Bahrain Household Kitchen Appliances Market Overview

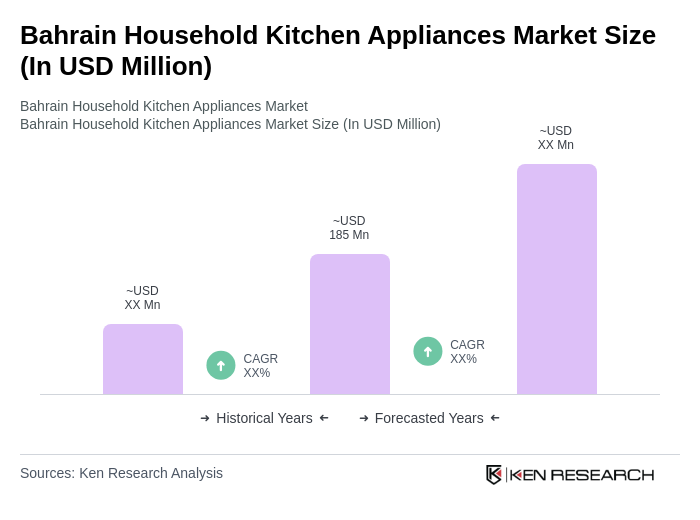

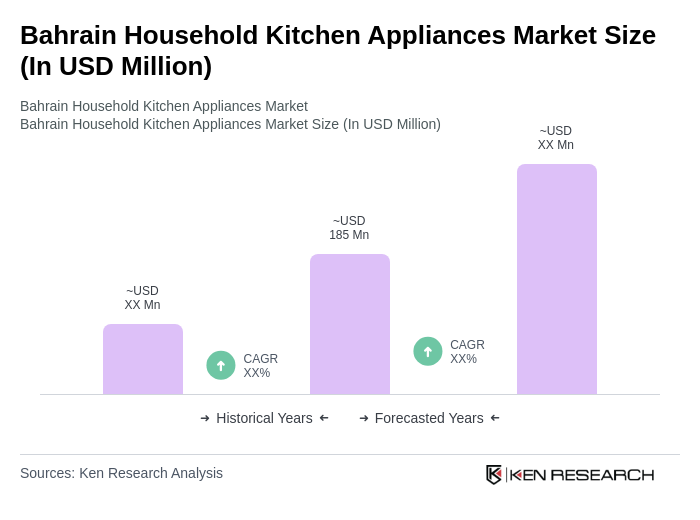

- The Bahrain Household Kitchen Appliances Market is valued at USD 185 million, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing preference for energy-efficient and smart appliances among consumers. The market has seen a significant shift towards modern kitchen solutions that enhance convenience and efficiency in daily cooking and food preparation. Notably, demand is further propelled by the adoption of smart, connected appliances and the growing influence of e-commerce, which enables broader access to the latest kitchen technologies .

- Key players in this market includeManama, the capital city, which serves as a commercial hub, and other major cities likeMuharraqandRiffa. These cities dominate the market due to their high population density, urban lifestyle, and concentration of retail outlets, making them prime locations for household appliance sales and distribution. The Northern Governorate is also emerging as a high-growth area, supported by large-scale housing projects and infrastructure development .

- In 2023, the Bahraini government implemented regulations aimed at promoting energy efficiency in household appliances. This initiative mandates that all new kitchen appliances meet specific energy consumption standards, encouraging manufacturers to innovate and produce more energy-efficient products. The regulation, titled“GCC Standardization Organization Technical Regulation for Energy Efficiency, Functionality and Labelling Requirements of Electrical Appliances (BD-142004-01), issued by the GCC Standardization Organization in 2023”, requires compliance with minimum energy performance standards and labeling, covering refrigerators, dishwashers, ovens, and other major kitchen appliances. The regulation aims to reduce overall energy consumption and promote sustainable practices among consumers .

