Region:Asia

Author(s):Shubham

Product Code:KRAA1049

Pages:95

Published On:August 2025

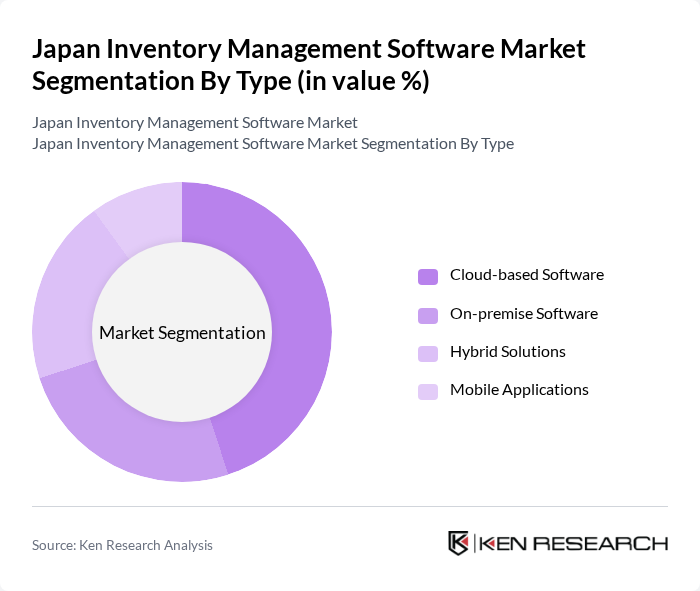

By Type:The market is segmented into four main types: Cloud-based Software, On-premise Software, Hybrid Solutions, and Mobile Applications. Cloud-based solutions are experiencing the highest adoption due to their scalability, real-time data access, and cost-effectiveness, making them suitable for businesses of all sizes. On-premise and hybrid solutions remain relevant for organizations with specific security or integration needs, while mobile applications are increasingly used for on-the-go inventory tracking and management .

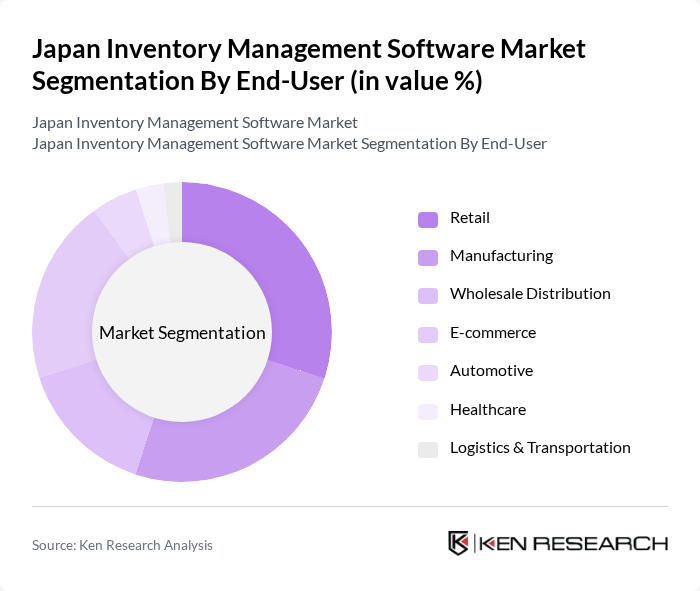

By End-User:The end-user segmentation includes Retail, Manufacturing, Wholesale Distribution, E-commerce, Automotive, Healthcare, and Logistics & Transportation. Retail and E-commerce are leading segments, driven by the need for real-time inventory tracking and management to meet consumer demands. Manufacturing and logistics sectors are also significant adopters due to the focus on supply chain optimization, automation, and lean inventory practices. Healthcare and automotive industries are increasingly leveraging inventory management software for compliance, traceability, and operational efficiency .

The Japan Inventory Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP Japan, Oracle Japan, Microsoft Japan, Infor Japan, Fujitsu Limited, Hitachi Solutions, Ltd., OBIC Business Consultants Co., Ltd. (OBC), Zoho Japan (Zoho Inventory), NetSuite Japan, Rakuraku Seisan (by Works Applications), Cin7, Unleashed Software, TradeGecko (QuickBooks Commerce), Inventory Plus (by System Support Inc.), Logizard Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan inventory management software market appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly prioritize efficiency and real-time data access, the integration of AI and machine learning into inventory systems is expected to enhance predictive analytics capabilities. Furthermore, the growing emphasis on sustainability will likely push companies to adopt eco-friendly inventory practices, aligning with global trends toward responsible business operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based Software On-premise Software Hybrid Solutions Mobile Applications |

| By End-User | Retail Manufacturing Wholesale Distribution E-commerce Automotive Healthcare Logistics & Transportation |

| By Industry Vertical | Food and Beverage Pharmaceuticals Electronics Apparel Automotive Healthcare Logistics & Transportation |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Sales Channel | Direct Sales Resellers Online Marketplaces |

| By Pricing Model | Subscription-based One-time License Fee Freemium Model |

| By Application | Inventory Control & Tracking Order Management Scanning & Barcoding Asset Management |

| By Others | Custom Solutions Consulting Services Training and Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Sector Software Adoption | 80 | Operations Managers, Production Planners |

| Logistics and Distribution Software Usage | 60 | Logistics Coordinators, Warehouse Supervisors |

| Food and Beverage Inventory Solutions | 50 | Quality Control Managers, Supply Chain Directors |

| Pharmaceutical Inventory Management | 40 | Regulatory Affairs Managers, Procurement Officers |

The Japan Inventory Management Software Market is valued at approximately USD 150 million, driven by the increasing demand for efficient inventory control, the rise of e-commerce, and the adoption of advanced technologies like AI and IoT in supply chain management.