Region:Asia

Author(s):Geetanshi

Product Code:KRAA2060

Pages:98

Published On:August 2025

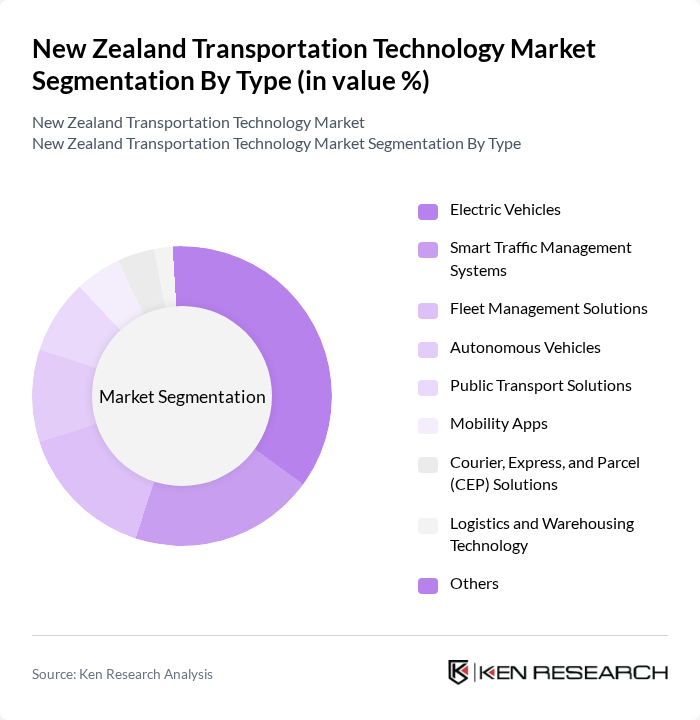

By Type:The market is segmented into Electric Vehicles, Smart Traffic Management Systems, Fleet Management Solutions, Autonomous Vehicles, Public Transport Solutions, Mobility Apps, Courier, Express, and Parcel (CEP) Solutions, Logistics and Warehousing Technology, and Others. Among these, Electric Vehicles are leading the market, supported by rising consumer awareness, government incentives, and the expansion of charging infrastructure. Smart Traffic Management Systems are rapidly growing due to urbanization and investments in intelligent transportation systems, while Fleet Management Solutions and CEP services benefit from the surge in e-commerce and demand for real-time logistics visibility.

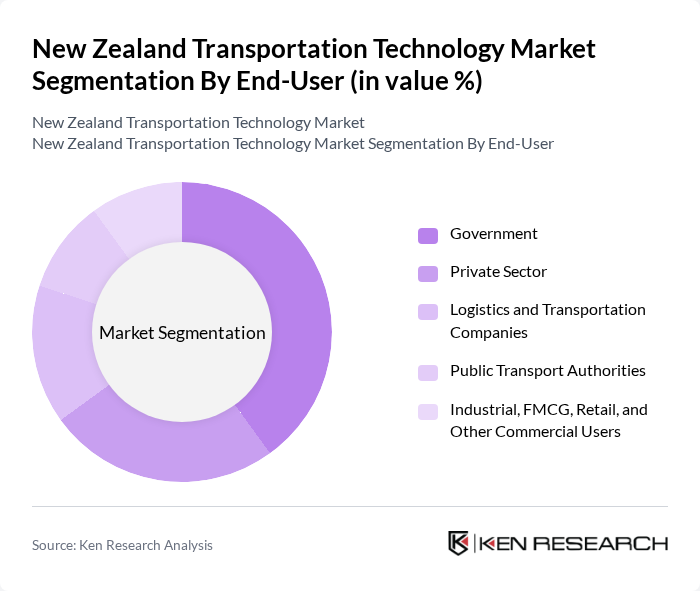

By End-User:The end-user segmentation includes Government, Private Sector, Logistics and Transportation Companies, Public Transport Authorities, and Industrial, FMCG, Retail, and Other Commercial Users. The Government sector leads, driven by public investments in infrastructure, technology upgrades, and sustainability programs. The Private Sector and Logistics Companies are expanding their adoption of digital solutions, AI-powered fleet management, and cloud-based logistics platforms, while Public Transport Authorities and commercial users are integrating smart mobility and data-driven planning to enhance operational efficiency.

The New Zealand Transportation Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as KiwiRail Holdings Limited, Waka Kotahi NZ Transport Agency, EROAD Limited, Z Energy Limited, Downer EDI Limited, Transdev Auckland, Go Bus Transport Limited, Auckland Transport, Wellington City Council, EnviroWaste Services Limited, ChargeNet NZ Limited, Flick Electric Co., Air New Zealand Limited, Mainfreight Limited, Uber Technologies, Inc., Ventia Services Group, Fletcher Building Limited, NZ Post Limited, Transdev Wellington, Toll New Zealand contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand transportation technology market is poised for significant advancements driven by urbanization and government initiatives. As cities expand, the demand for smart transportation solutions will increase, leading to greater investments in infrastructure and technology. The integration of AI and data analytics will enhance operational efficiency, while the focus on sustainability will drive the adoption of electric and autonomous vehicles. Overall, the market is expected to evolve rapidly, fostering innovation and improving mobility for New Zealand's urban populations.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Vehicles Smart Traffic Management Systems Fleet Management Solutions Autonomous Vehicles Public Transport Solutions Mobility Apps Courier, Express, and Parcel (CEP) Solutions Logistics and Warehousing Technology Others |

| By End-User | Government Private Sector Logistics and Transportation Companies Public Transport Authorities Industrial, FMCG, Retail, and Other Commercial Users |

| By Application | Urban Transportation Freight and Logistics Emergency Services Ride-Sharing Services Rural Delivery & Remote Area Solutions |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Transport Operators Third-Party Logistics Providers (3PL) |

| By Investment Source | Government Funding Private Investments Public-Private Partnerships Foreign Direct Investment |

| By Policy Support | Subsidies for Electric Vehicles Tax Incentives for Green Technology Grants for Infrastructure Development Regulatory Mandates for Emissions & Safety |

| By Technology Integration | IoT Solutions AI and Machine Learning Blockchain for Supply Chain Management Cloud-Based Transportation Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Adoption | 60 | Fleet Managers, Automotive Industry Experts |

| Smart Traffic Management Systems | 50 | City Planners, Transportation Engineers |

| Public Transport Innovations | 40 | Transit Authority Officials, Urban Mobility Researchers |

| Autonomous Vehicle Development | 45 | Technology Developers, Regulatory Affairs Specialists |

| Last-Mile Delivery Solutions | 55 | Logistics Coordinators, E-commerce Executives |

The New Zealand Transportation Technology Market is valued at approximately USD 18.5 billion, driven by advancements in electric vehicles, smart traffic management systems, and efficient logistics solutions, supported by government initiatives aimed at enhancing transportation infrastructure.