Region:Europe

Author(s):Shubham

Product Code:KRAA1116

Pages:93

Published On:August 2025

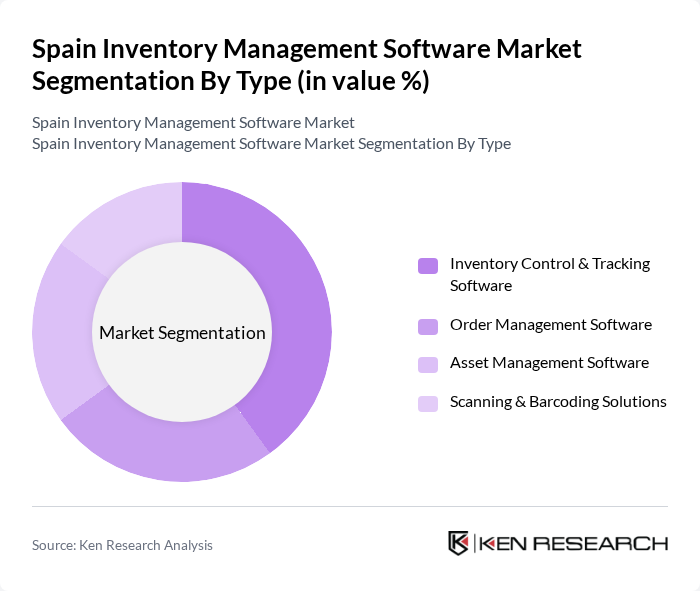

By Type:The inventory management software market can be segmented into four main types: Inventory Control & Tracking Software, Order Management Software, Asset Management Software, and Scanning & Barcoding Solutions. Among these, Inventory Control & Tracking Software is the most dominant segment, driven by the increasing need for businesses to maintain accurate stock levels, streamline operations, and leverage automation for inventory processes. The adoption of cloud-based and mobile inventory solutions further supports the demand for this software type .

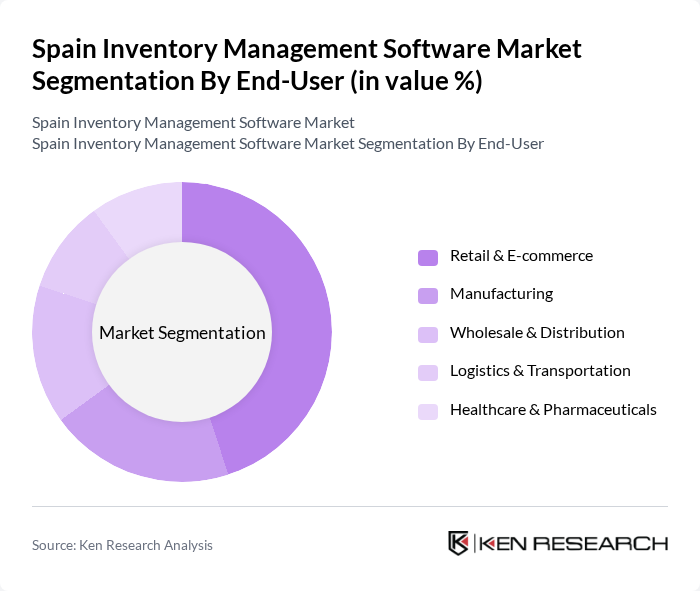

By End-User:The end-user segmentation of the inventory management software market includes Retail & E-commerce, Manufacturing, Wholesale & Distribution, Logistics & Transportation, and Healthcare & Pharmaceuticals. The Retail & E-commerce segment leads the market, fueled by the rapid growth of online shopping, omnichannel retailing, and the need for efficient inventory management to meet consumer demands. This segment's growth is also supported by the increasing integration of inventory systems with e-commerce platforms and real-time inventory tracking .

The Spain Inventory Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Dynamics 365, Infor, NetSuite (Oracle), Sage Group, Holded, Zucchetti Spain, Generix Group, SAGE X3, Odoo, Exact, Priority Software, Openbravo, and Megaventory contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inventory management software market in Spain appears promising, driven by technological advancements and increasing digitalization across sectors. As businesses continue to embrace automation and data-driven decision-making, the demand for sophisticated inventory solutions is expected to rise. Additionally, the integration of artificial intelligence and machine learning will enhance predictive analytics capabilities, allowing companies to optimize inventory levels and reduce waste. This trend is likely to reshape the competitive landscape significantly.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Control & Tracking Software Order Management Software Asset Management Software Scanning & Barcoding Solutions |

| By End-User | Retail & E-commerce Manufacturing Wholesale & Distribution Logistics & Transportation Healthcare & Pharmaceuticals |

| By Industry Vertical | Food & Beverage Electronics & Electricals Apparel & Fashion Automotive Pharmaceuticals |

| By Deployment Model | On-Premise Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Value-Added Resellers (VARs) |

| By Pricing Model | Subscription-Based Perpetual License Freemium/Trial Model |

| By Others | Custom Solutions Niche Market Offerings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Store Operations Directors |

| Manufacturing Supply Chain Solutions | 80 | Production Managers, Supply Chain Analysts |

| Logistics and Distribution Software | 60 | Logistics Coordinators, Warehouse Supervisors |

| E-commerce Inventory Systems | 90 | eCommerce Managers, Fulfillment Operations Heads |

| SME Inventory Solutions | 50 | Business Owners, IT Managers |

The Spain Inventory Management Software Market is valued at approximately USD 210 million, reflecting a significant growth driven by the increasing need for efficient inventory control and the rise of e-commerce and advanced technologies in supply chain management.