Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4770

Pages:89

Published On:December 2025

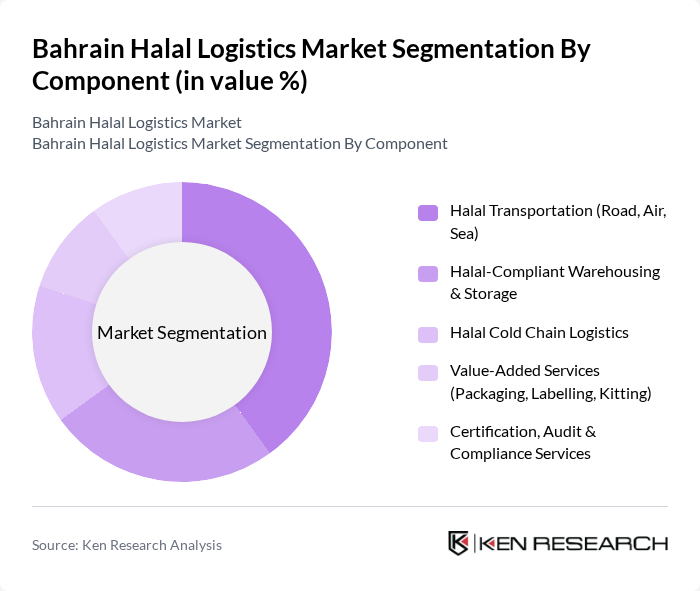

By Component:The components of the Bahrain Halal Logistics Market include Halal Transportation (Road, Air, Sea), Halal-Compliant Warehousing & Storage, Halal Cold Chain Logistics, Value-Added Services (Packaging, Labelling, Kitting), and Certification, Audit & Compliance Services. Among these, Halal Transportation is currently the leading segment due to the increasing demand for efficient and compliant transport solutions for halal products. The rise in e-commerce and cross-border trade has further fueled the need for reliable transportation services that adhere to halal standards, including dedicated fleets, segregated handling, and real-time tracking to ensure product integrity.

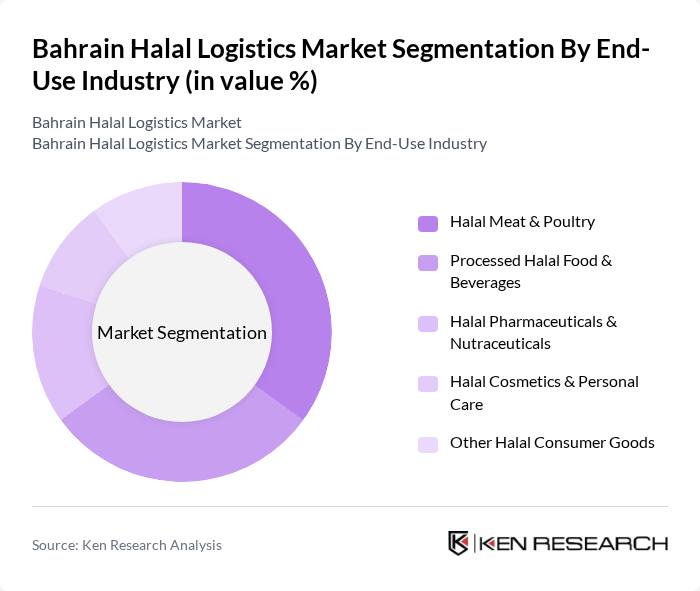

By End-Use Industry:The end-use industries in the Bahrain Halal Logistics Market include Halal Meat & Poultry, Processed Halal Food & Beverages, Halal Pharmaceuticals & Nutraceuticals, Halal Cosmetics & Personal Care, and Other Halal Consumer Goods. The Halal Meat & Poultry segment is the dominant player, driven by the high demand for halal-certified meat products among consumers in Bahrain and neighboring countries. The increasing focus on health and wellness has also contributed to the growth of halal pharmaceuticals and nutraceuticals, while rising consumer preference for halal cosmetics and personal care products is expanding logistics requirements in this segment.

The Bahrain Halal Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Logistics Zone (BLZ), Bahrain Airport Services – Cargo & Logistics, DHL Global Forwarding Bahrain, Aramex Bahrain, Agility Logistics Parks – Bahrain, Kuehne + Nagel Bahrain, DB Schenker Bahrain, Gulf Agency Company (GAC) Bahrain, Kanoo Logistics (Yusuf Bin Ahmed Kanoo) – Bahrain, Almoayyed International Group – Logistics Division, Panalpina / DSV Bahrain, FedEx Express Bahrain, UPS Supply Chain Solutions Bahrain, Al Jazeera Shipping Co. W.L.L. (Bahrain), BMMI Logistics (Bahrain Maritime & Mercantile International) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain halal logistics market appears promising, driven by increasing consumer demand for halal products and the expansion of e-commerce. As the government continues to support halal certification and logistics initiatives, the market is likely to see enhanced operational efficiencies. Additionally, the integration of advanced technologies such as AI and IoT will streamline logistics processes, improving transparency and traceability, which are critical for consumer trust in halal products.

| Segment | Sub-Segments |

|---|---|

| By Component | Halal Transportation (Road, Air, Sea) Halal-Compliant Warehousing & Storage Halal Cold Chain Logistics Value-Added Services (Packaging, Labelling, Kitting) Certification, Audit & Compliance Services |

| By End-Use Industry | Halal Meat & Poultry Processed Halal Food & Beverages Halal Pharmaceuticals & Nutraceuticals Halal Cosmetics & Personal Care Other Halal Consumer Goods |

| By Service Type | Freight Forwarding & Consolidation Customs Clearance & Trade Facilitation Last-Mile & E-commerce Fulfilment Supply Chain Management & 4PL Services |

| By Logistics Model | First-Party Logistics (1PL) Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) & Lead Logistics |

| By Technology Utilization | Temperature & Condition Monitoring (IoT Sensors) Blockchain & Digital Traceability Platforms Transport Management & Warehouse Management Systems Advanced Analytics & Route Optimization |

| By Trade Flow | Imports into Bahrain Exports & Re-exports from Bahrain Domestic Distribution Transit & Trans-shipment Cargo |

| By Customer Segment | Large Multinational Food & FMCG Companies Local Manufacturers & Distributors Modern Retail & E-commerce Platforms Government & Institutional Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Halal Food Logistics | 120 | Logistics Managers, Supply Chain Coordinators |

| Halal Cosmetics Distribution | 70 | Operations Managers, Product Compliance Officers |

| Halal Pharmaceuticals Supply Chain | 60 | Procurement Managers, Quality Assurance Specialists |

| Halal E-commerce Fulfillment | 80 | E-commerce Managers, Warehouse Supervisors |

| Halal Certification Bodies | 40 | Certification Officers, Regulatory Affairs Managers |

The Bahrain Halal Logistics Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the increasing demand for halal products and heightened consumer awareness regarding halal certification.