Region:Middle East

Author(s):Rebecca

Product Code:KRAA5702

Pages:92

Published On:January 2026

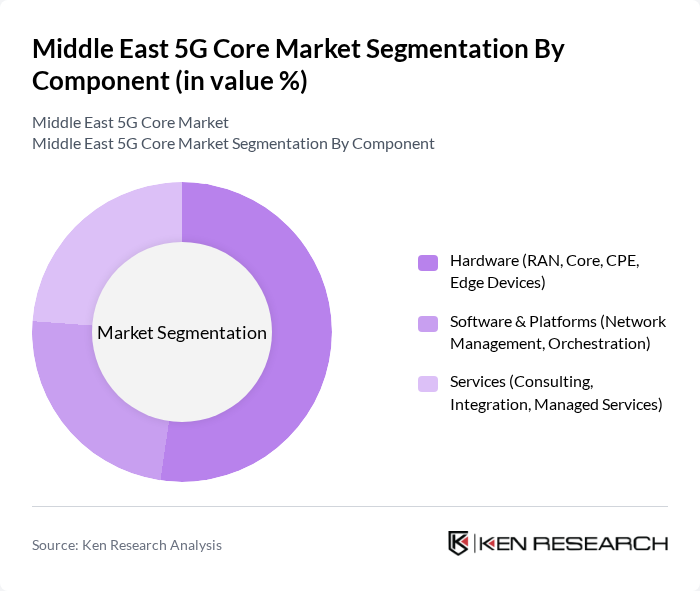

By Component:

The components of the market include Hardware, Software & Platforms, and Services. Among these, Hardware, which encompasses RAN, Core, CPE, and Edge Devices, is currently the leading subsegment, capturing an estimated 52.3% share of regional revenue. The increasing demand for robust infrastructure to support high-speed connectivity and the growing number of connected devices are driving the hardware segment's growth, particularly with rapid deployments of Radio Access Network systems and high-capacity backhaul infrastructure across the Gulf countries. Software & Platforms, focusing on network management and orchestration, also play a crucial role in optimizing network performance. Services, including consulting, integration, and managed services, are essential for ensuring seamless deployment and operation of 5G networks and are projected to witness the fastest growth, driven by enterprise-grade private 5G deployments across oil & gas facilities, logistics hubs, and manufacturing clusters.

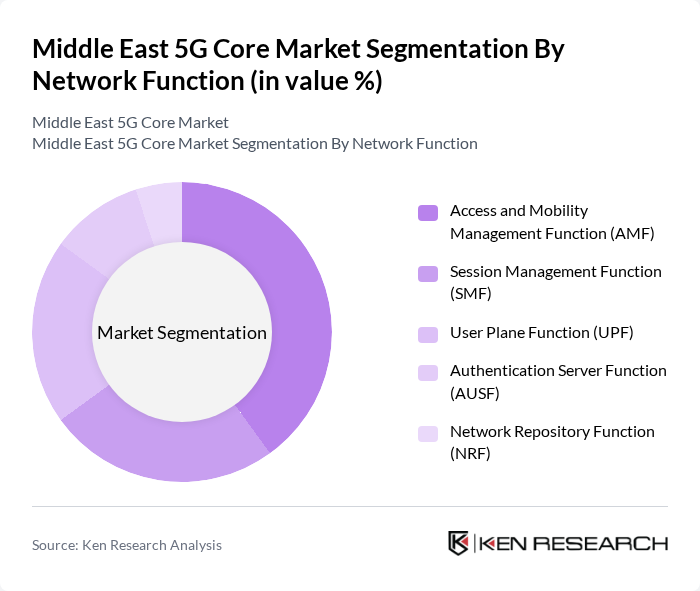

By Network Function:

The market is segmented by network functions, including Access and Mobility Management Function (AMF), Session Management Function (SMF), User Plane Function (UPF), Authentication Server Function (AUSF), and Network Repository Function (NRF). The Access and Mobility Management Function (AMF) is the dominant subsegment, as it is critical for managing user connections and mobility in 5G networks. The increasing number of mobile users and devices necessitates efficient access and mobility management, driving the demand for AMF solutions. Other functions, such as SMF and UPF, are also essential for ensuring seamless data flow and session management.

The Middle East 5G Core Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nokia Corporation, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., ZTE Corporation, Samsung Electronics Co., Ltd., Etisalat by e&, Saudi Telecom Company (STC), Ooredoo, Omantel, Vodafone Group PLC, Orange SA, Deutsche Telekom AG, Verizon Communications Inc., Qualcomm Incorporated, Mavenir contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East 5G core market appears promising, driven by technological advancements and increasing digitalization across sectors. As governments continue to prioritize digital infrastructure, the integration of AI and machine learning into 5G networks will enhance operational efficiency. Furthermore, the rise of smart cities will create new avenues for innovation, leading to increased collaboration among telecom operators and technology providers, ultimately fostering a more competitive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (RAN, Core, CPE, Edge Devices) Software & Platforms (Network Management, Orchestration) Services (Consulting, Integration, Managed Services) |

| By Network Function | Access and Mobility Management Function (AMF) Session Management Function (SMF) User Plane Function (UPF) Authentication Server Function (AUSF) Network Repository Function (NRF) |

| By Deployment Model | On-Premises Cloud-Based / Dedicated Cloud Network-as-a-Service (NaaS) |

| By Architecture | Standalone (SA) 5G Core Non-Standalone (NSA) 5G Core Open RAN Architecture |

| By End-User | Telecommunications Operators Enterprises Government Agencies Others |

| By Industry Vertical | Oil & Gas and Petrochemicals Manufacturing & Industrial Utilities & Energy Transportation, Logistics & Ports Healthcare & Campus Networks Smart Cities & Infrastructure Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant Region North Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators' 5G Core Network | 100 | Network Engineers, CTOs |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| 5G Technology Providers | 60 | Product Managers, Technical Sales Representatives |

| Enterprise Users of 5G Services | 70 | IT Managers, Operations Directors |

| Research Institutions and Think Tanks | 40 | Telecommunications Researchers, Analysts |

The Middle East 5G Core Market is valued at approximately USD 225 million, driven by the increasing demand for high-speed internet, IoT device proliferation, and enhanced mobile broadband services across various sectors, including smart cities and digital transformation initiatives.