Region:Europe

Author(s):Geetanshi

Product Code:KRAA1979

Pages:91

Published On:August 2025

By Type:The market is segmented into Transportation Management Systems (TMS), Warehouse Management Systems (WMS), Inventory Management Solutions, Supply Chain Planning Software, Order Management Systems, Freight Management Solutions, Last Mile Delivery Solutions, Cold Chain Logistics Solutions, and Digital Logistics Platforms. These segments reflect the increasing adoption of automation, real-time tracking, and integrated platforms to address the complexities of modern logistics and meet growing consumer expectations for speed and transparency .

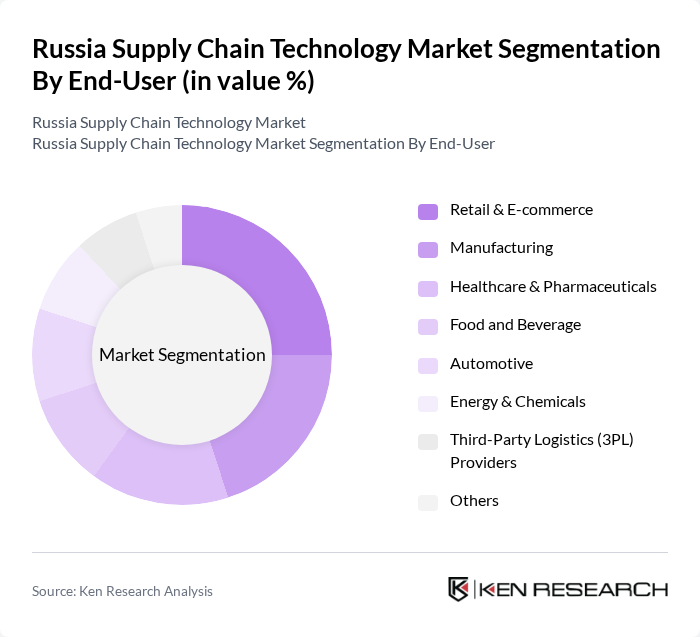

By End-User:End-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, Energy & Chemicals, Third-Party Logistics (3PL) Providers, and Others. Each sector’s demand is shaped by specific requirements for speed, compliance, traceability, and customization, with retail and e-commerce leading due to surging online sales and the need for agile fulfillment .

The Russia Supply Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Blue Yonder (formerly JDA Software Group, Inc.), Manhattan Associates, Inc., Infor, Inc., 1C Company (1? ????????), IBS (??????), LANIT (?????), KORUS Consulting (????? ??????????), Softline (????????), Ahlers Russia, Orientir Group (???????? ?????), C.H. Robinson Worldwide, Inc., Descartes Systems Group Inc., E2open, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russian supply chain technology market appears promising, driven by ongoing advancements in automation and digital solutions. As businesses increasingly prioritize efficiency and sustainability, the integration of AI and machine learning will become more prevalent. Additionally, the shift towards cloud-based solutions will facilitate real-time data access and collaboration among supply chain partners, enhancing responsiveness and agility in operations. These trends are expected to reshape the market landscape significantly.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Systems (TMS) Warehouse Management Systems (WMS) Inventory Management Solutions Supply Chain Planning Software Order Management Systems Freight Management Solutions Last Mile Delivery Solutions Cold Chain Logistics Solutions Digital Logistics Platforms |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Energy & Chemicals Third-Party Logistics (3PL) Providers Others |

| By Component | Software Hardware (e.g., RFID, IoT Devices) Services (Implementation, Consulting, Support) |

| By Sales Channel | Direct Sales Distributors & System Integrators Online Sales |

| By Distribution Mode | Road Rail Air Sea |

| By Price Range | Low Medium High |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Technology Adoption | 100 | Supply Chain Managers, IT Directors |

| Manufacturing Logistics Solutions | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Technologies | 90 | eCommerce Operations Managers, Logistics Coordinators |

| Cold Chain Management Systems | 60 | Logistics Directors, Quality Assurance Managers |

| AI and Automation in Supply Chains | 50 | Technology Managers, Process Improvement Managers |

The Russia Supply Chain Technology Market is valued at approximately USD 36 billion, driven by factors such as the growth of e-commerce, demand for efficient logistics solutions, and digital transformation initiatives.