Region:Middle East

Author(s):Shubham

Product Code:KRAC3537

Pages:90

Published On:October 2025

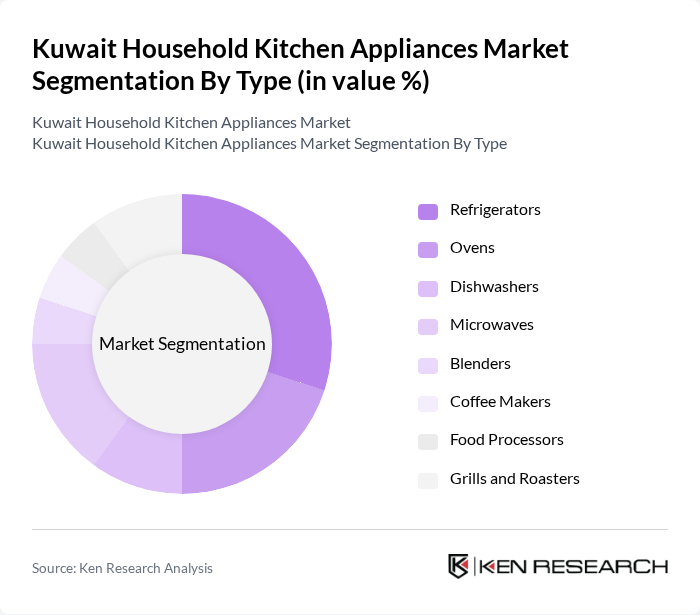

By Type:

The market is segmented by type into various categories, including refrigerators, ovens, dishwashers, microwaves, blenders, coffee makers, food processors, and grills and roasters. Among these, refrigerators dominate the market due to their essential role in food preservation and the growing trend of energy-efficient models. The increasing consumer awareness regarding health and food safety, coupled with the demand for larger and technologically advanced refrigerators, has led to a surge in demand for advanced refrigeration technologies, making it the leading sub-segment .

By End-User:

The market is segmented by end-user into residential and commercial categories. The residential segment holds a significant share, driven by the increasing number of households, the trend of home cooking, and the adoption of modern kitchen appliances to enhance convenience and efficiency. The commercial segment, while smaller, is experiencing growth due to the expansion of restaurants, cafes, and catering services that require high-quality and durable kitchen equipment .

The Kuwait Household Kitchen Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alghanim Industries, Al-Futtaim Group, M.H. Alshaya Co., Carrefour Kuwait, Lulu Hypermarket, Sharaf DG, Xcite by Alghanim Electronics, Panasonic Marketing Middle East, LG Electronics Gulf FZE, Samsung Electronics Levant, Whirlpool Middle East, Philips Electronics Middle East, Bosch Home Appliances, Electrolux Middle East, and Haier Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait household kitchen appliances market appears promising, driven by increasing consumer demand for innovative and energy-efficient products. As urbanization continues to rise, the market is expected to see a shift towards smart home solutions that integrate technology into everyday cooking. Additionally, the growing trend of health consciousness among consumers will likely lead to increased demand for appliances that promote healthier cooking methods, further enhancing market dynamics and opportunities for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Ovens Dishwashers Microwaves Blenders Coffee Makers Food Processors Grills and Roasters |

| By End-User | Residential Commercial |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands International Brands Private Labels |

| By Functionality | Basic Functionality Smart Functionality Multi-functional |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Kitchen Appliance Retailers | 60 | Store Managers, Sales Executives |

| Consumer Insights on Kitchen Appliances | 120 | Homeowners, Renters |

| Market Trends in Urban Areas | 50 | Urban Families, Young Professionals |

| Product Feature Preferences | 40 | Home Chefs, Culinary Enthusiasts |

| Brand Loyalty and Awareness | 70 | Frequent Buyers, Appliance Users |

The Kuwait Household Kitchen Appliances Market is valued at approximately USD 480 million, reflecting a significant growth trend driven by urbanization, rising disposable incomes, and a preference for modern kitchen solutions among consumers.