Region:Asia

Author(s):Dev

Product Code:KRAB0444

Pages:93

Published On:August 2025

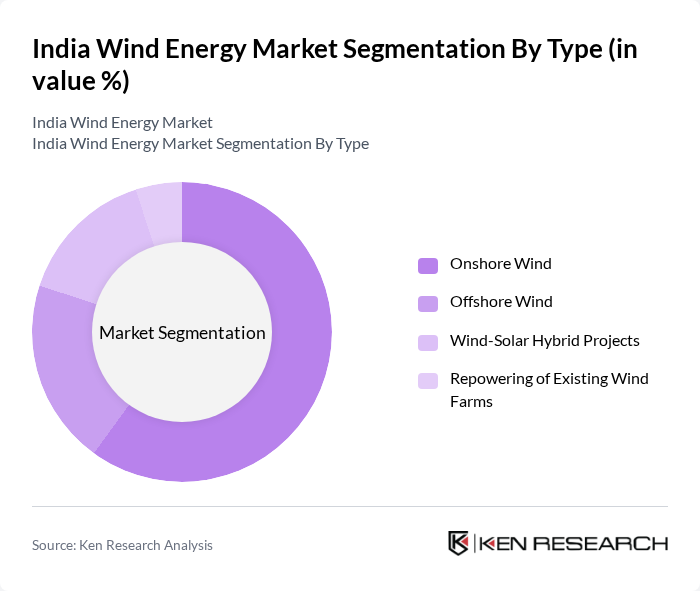

By Type:The market is segmented into Onshore Wind, Offshore Wind, Wind-Solar Hybrid Projects, and Repowering of Existing Wind Farms. Among these,Onshore Windis the most dominant segment due to mature domestic manufacturing, proven project execution, and lower levelized costs versus early-stage offshore projects. Hybridization is rising through wind-solar hybrid and RTC tenders that optimize capacity utilization and grid integration, while repowering focuses on replacing older sub-2 MW turbines with modern 3–4+ MW platforms at high-wind sites.

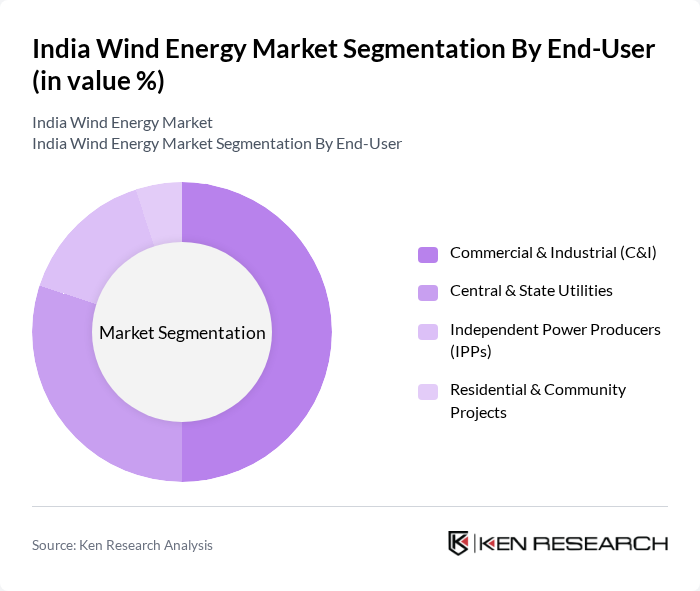

By End-User:The end-user segmentation includes Commercial & Industrial (C&I), Central & State Utilities, Independent Power Producers (IPPs), and Residential & Community Projects. TheC&Isegment is leading due to rising corporate decarbonization targets, green power procurement via open access and group captive models, and the cost-competitiveness of wind and wind-solar hybrids for 24x7 supply needs.

The India Wind Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Suzlon Energy Limited, Vestas Wind Technology India Private Limited, Siemens Gamesa Renewable Energy India (SGRE India), GE Vernova (Onshore Wind India), Tata Power Renewable Energy Limited (TPREL), ReNew Energy Global plc (ReNew), Adani Green Energy Limited (AGEL), Inox Wind Limited, Enercon India Private Limited (formerly Wind World India), Sembcorp Green Infra Limited, O2 Power Private Limited, Ayana Renewable Power Private Limited, Greenko Group, Serentica Renewables, Envision Energy India Private Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wind energy market in India appears promising, driven by increasing investments and technological innovations. In the future, the focus on offshore wind projects is expected to gain momentum, with the government targeting 30 GW of offshore capacity. Additionally, the integration of smart grid technologies will enhance energy management and distribution efficiency. As corporate sustainability initiatives grow, more businesses are likely to invest in renewable energy, further propelling the wind energy sector's growth in India.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Wind Offshore Wind Wind-Solar Hybrid Projects Repowering of Existing Wind Farms |

| By End-User | Commercial & Industrial (C&I) Central & State Utilities Independent Power Producers (IPPs) Residential & Community Projects |

| By Region | South India (Tamil Nadu, Karnataka, Andhra Pradesh, Telangana) West India (Gujarat, Maharashtra, Rajasthan) North & Central India (Madhya Pradesh, Uttar Pradesh) East & Northeast India (Odisha, Others) |

| By Technology | Horizontal Axis Wind Turbines (HAWT) Permanent Magnet Direct Drive & Gearbox-based Systems Advanced Control, SCADA & Forecasting Systems Hybridization with Storage (BESS) & Grid-forming Inverters |

| By Application | Grid-Connected Utility-Scale Open Access & Captive Use (C&I) Offshore Demonstration & Pilot Projects Repowering & Life-Extension Programs |

| By Investment Source | Domestic (Equity, NBFCs, IREDA) Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes & Viability Gap Funding (VGF) |

| By Policy Support | Competitive Bidding & Tariff-Based Competitive Procurement Renewable Energy Certificates (RECs) & RPO/RTM Compliance ISTS Waivers, GNA/Transmission Access & Green Energy Corridor Accelerated Depreciation, Customs Duty Concessions & PLI |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wind Farm Operators | 110 | Operations Managers, Site Engineers |

| Renewable Energy Investors | 80 | Investment Analysts, Portfolio Managers |

| Government Policy Makers | 50 | Energy Policy Advisors, Regulatory Officials |

| Technology Providers | 60 | Product Managers, R&D Engineers |

| Environmental Consultants | 40 | Sustainability Analysts, Environmental Engineers |

The India Wind Energy Market is valued at approximately USD 17 billion, driven by increasing demand for renewable energy, supportive government policies, and advancements in turbine technology that enhance generation efficiency.