Region:Asia

Author(s):Rebecca

Product Code:KRAA5712

Pages:82

Published On:January 2026

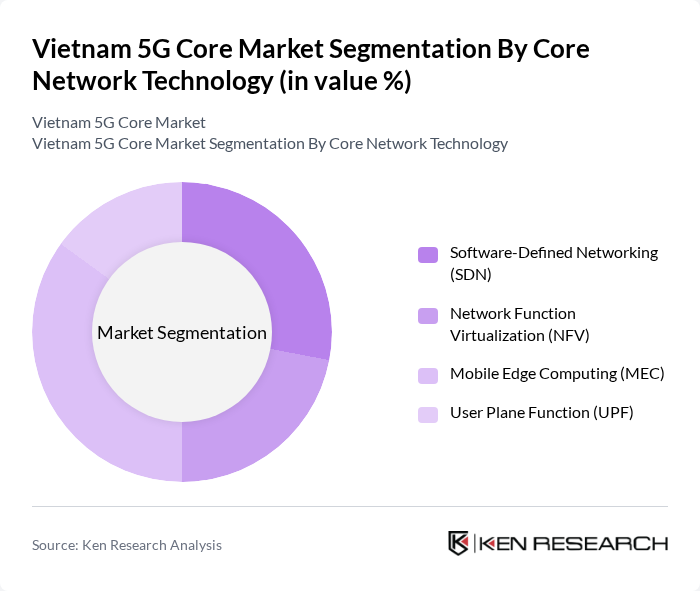

By Core Network Technology:The core network technology segment includes various technologies that enable the functioning of 5G networks. The subsegments are Software-Defined Networking (SDN), Network Function Virtualization (NFV), Mobile Edge Computing (MEC), and User Plane Function (UPF). Mobile Edge Computing (MEC) has emerged as the dominant core network technology segment, driven by the demand for low-latency, high-bandwidth applications. MEC enables innovative use cases and services in various industries, including smart cities, autonomous vehicles, healthcare, and industrial automation. Each of these technologies plays a crucial role in enhancing network efficiency, flexibility, and scalability, which are essential for supporting the growing demand for 5G services.

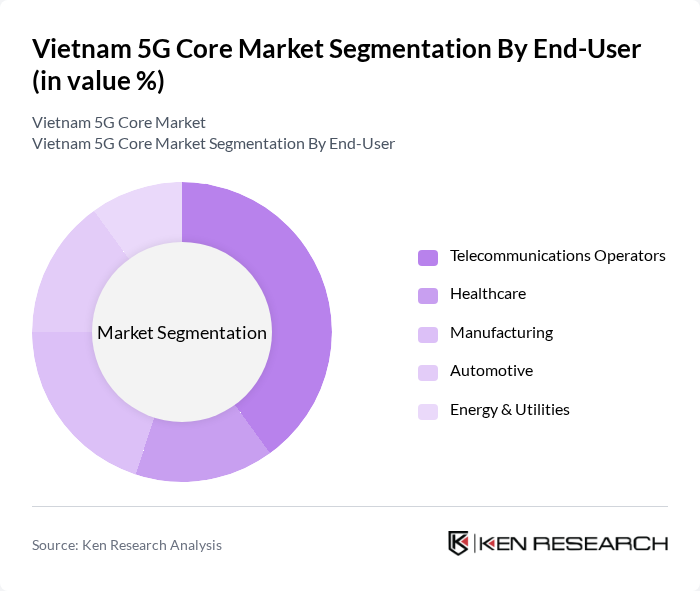

By End-User:The end-user segment encompasses various industries that utilize 5G technology, including Telecommunications Operators, Healthcare, Manufacturing, Automotive, and Energy & Utilities. Each sector leverages 5G capabilities to enhance operational efficiency, improve service delivery, and enable innovative applications that were previously not feasible with older network technologies. Telecommunications firms like MobiFone are expanding 5G-AI integrated B2B portfolios with over 100 digital solutions spanning industrial automation, healthcare, energy, education, and smart city applications.

The Vietnam 5G Core Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Group, VNPT (Vietnam Posts and Telecommunications Group), MobiFone, FPT Telecom, CMC Telecom, Saigon Cable Television (SCTV), Viettel Network, Vietnam Multimedia Corporation (VTC), NetNam, Bkav Corporation, HPT Vietnam, FPT Software, CMC Corporation, VNG Corporation, and Mobifone Technology Solutions contribute to innovation, geographic expansion, and service delivery in this space. Vietnam has emerged as a regional leader in Open RAN implementation, with Viettel High Technology commercially launching the world's first Open RAN-based 5G network using Qualcomm platforms, with over 300 live sites deployed and plans to scale the rollout to thousands of sites across Vietnam and international markets.

The future of the Vietnam 5G core market appears promising, driven by increasing investments in telecom infrastructure and the government's commitment to digital transformation. As urbanization accelerates and consumer demand for high-speed internet rises, the adoption of 5G technology is expected to expand significantly. Furthermore, the integration of advanced technologies such as edge computing and network slicing will enhance service delivery, positioning Vietnam as a competitive player in the regional digital economy landscape.

| Segment | Sub-Segments |

|---|---|

| By Core Network Technology | Software-Defined Networking (SDN) Network Function Virtualization (NFV) Mobile Edge Computing (MEC) User Plane Function (UPF) |

| By End-User | Telecommunications Operators Healthcare Manufacturing Automotive Energy & Utilities |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Deployment Model | Public 5G Core Networks Private 5G Core Networks Hybrid Deployment |

| By Application | Smart Cities Connected Vehicles Industrial Automation Remote Work & Education |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 45 | Network Engineers, Operations Managers |

| Government Regulatory Bodies | 25 | Policy Makers, Regulatory Analysts |

| Technology Vendors | 35 | Product Managers, Sales Directors |

| Enterprise Users of 5G | 30 | IT Managers, Business Development Executives |

| Research Institutions | 15 | Academic Researchers, Industry Analysts |

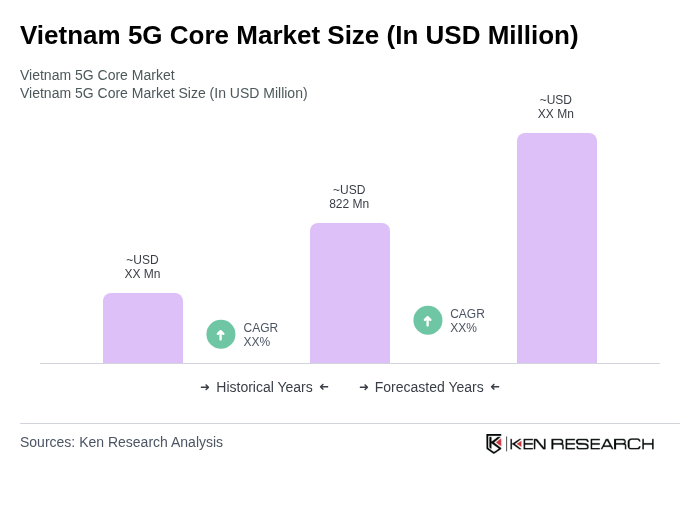

The Vietnam 5G Core Market is valued at approximately USD 822 million, reflecting significant growth driven by high-speed internet demand, IoT proliferation, and government initiatives for digital transformation across various sectors.