Qatar Digital Lending Market Overview

- The Qatar Digital Lending Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital financial services, a rise in smartphone penetration, and a growing preference for online lending platforms among consumers. The market has seen a significant shift towards digital solutions, enabling faster loan approvals and enhanced customer experiences.

- Key players in this market include Doha, Al Rayyan, and Lusail, which dominate due to their robust financial infrastructure, high internet penetration rates, and a tech-savvy population. These cities have become hubs for fintech innovation, attracting investments and fostering a competitive environment that supports the growth of digital lending services.

- In 2023, the Qatari government implemented regulations to enhance consumer protection in digital lending. This includes mandatory disclosures of loan terms and interest rates, ensuring transparency and fairness in lending practices. Such regulations aim to build consumer trust and promote responsible borrowing, contributing to the overall stability of the digital lending market.

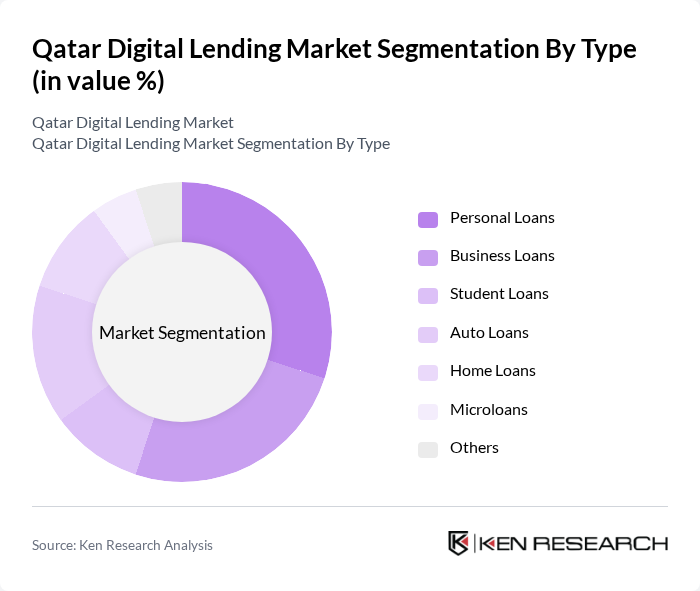

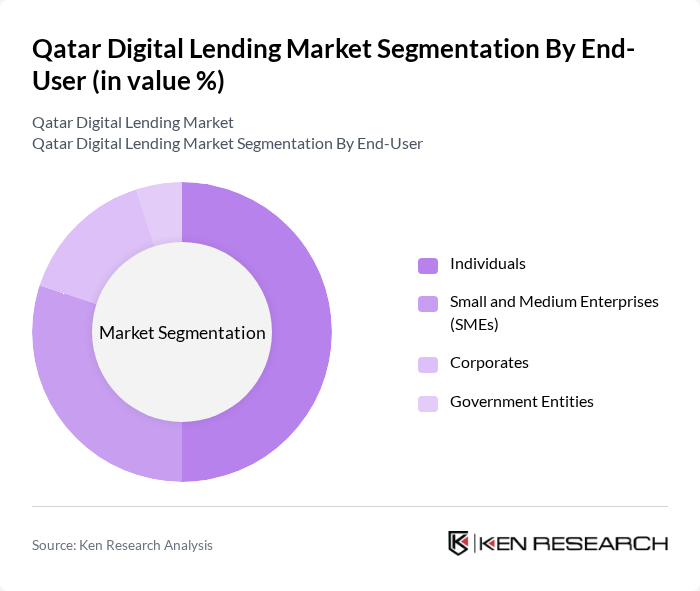

Qatar Digital Lending Market Segmentation

By Type:The digital lending market is segmented into various types of loans, including personal loans, business loans, student loans, auto loans, home loans, microloans, and others. Personal loans are particularly popular due to their flexibility and ease of access, catering to a wide range of consumer needs. Business loans are also significant, driven by the growth of SMEs in the region.

By End-User:The end-user segmentation includes individuals, small and medium enterprises (SMEs), corporates, and government entities. Individuals represent the largest segment, driven by the increasing need for personal financing solutions. SMEs are also a significant user group, as they seek funding for growth and operational needs.

Qatar Digital Lending Market Competitive Landscape

The Qatar Digital Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Islamic Bank, Doha Bank, Qatar National Bank, Al Khaliji Commercial Bank, Masraf Al Rayan, Qatar Development Bank, QNB Finansinvest, Fawry for Banking Technology and Electronic Payments, Kiva, Tamweelcom, Beehive, Lendico, YAPILI, Fintech Galaxy, PinPay contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Digital Lending Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, Qatar's smartphone penetration rate is projected to reach 95%, with approximately 2.9 million smartphone users. This widespread access to mobile technology facilitates digital lending platforms, allowing consumers to apply for loans conveniently. The high smartphone usage correlates with increased online financial transactions, which is expected to drive the digital lending market significantly, as more users engage with financial services through their devices.

- Rise in Digital Payment Adoption:In future, digital payment transactions in Qatar are anticipated to exceed QAR 60 billion, reflecting a robust shift towards cashless transactions. This trend is bolstered by government initiatives promoting digital finance, which enhances consumer confidence in online lending platforms. The growing acceptance of digital payments is crucial for the digital lending market, as it streamlines the loan disbursement and repayment processes, making them more efficient and user-friendly.

- Growing Demand for Quick Access to Credit:The demand for instant credit solutions in Qatar is surging, with an estimated 1.5 million individuals seeking quick loans in future. This trend is driven by the need for immediate financial support for personal and business expenses. Digital lending platforms cater to this demand by offering streamlined application processes and rapid approval times, thus positioning themselves as essential financial tools for consumers in need of urgent funding.

Market Challenges

- High Competition Among Lenders:The digital lending landscape in Qatar is becoming increasingly saturated, with over 35 active lenders competing for market share in future. This intense competition can lead to aggressive pricing strategies and reduced profit margins for lenders. Additionally, the proliferation of options may overwhelm consumers, making it challenging for lenders to differentiate their offerings and maintain customer loyalty in a crowded marketplace.

- Data Privacy Concerns:With the rise of digital lending, data privacy issues have become a significant concern. In future, approximately 65% of consumers express apprehension about sharing personal financial information online. This skepticism can hinder the growth of digital lending platforms, as potential borrowers may hesitate to engage with services perceived as insecure. Addressing these concerns through robust data protection measures is essential for fostering consumer trust and encouraging market expansion.

Qatar Digital Lending Market Future Outlook

The future of the digital lending market in Qatar appears promising, driven by technological advancements and evolving consumer preferences. As fintech solutions continue to innovate, lenders are likely to adopt more sophisticated credit assessment methods, enhancing their ability to serve diverse customer needs. Additionally, the integration of artificial intelligence in lending processes will streamline operations, improve risk management, and enhance customer experiences, positioning the market for sustained growth in the coming years.

Market Opportunities

- Expansion of Fintech Solutions:The fintech sector in Qatar is projected to attract QAR 1.5 billion in investments by future, creating opportunities for digital lenders to collaborate with tech startups. This partnership can lead to innovative lending solutions that cater to underserved segments, enhancing market reach and customer engagement.

- Collaboration with Traditional Banks:In future, over 45% of digital lenders in Qatar are expected to form partnerships with traditional banks. This collaboration can leverage established banking infrastructure and customer bases, facilitating the development of hybrid lending products that combine the strengths of both sectors, ultimately driving growth and enhancing service offerings.