Region:Global

Author(s):Dev

Product Code:KRAA1598

Pages:95

Published On:August 2025

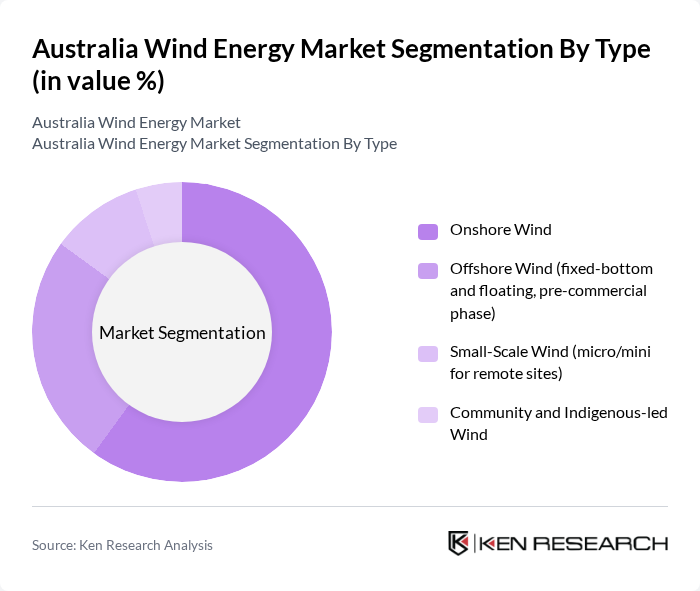

By Type:The wind energy market can be segmented into various types, including onshore wind, offshore wind (both fixed-bottom and floating), small-scale wind, and community and indigenous-led wind projects. Each type serves different market needs and consumer preferences, with onshore wind being the most prevalent due to its established technology and lower costs; current Australian market activity remains predominantly onshore, while offshore wind is in pre-commercial and permitting phases.

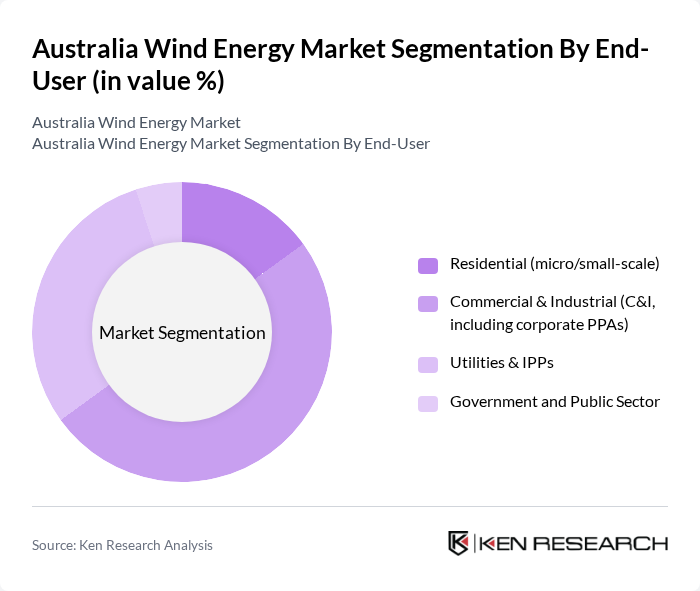

By End-User:The end-user segmentation includes residential, commercial & industrial (C&I), utilities & independent power producers (IPPs), and government and public sector entities. Each segment has unique energy needs, with the commercial and industrial sector showing significant growth due to increasing corporate commitments to sustainability and renewable energy procurement, including corporate PPAs supporting new wind capacity.

The Australia Wind Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy S.A. (Siemens Energy), GE Vernova (formerly GE Renewable Energy), Goldwind Australia, Nordex SE, Acciona Energía, Iberdrola Australia (formerly Infigen Energy), Clean Energy Finance Corporation (CEFC), ENGIE Australia & New Zealand, Origin Energy, AGL Energy, Tilt Renewables (owned by Powering Australian Renewables & Mercury NZ), RATCH-Australia Corporation, Neoen, CS Energy contribute to innovation, geographic expansion, and service delivery in this space. Recent market insights also underscore growing pairing of wind with large-scale batteries to improve grid firmness and reduce curtailment risk, supporting bankability of new projects.

The future of the wind energy market in Australia appears promising, driven by increasing investments in renewable technologies and supportive government policies. As the country aims for a net-zero emissions target in future, wind energy is expected to play a pivotal role in achieving this goal. The expansion of offshore wind projects and advancements in energy storage technologies will likely enhance grid reliability and efficiency, positioning Australia as a leader in renewable energy innovation and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Wind Offshore Wind (fixed-bottom and floating, pre-commercial phase) Small-Scale Wind (micro/mini for remote sites) Community and Indigenous-led Wind |

| By End-User | Residential (micro/small-scale) Commercial & Industrial (C&I, including corporate PPAs) Utilities & IPPs Government and Public Sector |

| By Application | Utility-Scale Grid-Connected Distributed Generation (behind-the-meter) Off-Grid & Remote/Islanded Systems Hybrid Projects (wind + solar + storage) |

| By Investment Source | Domestic Private Capital Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding/Grants (e.g., ARENA, CEFC) |

| By Policy Support | Large-scale Generation Certificates (LGCs)/RECs State Renewable Energy Targets & Reverse Auctions Tax Incentives/Accelerated Depreciation Grid Access & Connection Reforms |

| By Technology | Horizontal Axis Wind Turbines (HAWT) Vertical Axis Wind Turbines (VAWT) Floating and Fixed-Bottom Foundations (offshore) Digital O&M/SCADA and Condition Monitoring |

| By Distribution Mode | Direct EPC/Developer Sales OEM Direct Supply Dealers/Distributors (small wind) Power Purchase Agreements (PPAs and CfDs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wind Farm Operators | 90 | Project Managers, Operations Directors |

| Regulatory Bodies | 50 | Policy Analysts, Energy Regulators |

| Wind Turbine Manufacturers | 70 | Product Development Engineers, Sales Managers |

| Energy Consultants | 60 | Market Analysts, Sustainability Advisors |

| Investors in Renewable Energy | 40 | Investment Analysts, Portfolio Managers |

The Australia Wind Energy Market is valued at approximately USD 2.6 billion, driven by increasing demand for renewable energy, government initiatives, and advancements in wind turbine technology. This market is expected to continue growing as investments in wind projects increase.