Bahrain Household Kitchen Appliances Market Segmentation

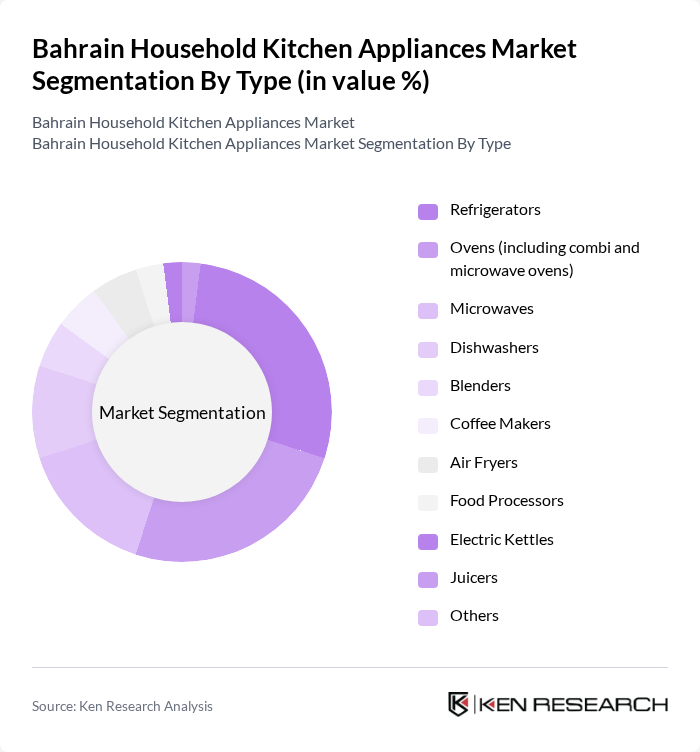

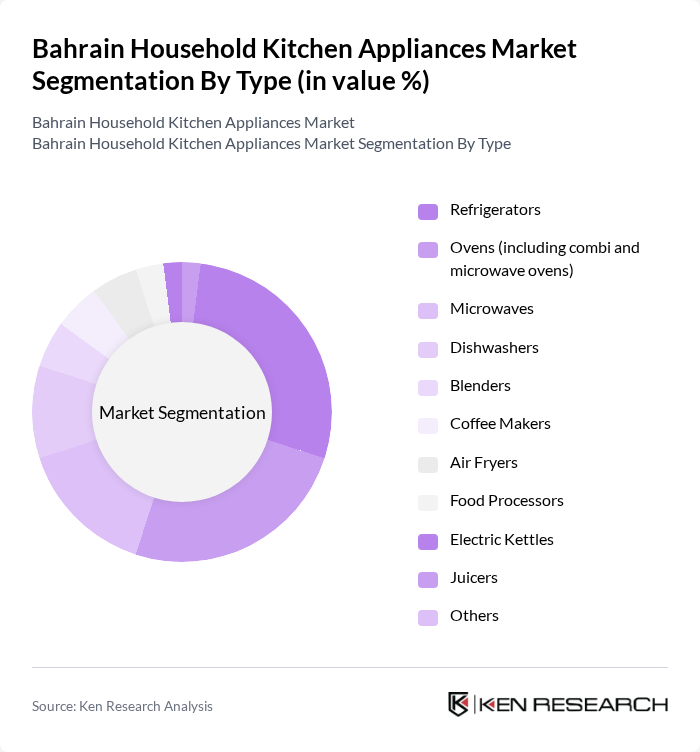

By Type:The market is segmented into various types of kitchen appliances, including refrigerators, ovens (including combi and microwave ovens), microwaves, dishwashers, blenders, coffee makers, air fryers, food processors, electric kettles, juicers, and others. Among these,refrigeratorsandovensare the most popular due to their essential roles in food preservation and cooking, respectively. The trend towards multifunctional appliances is also gaining traction, as consumers seek to maximize utility and minimize space in their kitchens. Air fryers and smart appliances are experiencing rapid growth, driven by health-conscious consumers and the adoption of connected home technologies .

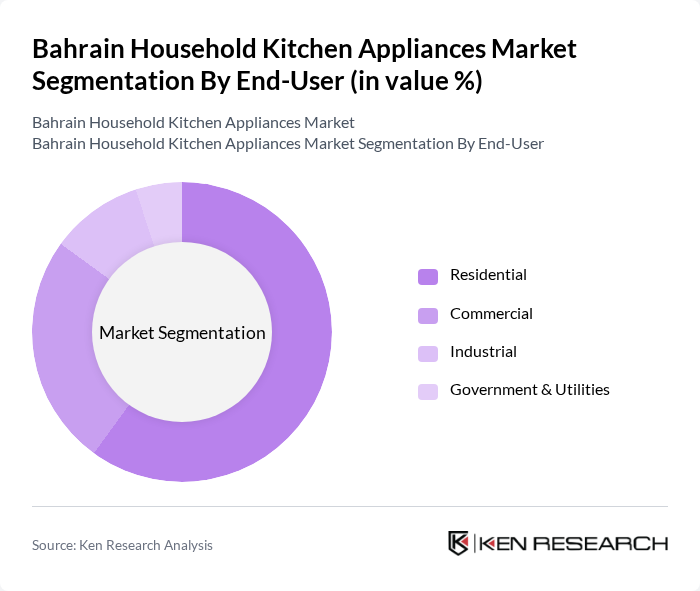

By End-User:The market is segmented by end-user into residential, commercial, industrial, and government & utilities. Theresidential segmentdominates the market, driven by the increasing number of households and the growing trend of home cooking. Consumers are investing in modern kitchen appliances to enhance their cooking experience and improve efficiency. The commercial segment is also significant, as restaurants and cafes seek high-quality appliances to meet their operational needs. The industrial and government & utilities segments remain niche, primarily focused on institutional kitchens and public sector facilities .

