Region:Asia

Author(s):Rebecca

Product Code:KRAA5739

Pages:98

Published On:January 2026

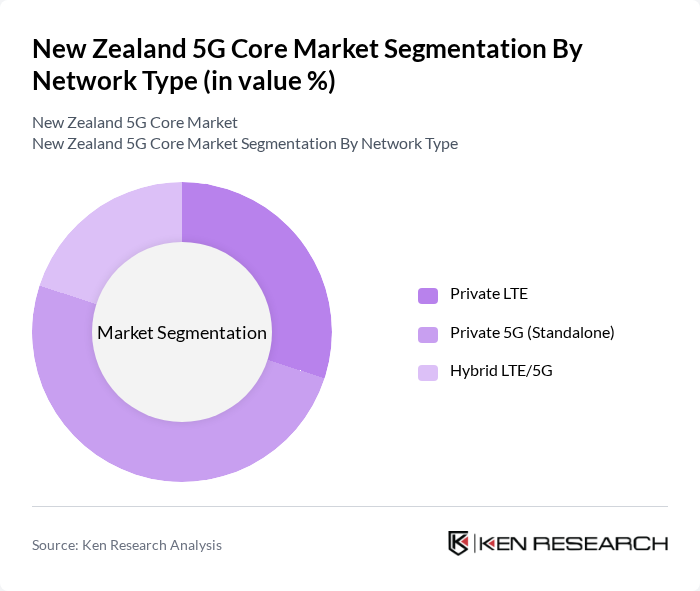

By Network Type:The network type segmentation includes Private LTE, Private 5G (Standalone), and Hybrid LTE/5G. The Private 5G (Standalone) segment is currently dominating the market due to its ability to provide dedicated, high-speed connectivity tailored for specific enterprise needs. This segment is particularly favored by industries requiring low latency and high reliability, such as manufacturing and healthcare. The increasing adoption of Industry 4.0 practices and enterprise digitalization is further propelling the demand for Private 5G solutions.

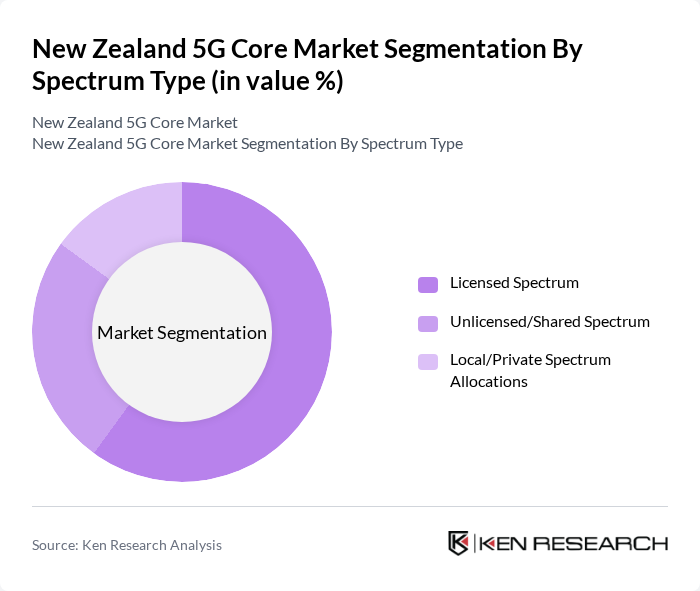

By Spectrum Type:The spectrum type segmentation encompasses Licensed Spectrum, Unlicensed/Shared Spectrum, and Local/Private Spectrum Allocations. The Licensed Spectrum segment is leading the market, primarily due to its exclusive rights and higher reliability for service providers. This segment is crucial for ensuring quality of service and is preferred by major telecommunications companies for deploying robust 5G networks. The regulatory framework in New Zealand supports the allocation of licensed spectrum, further enhancing its market position.

The New Zealand 5G Core Market is characterized by a dynamic mix of regional and international players. Leading participants such as Spark New Zealand Limited, One New Zealand Group Limited (formerly Vodafone New Zealand), 2degrees Network Limited, Chorus Limited, Nokia Corporation, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Samsung Electronics Co., Ltd. (Samsung Networks), NEC Corporation, Fujitsu Limited, ZTE Corporation, Thales Group, Infinera Corporation, Ciena Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand 5G core market appears promising, driven by technological advancements and increasing consumer demand for high-speed connectivity. As the government continues to invest in digital infrastructure, the rollout of 5G services is expected to accelerate, particularly in urban areas. Furthermore, the integration of edge computing and the rise of private 5G networks will enhance service delivery across various sectors, positioning New Zealand as a leader in 5G technology adoption in the Asia-Pacific region.

| Segment | Sub-Segments |

|---|---|

| By Network Type | Private LTE Private 5G (Standalone) Hybrid LTE/5G |

| By Spectrum Type | Licensed Spectrum Unlicensed/Shared Spectrum Local/Private Spectrum Allocations |

| By Deployment Model | On-Premises Cloud-Managed Hybrid |

| By Service Type | Infrastructure & Integration Services Managed Services Professional & Consulting Services |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Industry Vertical | Manufacturing & Industry 4.0 Mining, Oil & Gas Transport, Ports & Logistics Utilities & Energy Public Safety, Defence & Government Healthcare Agriculture & Smart Farming Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 45 | Network Engineers, Product Managers |

| Enterprise Users of 5G | 80 | IT Managers, Operations Directors |

| Regulatory Bodies | 25 | Policy Makers, Compliance Officers |

| Consumer Insights | 120 | General Public, Tech Enthusiasts |

| Industry Analysts | 30 | Market Researchers, Telecom Analysts |

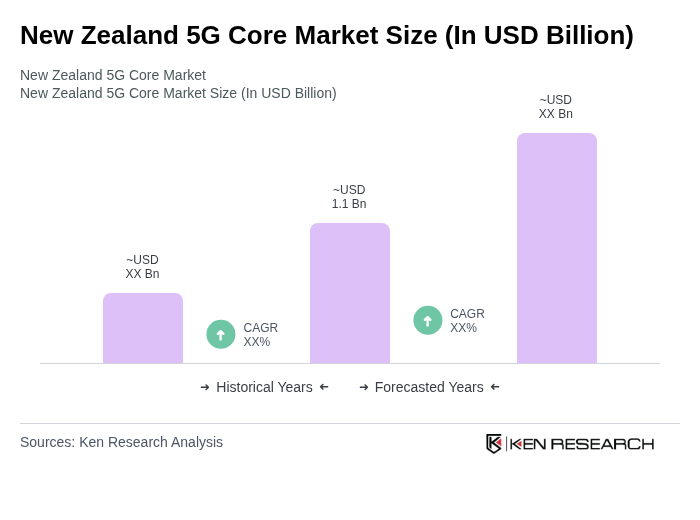

The New Zealand 5G Core Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for high-speed internet, IoT device proliferation, and enhanced mobile broadband services.