Region:North America

Author(s):Geetanshi

Product Code:KRAA2075

Pages:98

Published On:August 2025

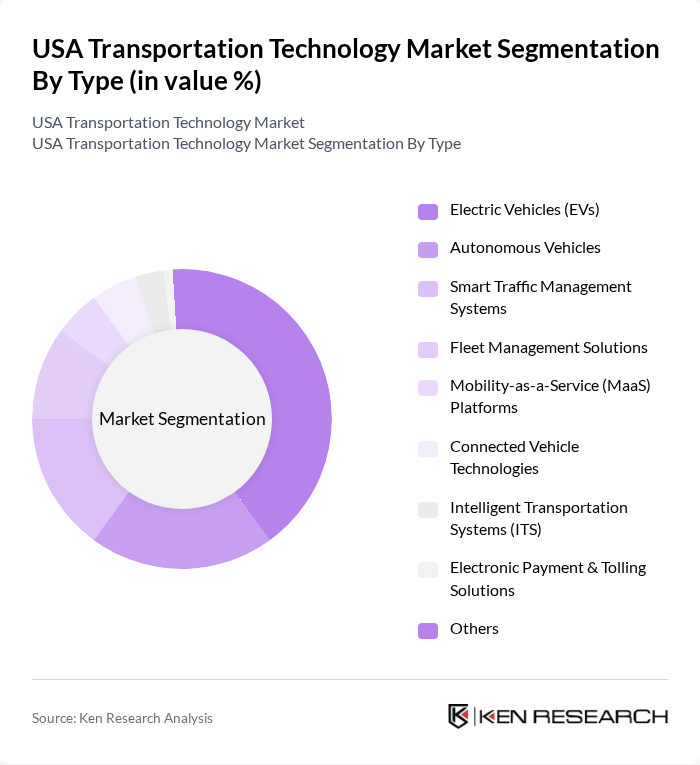

By Type:The market is segmented into various types, including Electric Vehicles (EVs), Autonomous Vehicles, Smart Traffic Management Systems, Fleet Management Solutions, Mobility-as-a-Service (MaaS) Platforms, Connected Vehicle Technologies, Intelligent Transportation Systems (ITS), Electronic Payment & Tolling Solutions, and Others. Among these, Electric Vehicles (EVs) are leading the market due to increasing consumer demand for sustainable transportation options, rapid electrification of fleets, and robust government incentives promoting EV adoption .

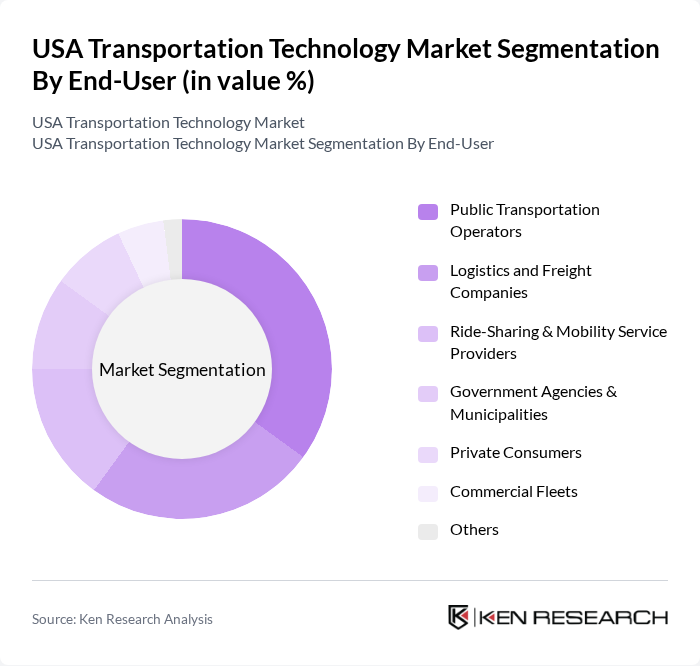

By End-User:The end-user segmentation includes Public Transportation Operators, Logistics and Freight Companies, Ride-Sharing & Mobility Service Providers, Government Agencies & Municipalities, Private Consumers, Commercial Fleets, and Others. Public Transportation Operators are currently the dominant segment, driven by the need for efficient and sustainable public transit solutions in urban areas, as well as increased federal and state funding for mass transit modernization .

The USA Transportation Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., Waymo LLC, Uber Technologies, Inc., Lyft, Inc., Ford Motor Company, General Motors Company, Rivian Automotive, Inc., Lucid Motors, Inc., Proterra Inc., ChargePoint Holdings, Inc., Aurora Innovation, Inc., Nuro, Inc., Peloton Technology, Inc., Mobileye Global Inc., Zoox, Inc., Via Transportation, Inc., TransLoc Inc., Samsara Inc., Motional AD LLC, Nikola Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The USA transportation technology market is poised for transformative growth driven by urbanization, technological advancements, and government investments. As cities expand, the demand for innovative transportation solutions will intensify, particularly in electric and autonomous vehicles. The integration of AI and IoT will enhance operational efficiency, while regulatory frameworks will evolve to support sustainable practices. Companies that adapt to these trends and invest in infrastructure will be well-positioned to capitalize on emerging opportunities in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Vehicles (EVs) Autonomous Vehicles Smart Traffic Management Systems Fleet Management Solutions Mobility-as-a-Service (MaaS) Platforms Connected Vehicle Technologies Intelligent Transportation Systems (ITS) Electronic Payment & Tolling Solutions Others |

| By End-User | Public Transportation Operators Logistics and Freight Companies Ride-Sharing & Mobility Service Providers Government Agencies & Municipalities Private Consumers Commercial Fleets Others |

| By Application | Urban Mobility Solutions Freight and Logistics Management Traffic Management & Optimization Public Transport Systems Emergency & Safety Services Infrastructure Monitoring Others |

| By Distribution Channel | Direct Sales Online Platforms Retail Outlets Partnerships with Fleet Operators System Integrators Others |

| By Component | Hardware (Sensors, Cameras, Onboard Units) Software (Analytics, Fleet Management, Routing) Services (Consulting, Maintenance, Integration) Connectivity Solutions (Telematics, V2X) Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Venture Capital & Startups Others |

| By Policy Support | Subsidies for Electric Vehicles Tax Incentives for R&D Grants for Infrastructure Development Regulatory Mandates (Safety, Emissions) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Autonomous Vehicle Technology | 60 | R&D Managers, Automotive Engineers |

| Smart Traffic Management Systems | 50 | City Planners, Traffic Engineers |

| Electric Mobility Solutions | 45 | Fleet Operators, Sustainability Managers |

| Logistics and Supply Chain Innovations | 55 | Logistics Directors, Supply Chain Analysts |

| Public Transportation Technology | 40 | Transit Authority Officials, Operations Managers |

The USA Transportation Technology Market is valued at approximately USD 35 billion, driven by advancements in electric vehicles, autonomous driving technologies, and smart traffic management systems, which are reshaping urban mobility and logistics.