Region:North America

Author(s):Shubham

Product Code:KRAC0586

Pages:88

Published On:August 2025

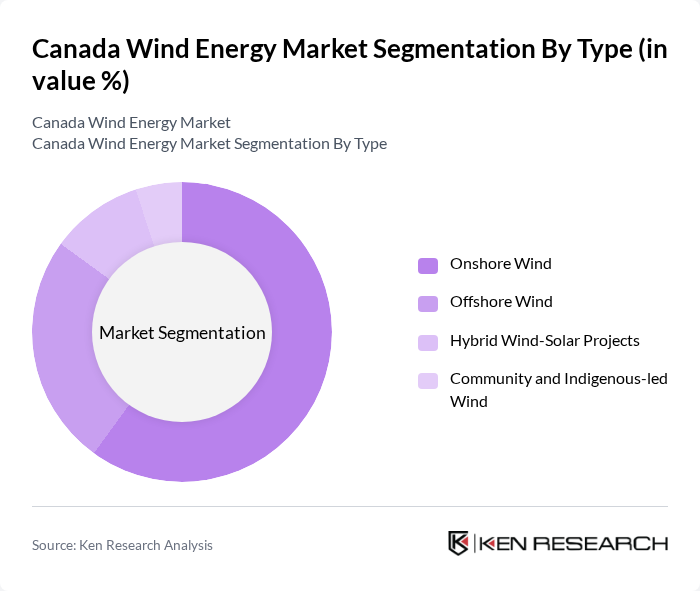

By Type:The segmentation of the market by type includes Onshore Wind, Offshore Wind, Hybrid Wind-Solar Projects, and Community and Indigenous-led Wind. Each of these subsegments plays a crucial role in the overall market dynamics, with onshore wind accounting for the vast majority of installed capacity today, while offshore wind is emerging through new regulatory enablers in Atlantic Canada; hybrid wind-solar and community/Indigenous-led projects are growing through corporate procurement, community partnerships, and grid-integration needs.

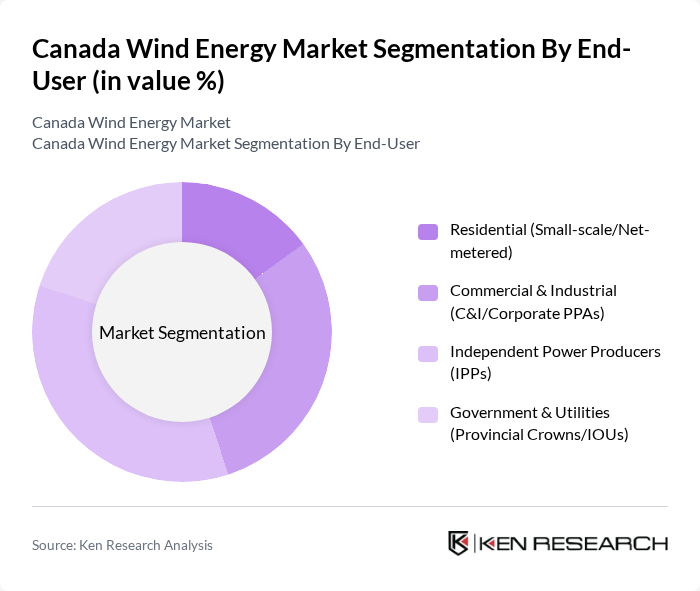

By End-User:The end-user segmentation includes Residential (Small-scale/Net-metered), Commercial & Industrial (C&I/Corporate PPAs), Independent Power Producers (IPPs), and Government & Utilities (Provincial Crowns/IOUs). Each segment reflects the diverse applications of wind energy across different sectors, with IPPs and utilities leading utility-scale additions, and C&I demand rising via corporate PPAs to meet decarbonization targets; residential/net-metered wind remains niche relative to utility-scale deployments.

The Canada Wind Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vestas Wind Systems A/S, GE Vernova (GE Renewable Energy), Nordex SE, Siemens Gamesa Renewable Energy, Enbridge Inc., Brookfield Renewable Partners L.P., Innergex Renewable Energy Inc., TransAlta Corporation, Capital Power Corporation, Northland Power Inc., Pattern Energy Group LP, Boralex Inc., EDF Renewables Canada Inc., Acciona Energía, BluEarth Renewables Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wind energy market in Canada appears promising, with a strong focus on sustainability and technological innovation. By future, the integration of artificial intelligence and IoT technologies is expected to enhance operational efficiency and grid management. Additionally, the expansion of offshore wind projects is anticipated to contribute significantly to capacity growth, as Canada aims to harness its vast coastal resources. These trends will likely position Canada as a leader in renewable energy production, fostering economic growth and environmental sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Wind Offshore Wind Hybrid Wind-Solar Projects Community and Indigenous-led Wind |

| By End-User | Residential (Small-scale/Net-metered) Commercial & Industrial (C&I/Corporate PPAs) Independent Power Producers (IPPs) Government & Utilities (Provincial Crowns/IOUs) |

| By Application | Utility-Scale Grid-Connected Distributed Generation (Behind-the-meter) Remote/Off-Grid and Mines Power-to-X (Green Hydrogen/Ammonia) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants & Tax Credits |

| By Policy Support | Investment Tax Credits (ITC/CCUS/Manufacturing) Production Incentives & Contracts for Difference Renewable Energy Certificates (RECs/Environmental Attributes) Provincial Procurement (RFPs/Auctions) |

| By Technology | Horizontal-Axis Wind Turbines (HAWT) Vertical-Axis Wind Turbines (VAWT) Digital O&M (SCADA, AI/ML, Predictive Maintenance) Floating Offshore Foundations |

| By Distribution Mode | Power Purchase Agreements (PPAs & VPPA) Merchant/Market Sales Utility offtake/Feed-in Contracts Community/Cooperative offtake |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wind Farm Developers | 100 | Project Managers, Business Development Executives |

| Utility Companies | 80 | Energy Analysts, Operations Managers |

| Regulatory Bodies | 50 | Policy Makers, Environmental Compliance Officers |

| Manufacturers of Wind Turbines | 70 | Product Managers, R&D Engineers |

| Consultants in Renewable Energy | 60 | Market Analysts, Sustainability Consultants |

The Canada Wind Energy Market is valued at approximately USD 10 billion, supported by an installed capacity of about 18 gigawatts. This valuation reflects a significant growth trend driven by investments in renewable energy and government policies promoting clean energy.