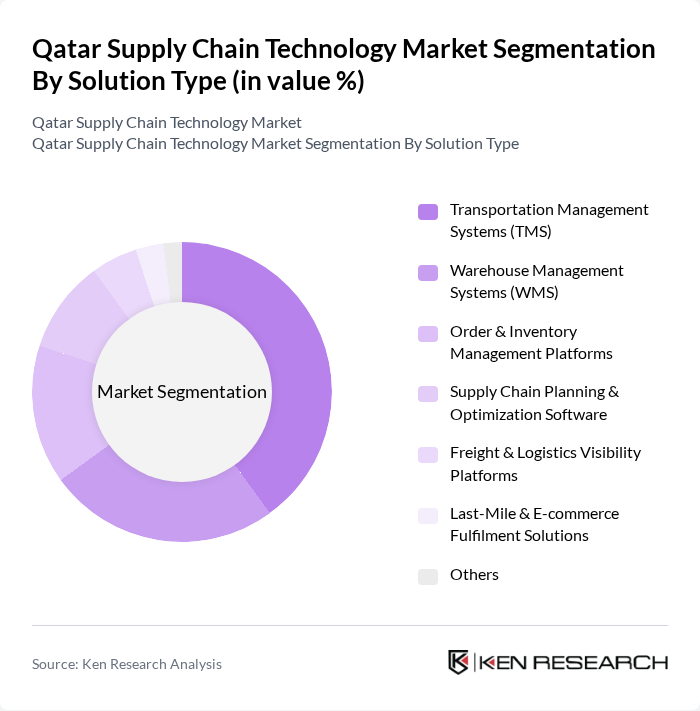

By Solution Type:The solution type segmentation includes a broad range of technologies that enhance supply chain efficiency and visibility across planning, execution, and monitoring layers. Supply Chain Management Software (SCM) is a core and increasingly dominant sub-segment, widely adopted to integrate planning, procurement, inventory, and logistics workflows and to enable data-driven decision-making. Transportation Management Systems (TMS) and Warehouse Management Systems (WMS) are also critical, as companies look to optimize routing, reduce transport costs, and improve storage, inventory accuracy, and order fulfillment to support growing e-commerce and omnichannel models. Additional solutions such as inventory optimization, order management platforms, freight and fleet management, last-mile delivery platforms, and real-time visibility and tracking solutions are being deployed to automate processes, enhance customer service levels, and support IoT- and AI-enabled operations.

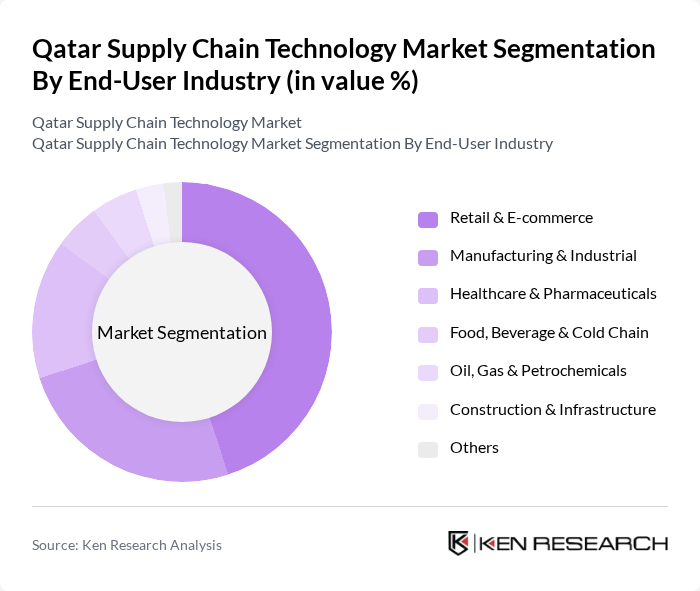

By End-User Industry:The end-user industry segmentation reflects adoption of supply chain technology across multiple sectors in Qatar. The retail and e-commerce sector is the leading segment, supported by rapid growth in online retail and parcel volumes and the need for agile, digitally managed logistics, omnichannel fulfillment, and returns processing. Manufacturing and industrial sectors, including advanced industries, rely on digital supply chain tools for production planning, inventory optimization, and integration of suppliers and distributors as part of wider Industry 4.0 and automation programs. The healthcare and pharmaceuticals industry is an increasingly important adopter of supply chain technology, emphasizing cold-chain monitoring, traceability, and regulatory compliance for medicines and sensitive products, often enabled by IoT sensors and cloud-based visibility platforms. Other sectors such as food and beverage, oil and gas / energy, government, and construction are also investing in supply chain solutions to improve service reliability and operational resilience.

