Region:Global

Author(s):Shubham

Product Code:KRAA1021

Pages:87

Published On:August 2025

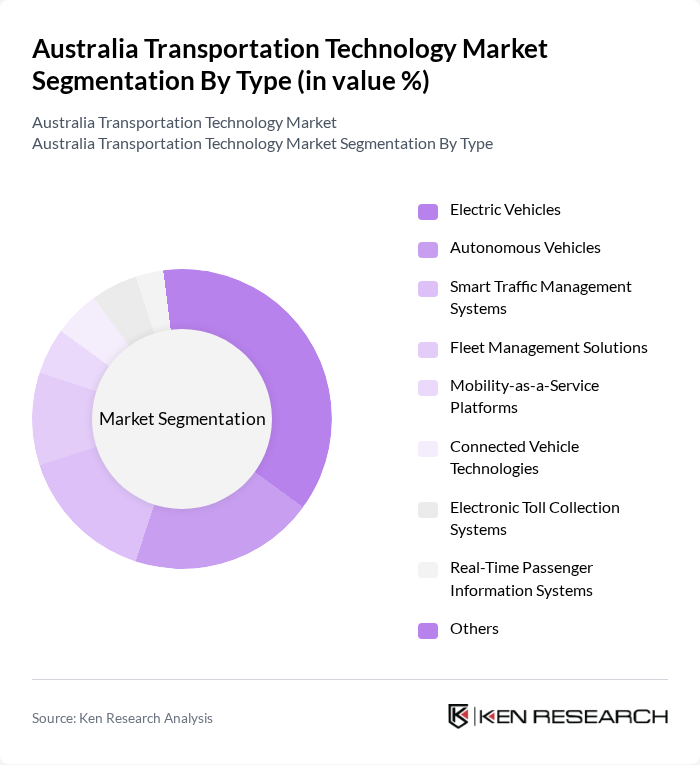

By Type:The market is segmented into various types, including Electric Vehicles, Autonomous Vehicles, Smart Traffic Management Systems, Fleet Management Solutions, Mobility-as-a-Service Platforms, Connected Vehicle Technologies, Electronic Toll Collection Systems, Real-Time Passenger Information Systems, and Others. Among these, Electric Vehicles are leading the market due to increasing consumer demand for sustainable transportation options and government incentives promoting electric mobility .

By End-User:The end-user segmentation includes Public Transportation Operators, Logistics and Freight Companies, Ride-Sharing and Mobility Service Providers, Government and Municipal Agencies, Private Consumers, Infrastructure Developers, and Others. Public Transportation Operators are the leading segment, driven by the need for efficient and sustainable public transport solutions in urban areas .

The Australia Transportation Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telstra Corporation Limited, Transurban Group, Qube Holdings Limited, Downer EDI Limited, Linfox Logistics, Toll Group, Australia Post, Siemens Mobility, Alstom Transport, Uber Technologies, Inc., Didi Chuxing, GoCatch, Fleet Complete, Cubic Transportation Systems, Intelematics Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia transportation technology market appears promising, driven by ongoing urbanization and government initiatives. As cities expand, the demand for innovative solutions like Mobility-as-a-Service (MaaS) and electric vehicle infrastructure will grow. Additionally, advancements in autonomous vehicle technologies are expected to reshape the transportation landscape. Collaborations between tech companies and transportation providers will further enhance service delivery, ensuring a more efficient and sustainable transportation ecosystem in Australia in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Vehicles Autonomous Vehicles Smart Traffic Management Systems Fleet Management Solutions Mobility-as-a-Service Platforms Connected Vehicle Technologies Electronic Toll Collection Systems Real-Time Passenger Information Systems Others |

| By End-User | Public Transportation Operators Logistics and Freight Companies Ride-Sharing and Mobility Service Providers Government and Municipal Agencies Private Consumers Infrastructure Developers Others |

| By Application | Urban Mobility Freight and Logistics Public Transport Systems Emergency and Incident Management Tolling and Payment Systems Others |

| By Distribution Channel | Direct Sales Online Platforms Retail Outlets Partnerships with Service Providers System Integrators Others |

| By Technology | GPS and Navigation Systems Telematics Solutions Vehicle-to-Everything (V2X) Communication Smart Sensors and IoT Devices Artificial Intelligence and Machine Learning Cloud-Based Transportation Management Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships International Investments Others |

| By Policy Support | Subsidies for Electric Vehicles Tax Incentives for R&D Grants for Infrastructure Development Smart City Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Adoption | 120 | Fleet Managers, Automotive Engineers |

| Smart Traffic Management Systems | 90 | City Planners, IT Managers in Transportation |

| Autonomous Vehicle Technology | 60 | R&D Directors, Regulatory Affairs Specialists |

| Public Transport Innovations | 50 | Transport Authority Officials, Operations Managers |

| Logistics and Supply Chain Technology | 70 | Logistics Coordinators, Supply Chain Analysts |

The Australia Transportation Technology Market is valued at approximately USD 130 billion, driven by advancements in digital logistics, urbanization, and a focus on sustainable transportation solutions, including electric vehicles and smart traffic management systems.