Region:Europe

Author(s):Shubham

Product Code:KRAA1148

Pages:97

Published On:August 2025

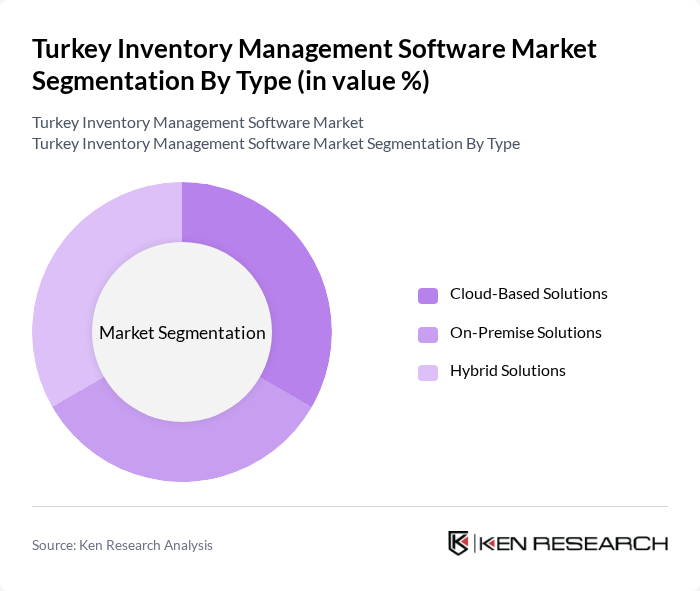

By Type:The market is segmented into three main types: Cloud-Based Solutions, On-Premise Solutions, and Hybrid Solutions. Cloud-Based Solutions are gaining traction due to their scalability, lower upfront costs, and ease of integration with other business systems, making them the preferred choice for many businesses. On-Premise Solutions remain relevant, particularly among larger enterprises with stringent security or customization requirements. Hybrid Solutions offer a blend of both, catering to businesses seeking flexibility in deployment and data management .

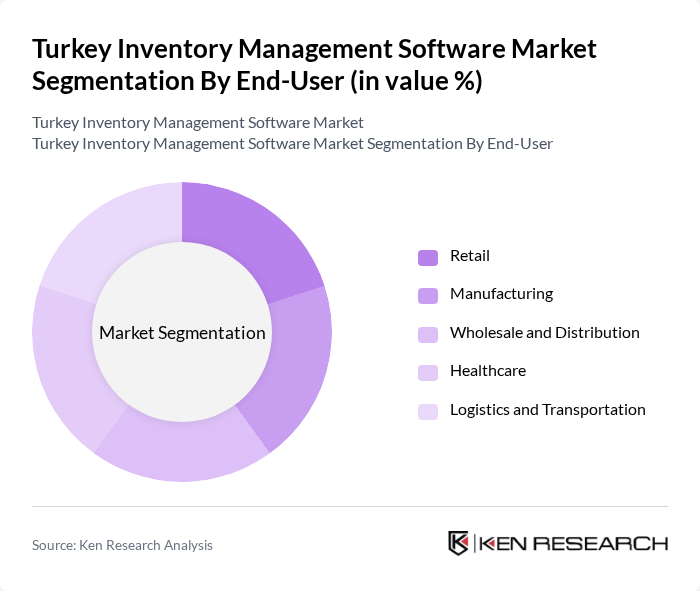

By End-User:The end-user segmentation includes Retail, Manufacturing, Wholesale and Distribution, Healthcare, and Logistics and Transportation. Retail is the leading segment, driven by the need for efficient stock management, omnichannel fulfillment, and customer satisfaction. Manufacturing follows closely, as companies seek to optimize supply chains and production workflows. The healthcare sector is increasingly adopting inventory management solutions to ensure availability, traceability, and regulatory compliance for critical supplies. Wholesale and distribution, as well as logistics and transportation, are also key adopters, leveraging software for real-time tracking and operational efficiency .

The Turkey Inventory Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Logo Yaz?l?m, Taktik Yaz?l?m, Nebim, NetSuite (Oracle NetSuite), SAP, Oracle, Microsoft Dynamics 365, Odoo, Zoho Inventory, Infor, Fishbowl Inventory, Mikro Yaz?l?m, Netsis (Logo Netsis), Sentez Yaz?l?m, Nebim V3 contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkey inventory management software market appears promising, driven by technological advancements and increasing digital transformation initiatives. As businesses recognize the importance of efficient inventory management, the integration of artificial intelligence and machine learning is expected to enhance predictive analytics capabilities. Additionally, the rise of mobile inventory management solutions will cater to the growing demand for flexibility and real-time data access, enabling businesses to respond swiftly to market changes and consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions |

| By End-User | Retail Manufacturing Wholesale and Distribution Healthcare Logistics and Transportation |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Industry Vertical | Food and Beverage Electronics Apparel Automotive Pharmaceuticals |

| By Sales Channel | Direct Sales Online Sales Resellers and Distributors |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Model |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, IT Directors |

| Manufacturing Supply Chain Software | 80 | Operations Managers, Supply Chain Analysts |

| Logistics and Distribution Software | 70 | Logistics Coordinators, Warehouse Managers |

| Small Business Inventory Solutions | 50 | Small Business Owners, IT Consultants |

| Enterprise Resource Planning (ERP) Systems | 90 | ERP Specialists, Business Analysts |

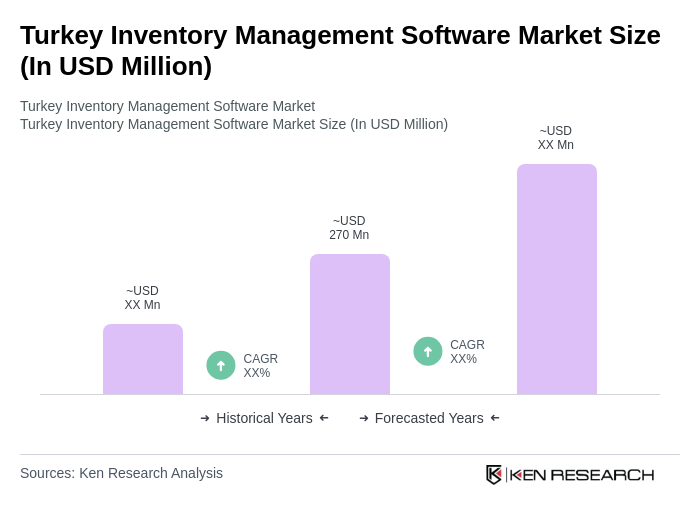

The Turkey Inventory Management Software Market is valued at approximately USD 270 million, driven by the increasing adoption of digital solutions across various sectors, including retail, manufacturing, and logistics.