The Qatar Supply Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Logistics, Gulf Warehousing Company (GWC), Agility Logistics, DB Schenker, Kuehne + Nagel, DHL Supply Chain, CEVA Logistics, Aramex, FedEx Express, UPS Supply Chain Solutions, Maersk Logistics & Services, XPO Logistics, DSV (including former Panalpina), SNCF Logistics / Geodis, Yusen Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar supply chain technology market appears promising, driven by ongoing digital transformation and increased investment in smart logistics solutions. As companies continue to embrace automation and data-driven decision-making, the integration of advanced technologies will enhance operational efficiency. Furthermore, the growing emphasis on sustainability and environmental responsibility will shape supply chain practices, encouraging businesses to adopt greener technologies and practices that align with global standards and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Transportation Management Systems (TMS) Warehouse Management Systems (WMS) Order & Inventory Management Platforms Supply Chain Planning & Optimization Software Freight & Logistics Visibility Platforms Last-Mile & E-commerce Fulfilment Solutions Others |

| By End-User Industry | Retail & E-commerce Manufacturing & Industrial Healthcare & Pharmaceuticals Food, Beverage & Cold Chain Oil, Gas & Petrochemicals Construction & Infrastructure Others |

| By Functional Area | Procurement & Sourcing Production & Operations Planning Logistics & Distribution Management Inventory & Demand Planning Reverse Logistics & Returns Management Compliance & Risk Management Others |

| By Deployment Mode | On-Premises Cloud / SaaS Hybrid |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Technology Layer | IoT & Telematics-enabled Solutions AI, ML & Advanced Analytics Platforms Blockchain & Distributed Ledger Solutions Robotics & Automation (including AMRs/AGVs) Control Towers & Digital Twins Others |

| By Service Type | Consulting & System Integration Implementation & Customization Managed Services Support, Maintenance & Training |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Technology Adoption | 100 | Supply Chain Managers, IT Directors |

| Warehouse Automation Solutions | 80 | Operations Managers, Warehouse Supervisors |

| Transportation Management Systems | 70 | Fleet Managers, Logistics Coordinators |

| Supply Chain Analytics Tools | 90 | Data Analysts, Business Intelligence Managers |

| Blockchain in Supply Chain | 60 | Technology Officers, Compliance Managers |

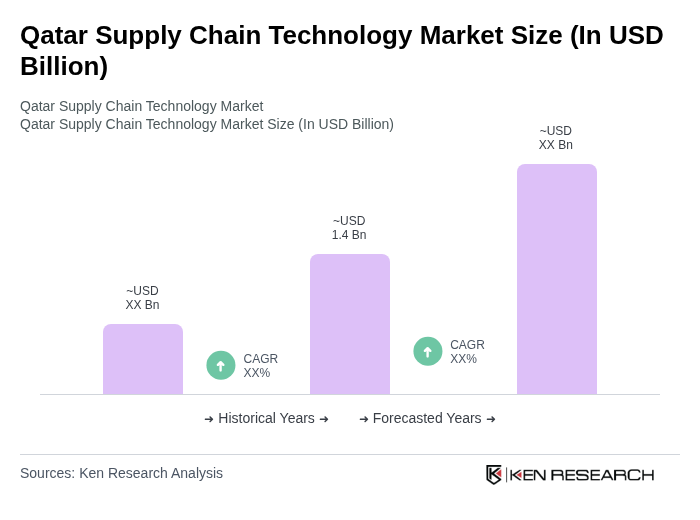

The Qatar Supply Chain Technology Market is valued at approximately USD 1.4 billion, driven by the integration of logistics and technology, alongside the growth of freight, logistics, and warehousing activities in the country.