Region:Middle East

Author(s):Geetanshi

Product Code:KRAE5872

Pages:82

Published On:December 2025

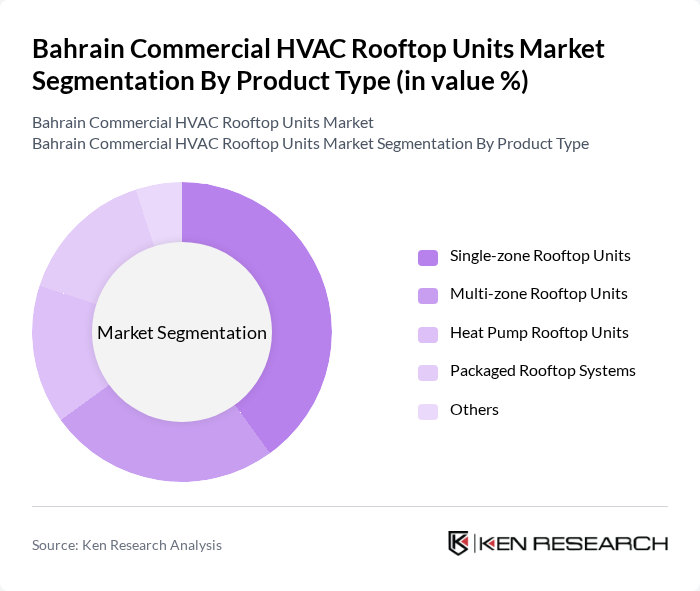

By Product Type:The product type segmentation includes various categories such as Single-zone Rooftop Units, Multi-zone Rooftop Units, Heat Pump Rooftop Units, Packaged Rooftop Systems, and Others. This structure is consistent with regional and global rooftop unit categorizations, where single-zone, multi-zone, heat pump and packaged systems are the primary commercial offerings. Among these, Single-zone Rooftop Units are leading the market in Bahrain for small to medium-sized commercial spaces such as stand?alone retail, quick?service restaurants and low?rise offices, due to their cost-effectiveness, compact footprint, and ease of installation and maintenance. Multi-zone Rooftop Units are also gaining traction, especially in larger office buildings, malls and education facilities, as they offer flexibility in temperature control across different zones and can be integrated with modern building management systems for better energy optimization.

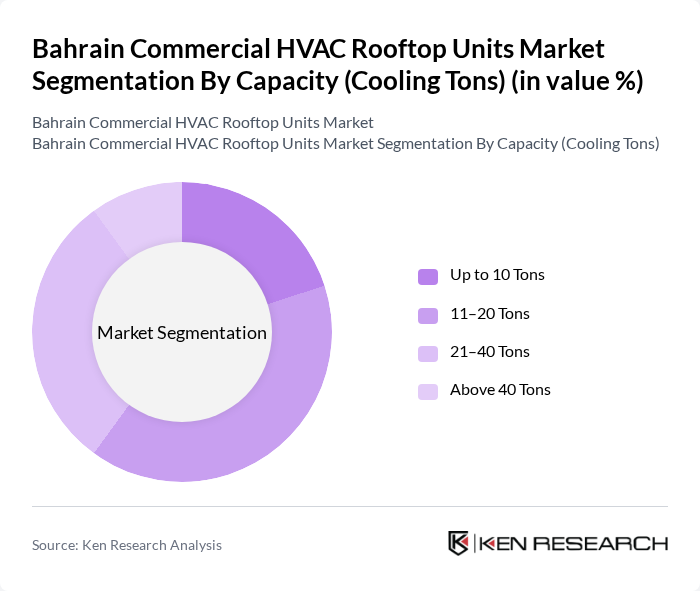

By Capacity (Cooling Tons):The capacity segmentation includes categories such as Up to 10 Tons, 11–20 Tons, 21–40 Tons, and Above 40 Tons. These capacity bands broadly align with typical commercial rooftop unit sizing used in Middle East projects, where small capacities serve shops and small offices while mid and large capacities address malls, warehouses and institutional buildings. The segment of 11–20 Tons is currently dominating the market, as it caters to a wide range of commercial applications, providing adequate cooling for medium-sized office buildings, clinics, mid?size retail and foodservice outlets. The demand for larger capacities, particularly in the 21–40 Tons range and above, is also increasing due to the growth of larger commercial facilities, logistics assets, and hospitality projects, along with the need for efficient, centralized cooling solutions that can integrate with energy management and control systems.

The Bahrain Commercial HVAC Rooftop Units Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trane Technologies plc, Carrier Global Corporation, Daikin Industries, Ltd., Johnson Controls International plc (York), Lennox International Inc., Rheem Manufacturing Company, Mitsubishi Electric Corporation, Bosch Thermotechnology, Fujitsu General Limited, Hitachi, Ltd., Panasonic Corporation, Gree Electric Appliances, Inc., Haier Smart Home Co., Ltd., Samsung Electronics Co., Ltd., and regional and local Bahrain-based OEMs & integrators contribute to innovation, geographic expansion, and service delivery in this space, particularly through high-efficiency packaged rooftop units, controls integration, and after?sales service offerings.

The future of the Bahrain commercial HVAC rooftop units market appears promising, driven by increasing investments in smart building technologies and a growing emphasis on sustainability. As businesses prioritize energy efficiency and indoor air quality, the integration of IoT-enabled systems is expected to gain traction. Furthermore, the ongoing expansion of renewable energy initiatives will likely create a favorable environment for innovative HVAC solutions, enhancing overall market growth and resilience in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Single-zone Rooftop Units Multi-zone Rooftop Units Heat Pump Rooftop Units Packaged Rooftop Systems Others |

| By Capacity (Cooling Tons) | Up to 10 Tons 11–20 Tons 21–40 Tons Above 40 Tons |

| By End-Use Sector | Commercial Offices Retail & Shopping Malls Hospitality (Hotels, Restaurants) Healthcare Facilities Education & Institutional Buildings Industrial & Logistics Facilities Others |

| By Technology | Conventional Rooftop Units Inverter & High-Efficiency Rooftop Units Smart / Connected Rooftop Units |

| By Installation Type | New Construction Retrofit & Replacement |

| By Ownership & Commercial Model | Owner-Procured Systems ESCO / Performance Contracting Models Lease / Rental Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building HVAC Systems | 120 | Facility Managers, Building Owners |

| Retail Sector HVAC Solutions | 80 | Store Managers, Operations Directors |

| Hospitality Industry HVAC Needs | 60 | Hotel Managers, Maintenance Supervisors |

| Healthcare Facility HVAC Requirements | 50 | Healthcare Administrators, Facility Engineers |

| Energy Efficiency in HVAC Systems | 70 | Energy Managers, Sustainability Officers |

The Bahrain Commercial HVAC Rooftop Units market is valued at approximately USD 12 million, reflecting its share within the broader Bahrain air conditioning and Middle East commercial HVAC markets, driven by increasing demand for energy-efficient cooling solutions.