Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3728

Pages:98

Published On:October 2025

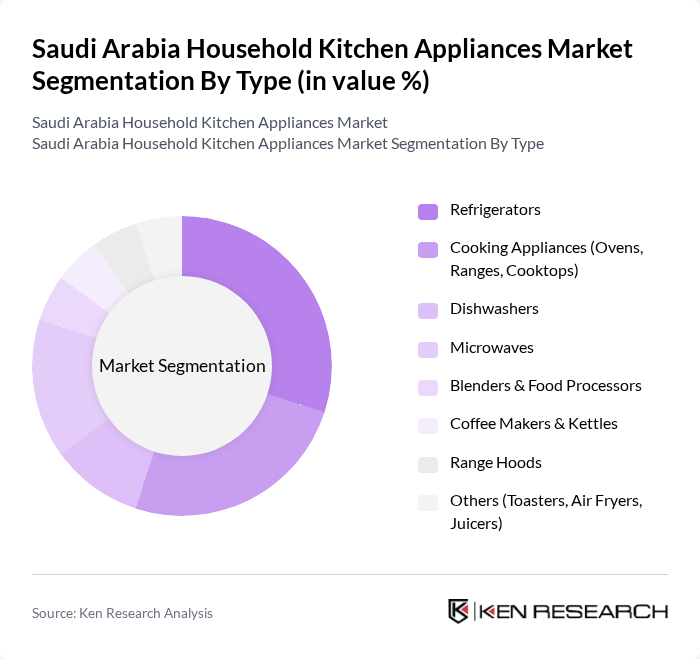

By Type:The market is segmented into various types of kitchen appliances, including refrigerators, cooking appliances, dishwashers, microwaves, blenders & food processors, coffee makers & kettles, range hoods, and others. Among these, cooking appliances were the largest revenue-generating segment in 2024, while dishwashers are experiencing the fastest growth. The increasing trend of home cooking and the demand for energy-efficient models are driving growth in these segments.

By End-User:The end-user segmentation includes residential, commercial, hospitality, and institutional sectors. The residential segment holds the largest share, driven by the increasing number of households and the growing trend of home cooking. The commercial segment, which includes restaurants and cafés, is also expanding as more consumers seek dining experiences that incorporate modern kitchen technologies.

The Saudi Arabia Household Kitchen Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corporation, Philips Electronics N.V., Panasonic Corporation, Electrolux AB, Bosch Home Appliances (BSH Hausgeräte GmbH), Haier Group Corporation, Midea Group Co., Ltd., Arçelik A.?., Sharp Corporation, Gorenje d.d., Smeg S.p.A., Hisense Group, Alessa Industries (Saudi Arabia), United Yousef M. Naghi Co. Ltd. (Saudi Arabia), Aljabr Electronics (Saudi Arabia), Nikai Group (UAE/Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia household kitchen appliances market appears promising, driven by increasing urbanization and rising disposable incomes. As consumers become more health-conscious, the demand for energy-efficient and smart appliances is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products. Companies that adapt to these trends and invest in innovative technologies will likely capture significant market share, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Cooking Appliances (Ovens, Ranges, Cooktops) Dishwashers Microwaves Blenders & Food Processors Coffee Makers & Kettles Range Hoods Others (Toasters, Air Fryers, Juicers) |

| By End-User | Residential Commercial (Restaurants, Cafés, Catering) Hospitality (Hotels, Resorts) Institutional (Hospitals, Schools) |

| By Distribution Channel | Online Retail (E-commerce) Offline Retail (Supermarkets, Hypermarkets, Specialty Stores) Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands (e.g., Alessa, Nikai, Aljabr, United Yousef M. Naghi Co.) International Brands |

| By Energy Efficiency Rating | Energy Star Rated / SASO A-rated Non-Energy Star Rated |

| By Application | Cooking Food Preservation Food Preparation Cleaning |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refrigerator Purchases | 120 | Homeowners, Appliance Buyers |

| Washing Machine Usage | 100 | Families, Single Professionals |

| Microwave Oven Preferences | 80 | Young Couples, College Students |

| Consumer Feedback on Energy Efficiency | 70 | Environmentally Conscious Consumers, Tech Enthusiasts |

| Smart Appliance Adoption | 75 | Tech-Savvy Homeowners, Early Adopters |

The Saudi Arabia Household Kitchen Appliances Market is valued at approximately USD 3.6 billion, driven by factors such as rising disposable incomes, urbanization, and a growing preference for modern kitchen solutions among consumers.