Region:Global

Author(s):Shubham

Product Code:KRAC3557

Pages:80

Published On:October 2025

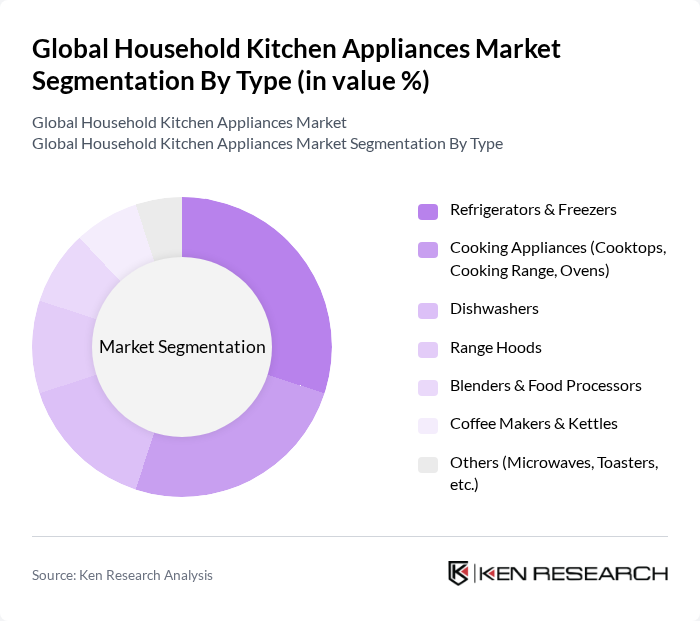

By Type:The market is segmented into various types of kitchen appliances, including Refrigerators & Freezers, Cooking Appliances (Cooktops, Cooking Range, Ovens), Dishwashers, Range Hoods, Blenders & Food Processors, Coffee Makers & Kettles, and Others (Microwaves, Toasters, etc.). Each of these segments caters to different consumer needs and preferences, with specific trends influencing their popularity. Refrigerators & Freezers remain the largest segment due to their essential role in food preservation, while Cooking Appliances and Dishwashers are experiencing growth driven by urban lifestyles and the increasing adoption of smart and energy-efficient models. Blenders, food processors, and coffee makers are gaining traction among health-conscious and convenience-focused consumers .

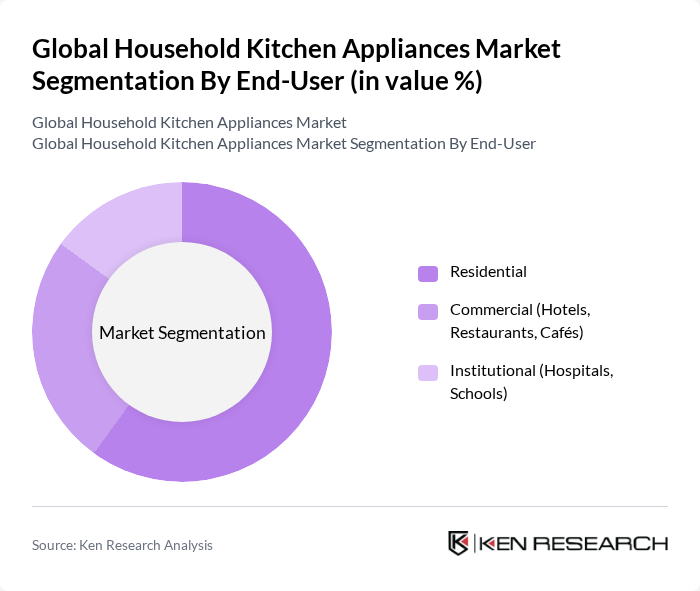

By End-User:The market is segmented by end-user into Residential, Commercial (Hotels, Restaurants, Cafés), and Institutional (Hospitals, Schools). Each segment has distinct requirements and purchasing behaviors, influencing the types of appliances that are most in demand. The residential segment leads due to the widespread adoption of kitchen appliances in households, while the commercial and institutional segments demand higher-capacity and durable appliances tailored to intensive use .

The Global Household Kitchen Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, Electrolux AB, LG Electronics Inc., Samsung Electronics Co., Ltd., BSH Hausgeräte GmbH (Bosch & Siemens), Panasonic Holdings Corporation, Haier Group Corporation, GE Appliances, a Haier company, Miele & Cie. KG, Frigidaire (Electrolux brand), KitchenAid (Whirlpool brand), Sharp Corporation, Kenmore (Sears brand), Smeg S.p.A., Gaggenau (BSH Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the household kitchen appliances market appears promising, driven by technological advancements and changing consumer preferences. As smart home integration becomes more prevalent, manufacturers are expected to focus on developing appliances that seamlessly connect with other smart devices. Additionally, sustainability will play a crucial role, with companies increasingly prioritizing eco-friendly materials and energy-efficient designs. These trends will likely shape product offerings and marketing strategies, ensuring that the market remains dynamic and responsive to consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators & Freezers Cooking Appliances (Cooktops, Cooking Range, Ovens) Dishwashers Range Hoods Blenders & Food Processors Coffee Makers & Kettles Others (Microwaves, Toasters, etc.) |

| By End-User | Residential Commercial (Hotels, Restaurants, Cafés) Institutional (Hospitals, Schools) |

| By Sales Channel | Supermarkets & Hypermarkets Specialty Stores E-Commerce Others (Direct Sales, Distributors) |

| By Price Range | Budget Mid-Range Premium |

| By Brand | National Brands Private Labels International Brands |

| By Product Features | Energy Efficient Smart Technology Multi-functionality |

| By Material | Stainless Steel Plastic Glass Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Kitchen Appliance Retailers | 120 | Store Managers, Sales Representatives |

| Consumer Insights on Kitchen Appliances | 140 | Homeowners, Renters |

| Manufacturers of Kitchen Appliances | 100 | Product Development Managers, Marketing Directors |

| Industry Experts and Analysts | 50 | Market Analysts, Industry Consultants |

| Retail Supply Chain Professionals | 80 | Supply Chain Managers, Logistics Coordinators |

The Global Household Kitchen Appliances Market is valued at approximately USD 280 billion, reflecting significant growth driven by consumer demand for convenience, energy efficiency, and smart technology integration in kitchen appliances.