Region:Asia

Author(s):Shubham

Product Code:KRAA1109

Pages:90

Published On:August 2025

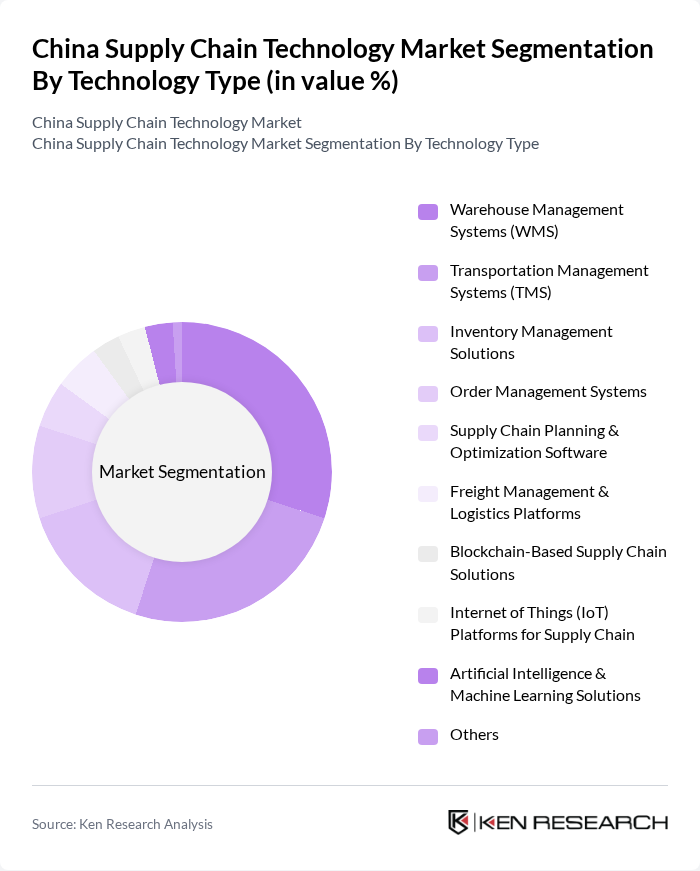

By Technology Type:The technology type segmentation includes a range of digital and automation solutions that enhance supply chain operations. Warehouse Management Systems (WMS) remain the leading sub-segment, essential for optimizing inventory management and improving order fulfillment. Transportation Management Systems (TMS) are also critical, supporting logistics and route optimization. Technologies such as IoT platforms, artificial intelligence, and blockchain are gaining rapid adoption, driven by the need for real-time data, predictive analytics, and secure, transparent transactions .

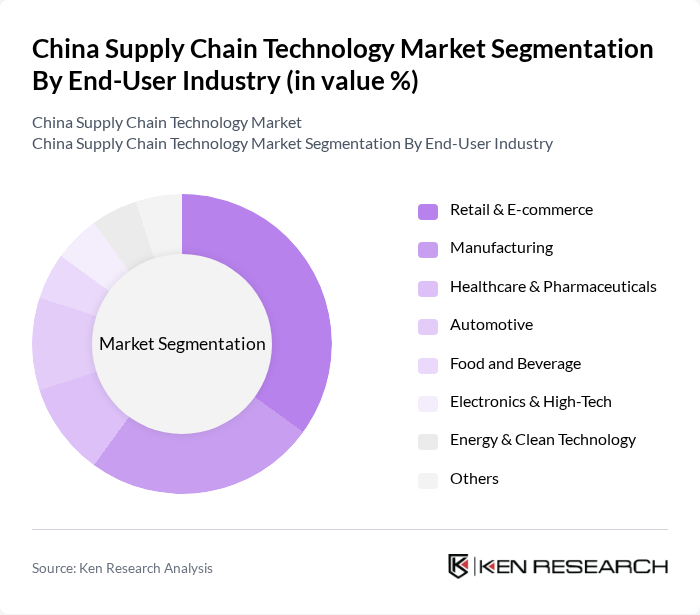

By End-User Industry:The end-user industry segmentation highlights the broad adoption of supply chain technology across sectors. The retail and e-commerce sector is the largest adopter, driven by the need for efficient inventory management, omnichannel fulfillment, and customer satisfaction. Manufacturing is a major user, leveraging digital supply chain tools to streamline production and reduce costs. Healthcare, automotive, and electronics sectors are increasingly investing in supply chain technologies to improve traceability, compliance, and operational efficiency .

The China Supply Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alibaba Group (Cainiao Network), JD Logistics (JD.com), Huawei Technologies, Kingdee International Software Group, Inspur Group, SF Technology (SF Express), Yonyou Network Technology, Geek+ Robotics, Hikvision Digital Technology, Oracle Corporation, SAP SE, Blue Yonder, Manhattan Associates, Infor, Kingsoft Cloud contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China supply chain technology market is poised for transformative growth, driven by advancements in artificial intelligence and machine learning. As companies increasingly adopt these technologies, operational efficiencies are expected to improve significantly. Additionally, the integration of IoT devices will enhance real-time tracking and data analytics capabilities, allowing for more agile supply chain management. These trends will likely reshape the industry, fostering innovation and resilience in the face of global challenges.

| Segment | Sub-Segments |

|---|---|

| By Technology Type | Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Inventory Management Solutions Order Management Systems Supply Chain Planning & Optimization Software Freight Management & Logistics Platforms Blockchain-Based Supply Chain Solutions Internet of Things (IoT) Platforms for Supply Chain Artificial Intelligence & Machine Learning Solutions Others |

| By End-User Industry | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food and Beverage Electronics & High-Tech Energy & Clean Technology Others |

| By Application | Demand Forecasting & Planning Supply Chain Visibility & Traceability Risk & Compliance Management Performance Measurement & Analytics Supplier Collaboration & Sourcing Last-Mile Delivery Optimization Others |

| By Sales Channel | Direct Sales Online Sales Distributors & System Integrators Value-Added Resellers (VARs) Others |

| By Deployment Mode | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Technology | 120 | Supply Chain Managers, IT Directors |

| Logistics Automation Solutions | 90 | Operations Managers, Automation Specialists |

| Retail Supply Chain Innovations | 70 | Retail Operations Heads, Technology Officers |

| Cold Chain Management Technologies | 60 | Logistics Coordinators, Quality Assurance Managers |

| Blockchain in Supply Chain | 50 | Blockchain Developers, Supply Chain Analysts |

The China Supply Chain Technology Market is valued at approximately USD 48 billion, driven by digital transformation, automation demand, and the need for enhanced supply chain visibility and efficiency. This growth reflects significant investments in technology solutions for logistics management.