Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1990

Pages:91

Published On:August 2025

By Type:The market is segmented into various types, including Electric Vehicles, Smart Traffic Management Systems, Fleet Management Solutions, Public Transportation Technologies, Autonomous Vehicles, Mobility-as-a-Service Platforms, Digital Freight Management Systems, Real-Time Tracking and Visibility Solutions, Last-Mile Delivery Technologies, and Others. Each of these segments plays a crucial role in shaping the transportation landscape in Chile. The adoption of electric vehicles and digital fleet management is accelerating, driven by sustainability goals and operational efficiency requirements. Smart traffic management and real-time tracking solutions are increasingly deployed in urban centers to optimize traffic flow and enhance safety .

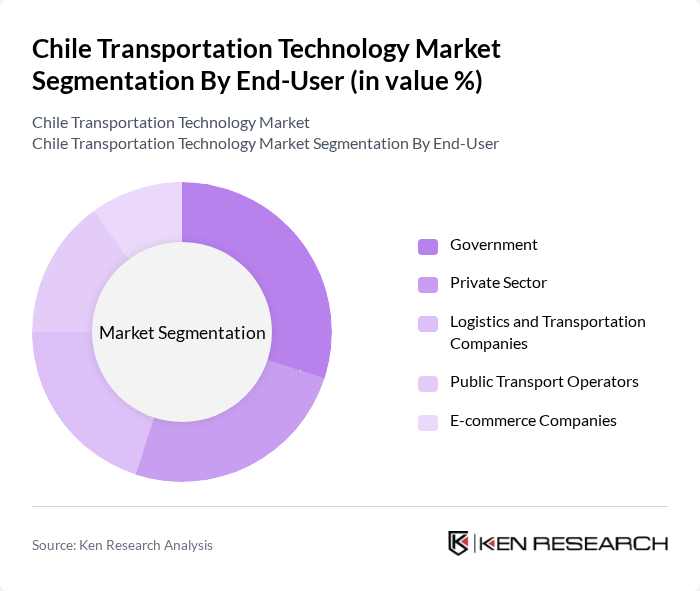

By End-User:The end-user segmentation includes Government, Private Sector, Logistics and Transportation Companies, Public Transport Operators, and E-commerce Companies. Each of these segments has unique requirements and contributes differently to the overall market dynamics. Government and public transport operators are focused on infrastructure modernization and regulatory compliance, while logistics, private sector, and e-commerce companies prioritize digitalization, real-time visibility, and last-mile delivery optimization .

The Chile Transportation Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as LATAM Airlines Group S.A., Uber Technologies Inc., DiDi Mobility (DiDi Chuxing), Pullman Bus S.A., Enel X Chile S.p.A., Siemens Mobility S.A., Red Metropolitana de Movilidad (ex-Transantiago), Telefónica Chile S.A. (Movistar), SQM (Sociedad Química y Minera de Chile S.A.), Metro S.A. (Metro de Santiago), Accenture Chile Ltda., IBM Chile S.A.C., Schneider Electric Chile S.A., Alstom Chile S.A., and Volvo Chile S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Chile transportation technology market is poised for significant transformation as urbanization accelerates and government investments in infrastructure continue. In future, the integration of smart technologies and sustainable practices will likely reshape mobility solutions, enhancing efficiency and reducing environmental impact. The rise of electric vehicles and autonomous systems will further drive innovation, while public-private partnerships will play a crucial role in funding and implementing large-scale projects, ensuring a robust and adaptive transportation ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Vehicles Smart Traffic Management Systems Fleet Management Solutions Public Transportation Technologies Autonomous Vehicles Mobility-as-a-Service Platforms Digital Freight Management Systems Real-Time Tracking and Visibility Solutions Last-Mile Delivery Technologies Others |

| By End-User | Government Private Sector Logistics and Transportation Companies Public Transport Operators E-commerce Companies |

| By Application | Urban Transportation Freight and Logistics Emergency Services Personal Mobility Intermodal Transport |

| By Distribution Channel | Direct Sales Online Platforms Retail Outlets |

| By Investment Source | Government Funding Private Investments International Aid Multilateral Development Banks |

| By Policy Support | Subsidies for Electric Vehicles Tax Incentives for Green Technologies Grants for Infrastructure Development Public-Private Partnership Initiatives |

| By Technology Integration | IoT Integration AI and Machine Learning Applications Blockchain for Supply Chain Management Cloud-Based Transportation Management Systems Telematics and Connected Vehicle Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Transportation Systems | 60 | City Planners, Technology Implementers |

| Electric Vehicle Adoption | 50 | Fleet Managers, Automotive Industry Experts |

| Public Transportation Innovations | 40 | Transit Authority Officials, Urban Mobility Researchers |

| Logistics and Supply Chain Technology | 50 | Logistics Coordinators, Supply Chain Analysts |

| Infrastructure Development Projects | 40 | Construction Managers, Civil Engineers |

The Chile Transportation Technology Market is valued at approximately USD 12.6 billion, driven by increasing demand for efficient transportation solutions, urbanization, and government infrastructure investments.