Region:Europe

Author(s):Rebecca

Product Code:KRAA0347

Pages:80

Published On:August 2025

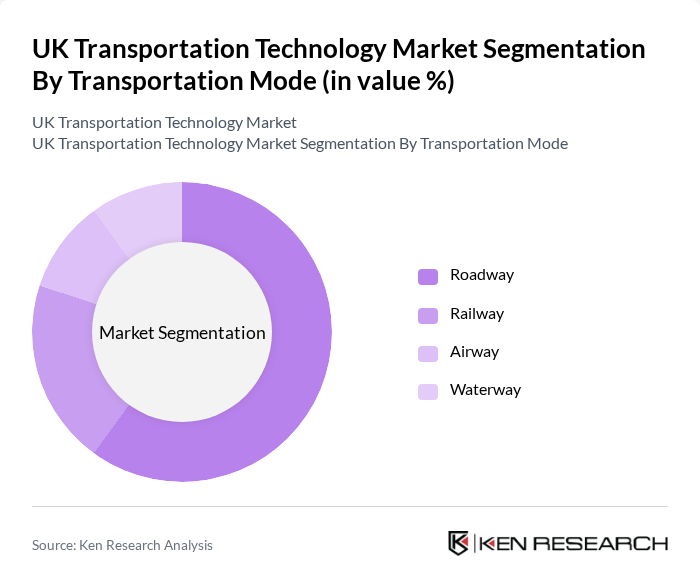

By Transportation Mode:The transportation mode segment includes roadway, railway, airway, and waterway. Roadway remains the most utilized mode due to the UK's extensive road networks and the dominance of road freight and passenger transport. The railway segment is significant and benefits from ongoing government investments in infrastructure modernization and electrification. Airway is essential for both domestic and international long-distance travel, while waterway supports freight movement, particularly for bulk goods and international trade .

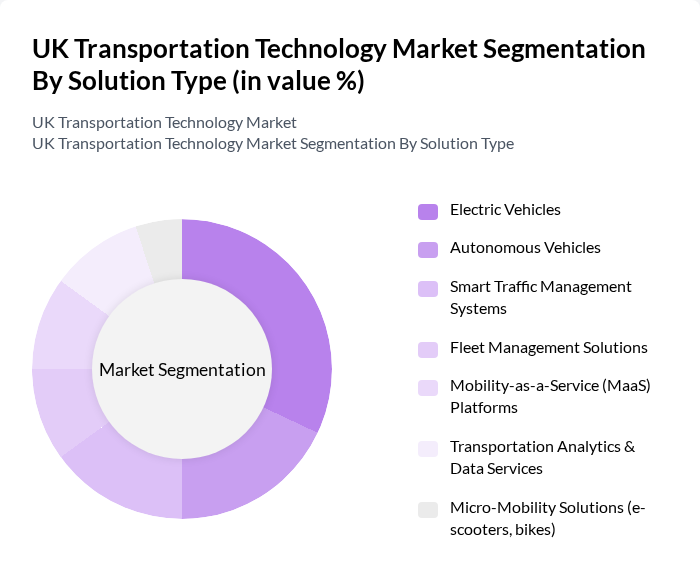

By Solution Type:The solution type segment encompasses electric vehicles, autonomous vehicles, smart traffic management systems, fleet management solutions, Mobility-as-a-Service (MaaS) platforms, transportation analytics & data services, and micro-mobility solutions. Electric vehicles lead the market, driven by consumer demand for sustainable transport and government incentives. Autonomous vehicles are gaining traction as technology and regulatory frameworks advance. Smart traffic management systems are critical for optimizing urban mobility and reducing congestion. Fleet management, MaaS platforms, and analytics are increasingly adopted by commercial operators and municipalities, while micro-mobility solutions such as e-scooters and bikes are expanding rapidly in urban centers .

The UK Transportation Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jaguar Land Rover, Siemens Mobility, Arriva, FirstGroup, Stagecoach Group, Transport for London (TfL), Go-Ahead Group, National Express, Uber Technologies, Zipcar, DPD Group, DHL Supply Chain, Bosch Mobility Solutions, Ford Motor Company, Tesla, Inc., Arrival, Octopus Electric Vehicles, Via Transportation, Addison Lee, Hitachi Rail contribute to innovation, geographic expansion, and service delivery in this space.

The UK transportation technology market is poised for transformative growth, driven by increasing investments in sustainable solutions and smart city initiatives. In future, advancements in autonomous vehicle technology and the expansion of electric vehicle infrastructure will significantly reshape urban mobility. The integration of data analytics and smart traffic management systems will enhance operational efficiency, while public-private partnerships will foster innovation, ensuring the UK remains at the forefront of transportation technology advancements.

| Segment | Sub-Segments |

|---|---|

| By Transportation Mode | Roadway Railway Airway Waterway |

| By Solution Type | Electric Vehicles Autonomous Vehicles Smart Traffic Management Systems Fleet Management Solutions Mobility-as-a-Service (MaaS) Platforms Transportation Analytics & Data Services Micro-Mobility Solutions (e-scooters, bikes) |

| By End-User | Public Sector (Government & Municipalities) Private Transportation Providers Logistics & Supply Chain Companies Corporate Fleets Consumers |

| By Technology | Electric Powertrains Connected Vehicle Technology (IoT, Telematics) Advanced Driver Assistance Systems (ADAS) Vehicle-to-Everything (V2X) Communication Artificial Intelligence & Automation |

| By Application | Fleet Management Traffic Management Route Optimization Passenger Information Systems Last-Mile Delivery |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships (PPP) Venture Capital |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Regulatory Support for Innovation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Transportation Solutions | 80 | Technology Managers, Urban Planners |

| Fleet Management Technologies | 60 | Fleet Operations Managers, Logistics Managers |

| Public Transport Innovations | 50 | Transit Authority Officials, Policy Makers |

| Electric Vehicle Infrastructure | 40 | Infrastructure Developers, Energy Managers |

| Autonomous Vehicle Technologies | 45 | R&D Engineers, Automotive Technology Experts |

The UK Transportation Technology Market is valued at approximately USD 7 billion, reflecting significant growth driven by advancements in electric vehicle technology, smart transportation infrastructure, and increased emphasis on sustainability and carbon emission reduction.