Global Southeast Household Kitchen Appliances Market Overview

- The Southeast Asia Household Kitchen Appliances Market is valued at approximately USD 15 billion, based on a five-year analysis. Growth is primarily driven by rising urbanization, increasing disposable incomes, and a strong shift toward smart and energy-efficient appliances. Consumers are investing in technologically advanced products, with a notable preference for appliances that offer convenience, connectivity, and sustainability, further boosting overall market demand .

- Countries such as Indonesia, Thailand, and Vietnam are leading the market, supported by large populations, rapid urbanization, and expanding middle-class segments. These nations have experienced a surge in demand as consumers increasingly adopt modern living standards and prioritize convenience, efficiency, and health-conscious cooking practices in their homes .

- In 2023, governments across Southeast Asia enforced energy efficiency regulations for household appliances. For example, the ASEAN Energy Management Scheme (AEMAS) and the Minimum Energy Performance Standards (MEPS) issued by the ASEAN Centre for Energy and national regulatory bodies require all new kitchen appliances to comply with specific energy consumption thresholds, driving manufacturers to innovate and produce more energy-efficient products .

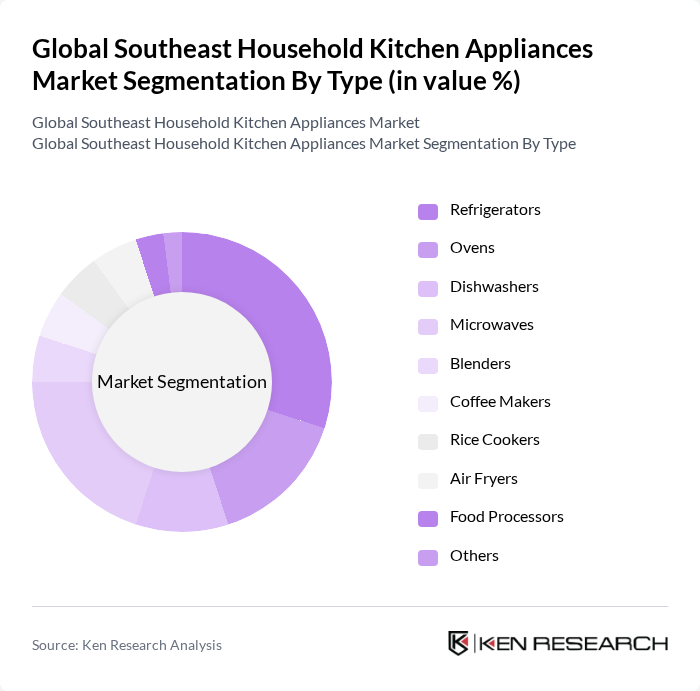

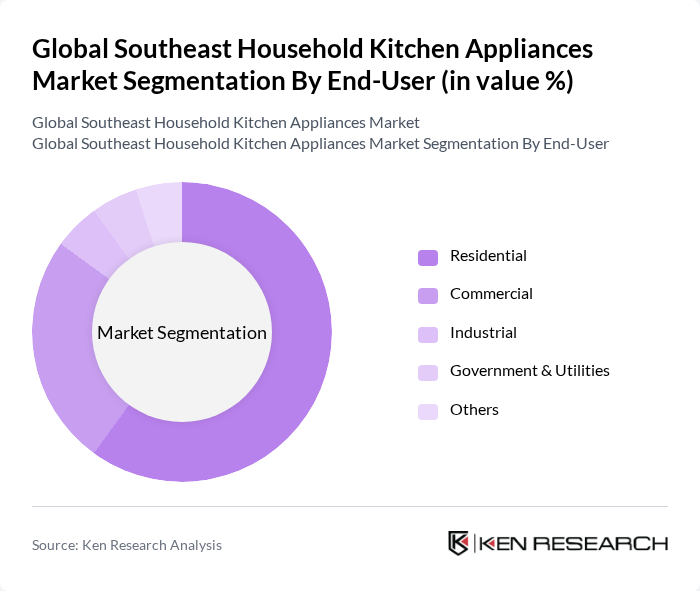

Global Southeast Household Kitchen Appliances Market Segmentation

By Type:The market is segmented into refrigerators, ovens, dishwashers, microwaves, blenders, coffee makers, rice cookers, air fryers, food processors, and others. Refrigerators and microwaves remain the most popular, reflecting their essential roles in food preservation and rapid meal preparation. The growing focus on healthy eating and convenience has also led to increased demand for blenders, air fryers, and food processors, as consumers seek appliances that support nutritious and efficient cooking .

