Region:Europe

Author(s):Rebecca

Product Code:KRAA1381

Pages:84

Published On:August 2025

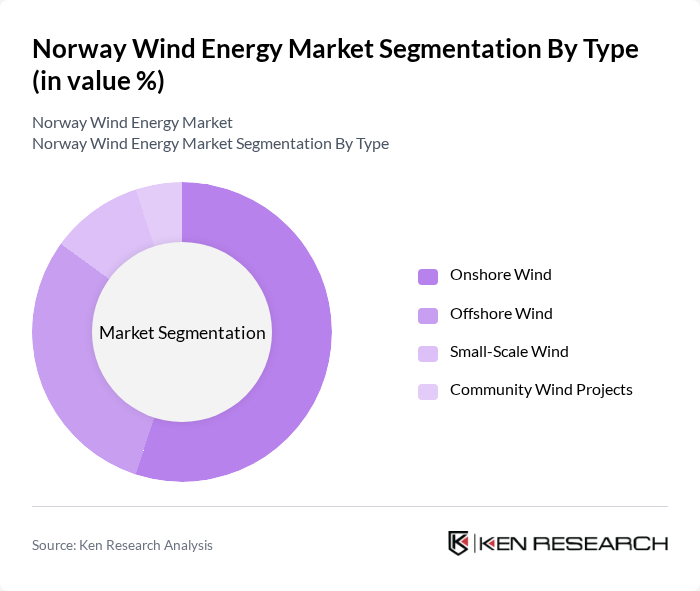

By Type:The market is segmented into Onshore Wind, Offshore Wind, Small-Scale Wind, and Community Wind Projects. Onshore wind projects currently represent the largest share due to their lower installation costs, mature technology, and established permitting processes. Offshore wind is gaining momentum, driven by advancements in floating turbine technology, higher energy yields, and Norway’s strategic ambitions for offshore wind export. Small-scale and community wind projects are increasingly adopted by local communities and cooperatives, supporting energy independence and local sustainability goals .

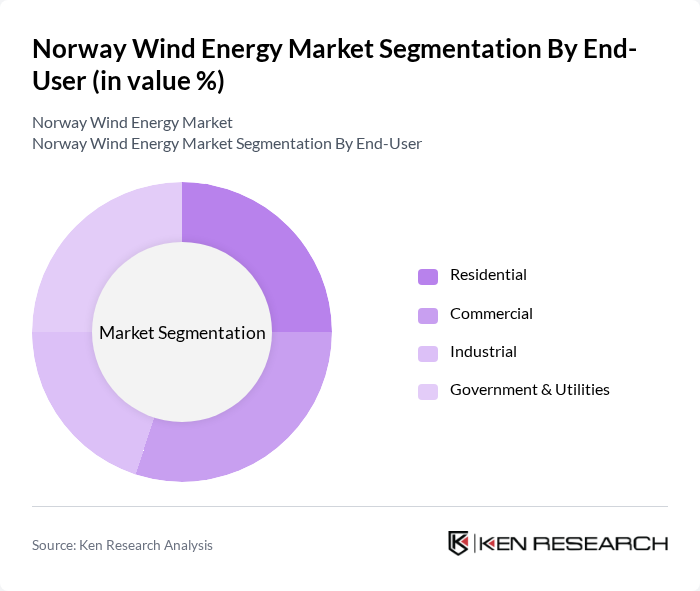

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The residential sector is experiencing increased adoption of small-scale wind solutions, reflecting a broader trend toward decentralized energy. The commercial and industrial sectors are significant contributors, driven by corporate sustainability commitments and the need for stable, long-term energy costs. Government and utilities remain key facilitators, supporting large-scale wind projects and grid integration through policy and investment .

The Norway Wind Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Statkraft AS, Equinor ASA, TrønderEnergi AS, Siemens Gamesa Renewable Energy S.A., Nordex SE, Vestas Wind Systems A/S, Engie SA, Ørsted A/S, Eolus Vind AB, RWE AG, Enel Green Power S.p.A., Iberdrola S.A., Acciona Energía, RES Group, and Mainstream Renewable Power contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wind energy market in Norway appears promising, driven by increasing investments in green technologies and a strong governmental push towards renewable energy. In future, the focus on hybrid energy systems integrating wind with solar and storage solutions is expected to gain traction. Additionally, the rise of community wind projects will empower local stakeholders, fostering greater public support and investment in sustainable energy initiatives, ultimately enhancing energy security and reducing carbon footprints.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Wind Offshore Wind Small-Scale Wind Community Wind Projects |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Utility-Scale Projects Distributed Generation Hybrid Systems Energy Storage Integration |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Credits (RECs) Grid Access Incentives |

| By Technology | Horizontal Axis Wind Turbines Vertical Axis Wind Turbines Advanced Control Systems Floating Offshore Wind Turbines |

| By Distribution Mode | Direct Sales Online Sales Distributors EPC Contractors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Wind Farm Development | 100 | Project Managers, Development Directors |

| Offshore Wind Energy Projects | 60 | Marine Engineers, Environmental Consultants |

| Energy Policy and Regulation | 50 | Government Officials, Policy Analysts |

| Wind Turbine Manufacturing | 40 | Manufacturing Engineers, Supply Chain Managers |

| Energy Market Analysis | 70 | Market Analysts, Financial Advisors |

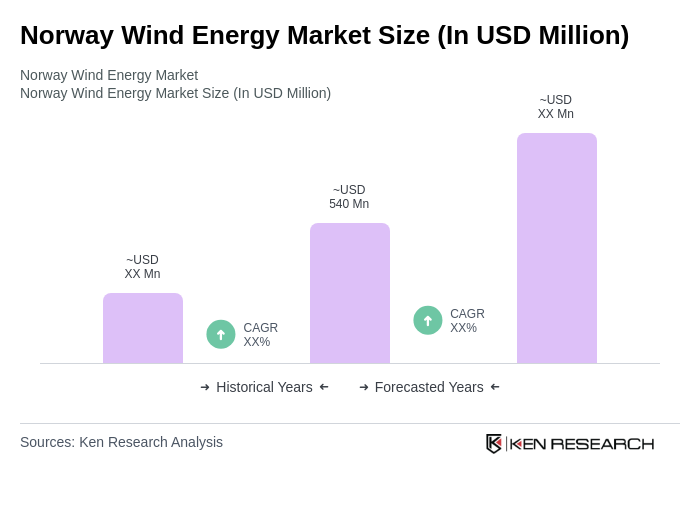

The Norway Wind Energy Market is valued at approximately USD 540 million, reflecting significant growth driven by the increasing demand for renewable energy, national decarbonization targets, and advancements in wind turbine technology.