Bahrain Household Kitchen Appliances Market Competitive Landscape

The Bahrain Household Kitchen Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as LG Electronics, Samsung Electronics, Whirlpool Corporation, Philips (Koninklijke Philips N.V.), Panasonic Corporation, Electrolux AB, Bosch Home Appliances (BSH Hausgeräte GmbH), Haier Group, Midea Group, Sharp Corporation, Kenwood Limited, Breville Group, Cuisinart (Conair Corporation), Black+Decker (Stanley Black & Decker), Tefal (Groupe SEB), Hisense, Beko (Arçelik A.?.), Morphy Richards, Russell Hobbs, Moulinex (Groupe SEB) contribute to innovation, geographic expansion, and service delivery in this space .

Bahrain Household Kitchen Appliances Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The average disposable income in Bahrain is projected to reach approximately BHD 1,500 per month in future, reflecting a 5% increase from the previous year. This rise in income enables consumers to invest in higher-quality kitchen appliances, driving demand for premium products. As households prioritize convenience and efficiency, the market for household kitchen appliances is expected to expand, with consumers willing to spend more on innovative and energy-efficient solutions that enhance their cooking experience.

- Rising Urbanization:Urbanization in Bahrain is accelerating, with over 90% of the population residing in urban areas as of future. This trend is leading to smaller living spaces, increasing the demand for compact and multifunctional kitchen appliances. Urban consumers are more likely to adopt modern cooking technologies, which are essential for efficient meal preparation in limited spaces. Consequently, manufacturers are focusing on developing products that cater to the needs of urban households, further stimulating market growth.

- Technological Advancements in Kitchen Appliances:The kitchen appliances sector is witnessing rapid technological advancements, with smart appliances gaining traction. By future, it is estimated that 30% of households in Bahrain will own smart kitchen devices, such as connected ovens and refrigerators. These innovations not only enhance convenience but also improve energy efficiency, aligning with consumer preferences for sustainable living. As technology continues to evolve, the market is expected to see increased adoption of smart appliances, driving overall growth.

Market Challenges

- High Import Tariffs:Bahrain imposes import tariffs averaging 5% on household kitchen appliances, which can significantly increase retail prices. This financial burden affects both consumers and retailers, limiting access to a broader range of products. As a result, many consumers may opt for lower-quality alternatives or delay purchases, hindering market growth. The high tariffs also discourage international brands from entering the market, reducing competition and innovation in the sector.

- Intense Competition from International Brands:The Bahrain household kitchen appliances market is characterized by fierce competition from established international brands, which dominate the market share. Local brands struggle to compete due to limited resources and brand recognition. In future, international brands are expected to hold over 70% of the market share, making it challenging for local manufacturers to gain traction. This competitive landscape can lead to price wars, further squeezing profit margins for local players and stifling growth opportunities.

Bahrain Household Kitchen Appliances Market Future Outlook

The future of the Bahrain household kitchen appliances market appears promising, driven by increasing consumer demand for innovative and energy-efficient products. As disposable incomes rise and urbanization continues, the market is likely to see a shift towards smart appliances that enhance convenience and sustainability. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enabling consumers to make informed purchasing decisions. Overall, the market is poised for growth, with opportunities for both local and international players to innovate and capture consumer interest.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in Bahrain is significant, with online retail sales projected to reach BHD 200 million in future. This trend presents an opportunity for kitchen appliance manufacturers to enhance their online presence and reach a broader audience. By leveraging digital marketing strategies, brands can effectively engage consumers and drive sales through online channels, capitalizing on the increasing preference for online shopping.

- Increasing Focus on Smart Home Technologies:As smart home technologies gain popularity, the demand for connected kitchen appliances is expected to rise. By future, the market for smart kitchen devices in Bahrain is anticipated to grow to BHD 50 million. This presents a lucrative opportunity for manufacturers to innovate and develop products that integrate seamlessly with smart home ecosystems, catering to tech-savvy consumers seeking convenience and efficiency in their cooking experiences.