Region:Asia

Author(s):Shubham

Product Code:KRAA1075

Pages:97

Published On:August 2025

By Type:The market is segmented into Electric Vehicles (EVs), Autonomous Vehicles (AVs), Smart Traffic Management & ITS (Intelligent Transportation Systems), Logistics & Supply Chain Digitalization Solutions, Mobility-as-a-Service (MaaS) Platforms, Fleet Management & Telematics Solutions, Connected Vehicle Technologies (V2X, IoT), and Others. Among these, Electric Vehicles (EVs) are leading the market, driven by robust consumer demand for sustainable transportation and strong government incentives supporting EV adoption .

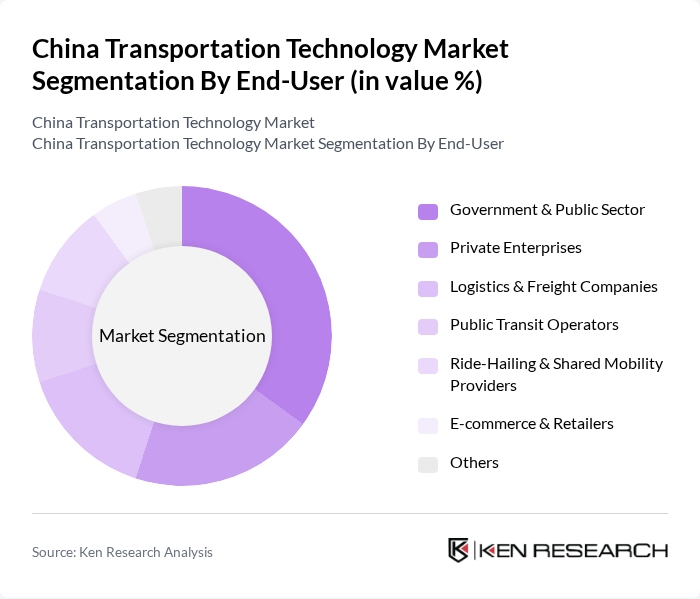

By End-User:The end-user segmentation includes Government & Public Sector, Private Enterprises, Logistics & Freight Companies, Public Transit Operators, Ride-Hailing & Shared Mobility Providers, E-commerce & Retailers, and Others. The Government & Public Sector is the leading segment, driven by substantial investments in infrastructure and public transportation initiatives aimed at improving urban mobility and reducing congestion .

The China Transportation Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as BYD Company Limited, Geely Automobile Holdings Limited, Didi Chuxing Technology Co., NIO Inc., SAIC Motor Corporation Limited, CRRC Corporation Limited, China COSCO Shipping Corporation Limited, China Railway Group Limited, Alibaba Group Holding Limited, Tencent Holdings Limited, Baidu, Inc., SF Express (SF Holding Co., Ltd.), YTO Express Group Co., Ltd., JD Logistics, Inc., Xpeng Motors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China transportation technology market is poised for transformative growth, driven by advancements in smart city initiatives and the increasing integration of artificial intelligence in mobility solutions. As urbanization accelerates, cities will prioritize sustainable transportation options, leading to a surge in electric and autonomous vehicle adoption. Furthermore, partnerships between technology firms and transportation providers will foster innovation, enhancing operational efficiency and customer experience. The focus on last-mile delivery solutions will also reshape logistics, creating a more interconnected transportation ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Vehicles (EVs) Autonomous Vehicles (AVs) Smart Traffic Management & ITS (Intelligent Transportation Systems) Logistics & Supply Chain Digitalization Solutions Mobility-as-a-Service (MaaS) Platforms Fleet Management & Telematics Solutions Connected Vehicle Technologies (V2X, IoT) Others |

| By End-User | Government & Public Sector Private Enterprises Logistics & Freight Companies Public Transit Operators Ride-Hailing & Shared Mobility Providers E-commerce & Retailers Others |

| By Application | Urban Passenger Transportation Freight & Cargo Logistics Public Transit Systems Emergency & Safety Services Port & Airport Operations Others |

| By Investment Source | Government Funding Private Capital & Venture Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Transportation Mode | Roadways Railways Seaways Airways Multimodal/Integrated Solutions Others |

| By Policy Support | EV Subsidies & Incentives Tax Benefits for Smart Transportation Grants for R&D and Innovation Green Transportation Initiatives Others |

| By Price Range | Budget Segment Mid-Range Segment Premium Segment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Logistics Solutions | 100 | Logistics Managers, Technology Officers |

| Autonomous Vehicle Deployment | 60 | Fleet Operators, R&D Managers |

| IoT in Transportation | 50 | IT Managers, Operations Directors |

| Urban Mobility Solutions | 70 | Urban Planners, Policy Makers |

| Infrastructure Development Projects | 55 | Project Managers, Civil Engineers |

The China Transportation Technology Market is valued at approximately USD 300 billion, driven by rapid urbanization, government investments in infrastructure, and the adoption of smart transportation solutions, including electric vehicles and intelligent transportation systems.