Region:Middle East

Author(s):Rebecca

Product Code:KRAA5732

Pages:97

Published On:January 2026

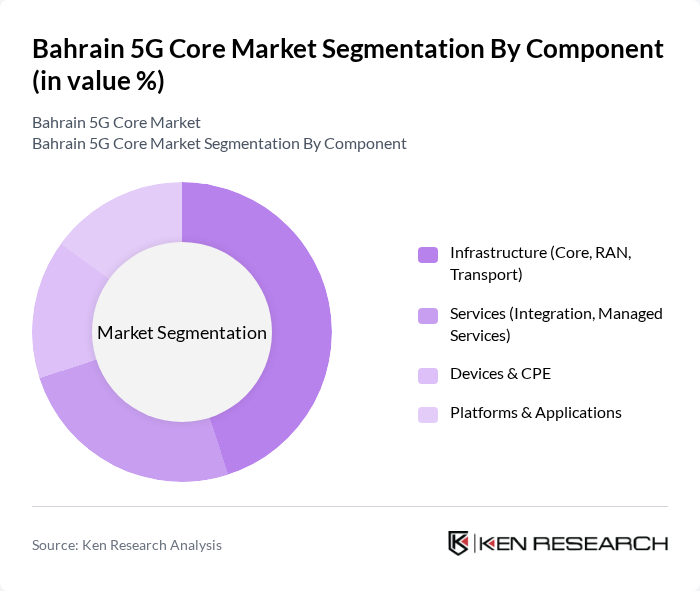

By Component:

The Bahrain 5G Core Market is segmented by components, which include Infrastructure (Core, RAN, Transport), Services (Integration, Managed Services), Devices & CPE, and Platforms & Applications. Among these, Infrastructure is the leading sub-segment, driven by the need for robust network capabilities to support the increasing data traffic and connectivity demands. The rapid deployment of 5G infrastructure by major telecom operators has been pivotal in enhancing network performance and reliability, making it a critical focus area for investment.

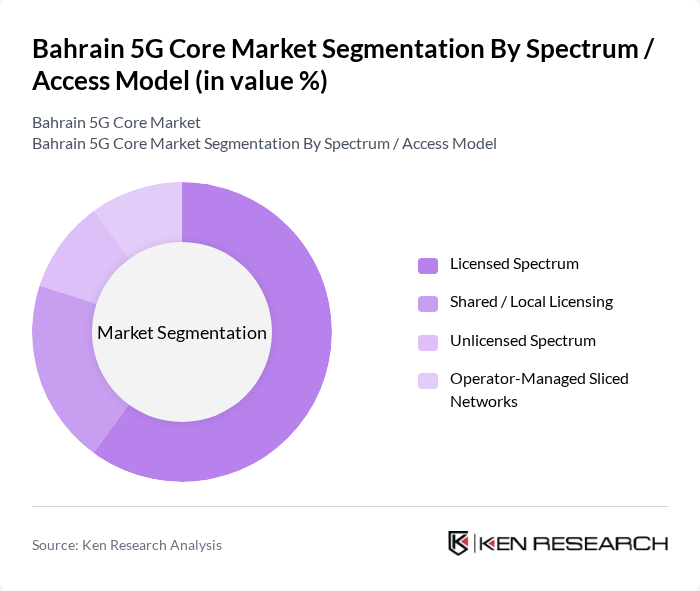

By Spectrum / Access Model:

This market is also segmented by spectrum/access models, including Licensed Spectrum, Shared / Local Licensing, Unlicensed Spectrum, and Operator-Managed Sliced Networks. The Licensed Spectrum segment is currently the most dominant, as it provides telecom operators with exclusive rights to specific frequency bands, ensuring better quality of service and reduced interference. This exclusivity is crucial for the successful implementation of 5G networks, which require dedicated bandwidth to deliver high-speed connectivity.

The Bahrain 5G Core Market is characterized by a dynamic mix of regional and international players. Leading participants such as Batelco, Zain Bahrain, stc Bahrain, Viva Bahrain, Ericsson, Nokia, Huawei, Cisco Systems, Samsung Electronics, Qualcomm, Intel Corporation, NEC Corporation, Fujitsu, Ciena Corporation, and Juniper Networks contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain 5G core market appears promising, driven by ongoing investments in digital infrastructure and the increasing integration of advanced technologies. As the government continues to prioritize digital transformation, the adoption of 5G is expected to accelerate, particularly in sectors like healthcare and education. Additionally, the rise of smart city projects will create further demand for high-speed connectivity, positioning Bahrain as a regional leader in telecommunications innovation and technology adoption.

| Segment | Sub-Segments |

|---|---|

| By Component | Infrastructure (Core, RAN, Transport) Services (Integration, Managed Services) Devices & CPE Platforms & Applications |

| By Spectrum / Access Model | Licensed Spectrum Shared / Local Licensing Unlicensed Spectrum Operator-Managed Sliced Networks |

| By Deployment Model | On-Premises Cloud / Edge-Hosted Hybrid Others |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Industry Vertical | Manufacturing & Industrial Oil, Gas & Utilities Transportation & Logistics Public Sector & Smart Cities Healthcare, Education & Campuses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 45 | Network Engineers, Business Development Managers |

| Enterprise Users | 80 | IT Managers, Operations Directors |

| Government Regulators | 50 | Policy Makers, Regulatory Affairs Specialists |

| Technology Consultants | 70 | Telecom Analysts, Market Researchers |

| End-Users (Consumers) | 90 | General Public, Tech Enthusiasts |

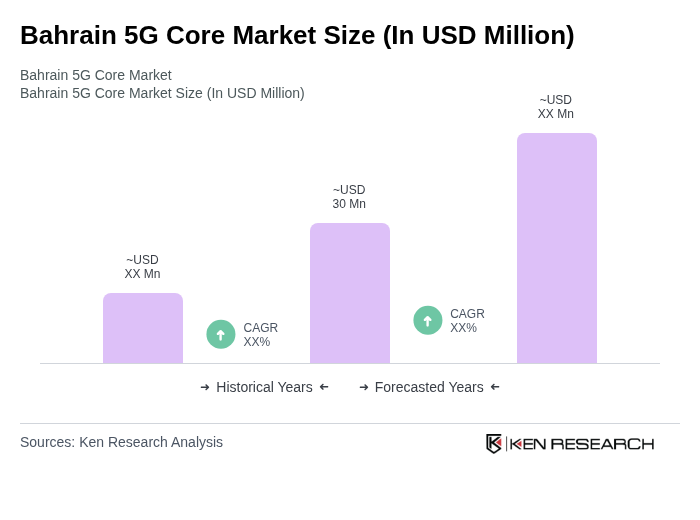

The Bahrain 5G Core Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for high-speed internet, IoT device proliferation, and government initiatives promoting 5G technology.