By End-User:The market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment holds the largest share, driven by the rising number of households, urban migration, and the growing trend of home cooking. The commercial segment is also significant, with restaurants, cafes, and food service providers investing in high-quality, energy-efficient appliances to enhance operational efficiency and service quality .

Global Southeast Household Kitchen Appliances Market Competitive Landscape

The Global Southeast Household Kitchen Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, LG Electronics, Samsung Electronics, Electrolux AB, Panasonic Holdings Corporation, Robert Bosch GmbH, Haier Smart Home Co., Ltd., Koninklijke Philips N.V., Miele & Cie. KG, GE Appliances (Haier Group), KitchenAid (Whirlpool Corporation), Frigidaire (Electrolux Group), Sharp Corporation, Smeg S.p.A., Gaggenau Hausgeräte GmbH, Midea Group, TCL Smart Home Appliances Co., Ltd., Morphy Richards Limited, Daikin Industries, Ltd., Hitachi, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Southeast Household Kitchen Appliances Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization in Southeast Asia is projected to reach 50% in the future, with urban populations growing by approximately 22 million annually. This shift drives demand for household kitchen appliances as urban dwellers seek convenience and efficiency in their homes. The World Bank reports that urban areas contribute over 75% of the region's GDP, highlighting the economic impetus behind this trend. As cities expand, the need for modern kitchen solutions becomes increasingly critical, fueling market growth.

- Rising Disposable Incomes:The average disposable income in Southeast Asia is expected to increase by 6% annually, reaching approximately $4,000 per capita in the future. This rise in income allows consumers to invest in higher-quality kitchen appliances, enhancing their cooking experiences. According to the Asian Development Bank, increased purchasing power correlates with a shift towards premium and energy-efficient appliances, further driving market demand. As consumers prioritize quality, brands that offer innovative solutions stand to benefit significantly.

- Technological Advancements in Kitchen Appliances:The integration of smart technology in kitchen appliances is revolutionizing the market, with an estimated 35% of households in urban areas adopting smart appliances in the future. Innovations such as IoT-enabled devices enhance user convenience and energy efficiency. Reports from industry analysts indicate that smart appliances can reduce energy consumption by up to 25%, appealing to environmentally conscious consumers. This technological shift is a key driver of growth, as brands innovate to meet evolving consumer preferences.

Market Challenges

- High Competition and Market Saturation:The Southeast household kitchen appliances market is characterized by intense competition, with over 250 brands vying for market share. This saturation leads to price wars, reducing profit margins for manufacturers. According to market reports, the top five brands hold only 45% of the market share, indicating a fragmented landscape. Companies must differentiate their products through innovation and branding to maintain competitiveness in this challenging environment.

- Supply Chain Disruptions:The ongoing global supply chain disruptions, exacerbated by geopolitical tensions and the COVID-19 pandemic, have significantly impacted the availability of raw materials. In the future, the cost of key materials like steel and plastics is projected to rise by 20%, affecting production costs for kitchen appliances. Manufacturers face challenges in sourcing components, leading to delays and increased prices, which can deter consumers and hinder market growth.

Global Southeast Household Kitchen Appliances Market Future Outlook

The future of the Southeast household kitchen appliances market appears promising, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for innovative, energy-efficient appliances is expected to rise. Additionally, the growing trend of smart home integration will likely lead to increased adoption of connected kitchen devices. Companies that focus on sustainability and eco-friendly practices will find new opportunities to capture market share, aligning with consumer values and regulatory requirements.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets in Southeast Asia, such as Vietnam and Indonesia, present significant growth opportunities. With rising middle-class populations and increasing urbanization, these markets are expected to see a surge in demand for kitchen appliances. Companies that strategically enter these regions can capitalize on the growing consumer base and enhance their market presence.

- Development of Smart Appliances:The demand for smart appliances is on the rise, with an estimated market value of $12 billion in the future. Companies that invest in R&D to create innovative, connected kitchen solutions can tap into this lucrative segment. Features like remote control, energy monitoring, and integration with smart home systems will attract tech-savvy consumers, driving sales and brand loyalty.