Region:Europe

Author(s):Shubham

Product Code:KRAA0892

Pages:96

Published On:August 2025

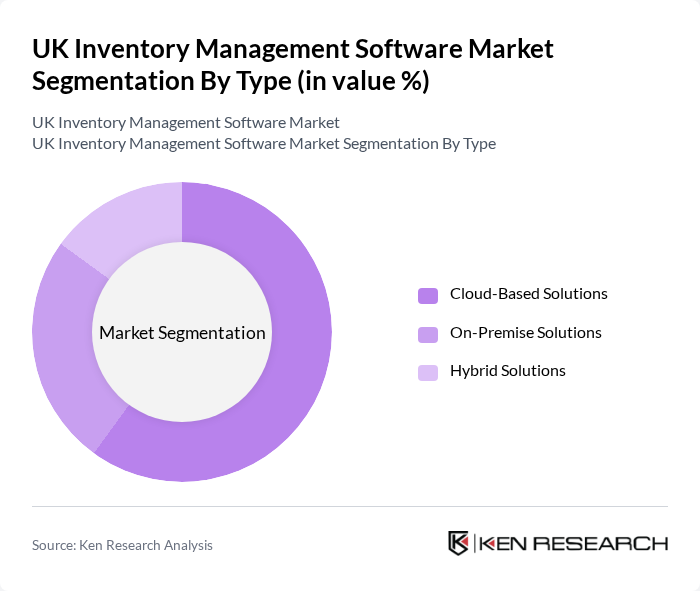

By Type:

The subsegments under this category include Cloud-Based Solutions, On-Premise Solutions, and Hybrid Solutions. Cloud-Based Solutions dominate the market due to their scalability, cost-effectiveness, and ease of access. Businesses are increasingly opting for cloud solutions to support remote work, enable real-time data access, and enhance operational efficiency. The flexibility offered by cloud-based systems allows companies to adapt quickly to changing market conditions, making them the preferred choice for many organizations .

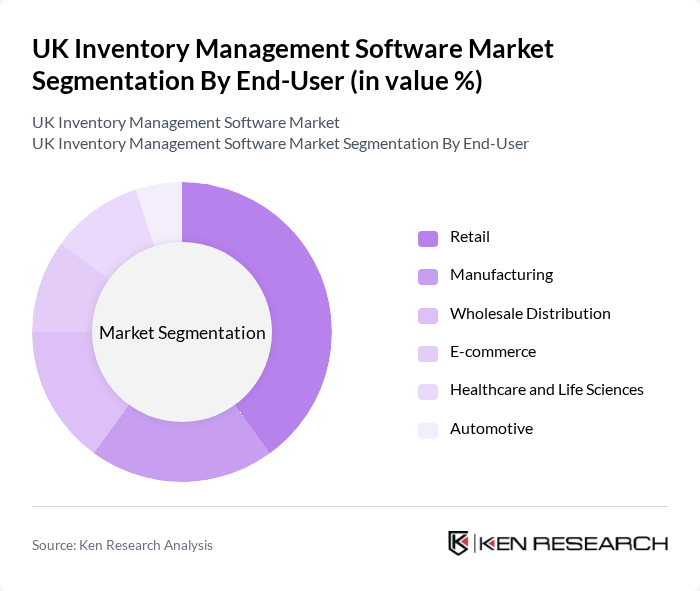

By End-User:

This category includes Retail, Manufacturing, Wholesale Distribution, E-commerce, Healthcare and Life Sciences, and Automotive. The Retail sector leads the market, driven by the rapid growth of online shopping and the need for efficient inventory management to meet consumer demands. Retailers are increasingly adopting sophisticated inventory solutions to manage stock levels, reduce waste, and enhance customer satisfaction. The shift towards omnichannel retailing and the integration of inventory management with e-commerce and ERP platforms further emphasize the importance of effective inventory management in this sector .

The UK Inventory Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP, Oracle, Microsoft Dynamics 365, NetSuite (Oracle NetSuite), Zoho Inventory, Brightpearl (a Sage company), Unleashed Software, Cin7, Access Group (Access Inventory), Khaos Control, OrderWise, Mintsoft, DEAR Systems (now Cin7 Core), QuickBooks Commerce (formerly TradeGecko), and SkuVault contribute to innovation, geographic expansion, and service delivery in this space.

The UK inventory management software market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As businesses increasingly prioritize efficiency and accuracy, the integration of artificial intelligence and machine learning into inventory systems will become more prevalent. Additionally, the shift towards mobile solutions will enhance accessibility, allowing real-time inventory management from various devices, thus improving operational agility and responsiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions |

| By End-User | Retail Manufacturing Wholesale Distribution E-commerce Healthcare and Life Sciences Automotive |

| By Industry Vertical | Food and Beverage Pharmaceuticals Electronics Apparel Energy and Utilities |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Functionality | Inventory Tracking & Monitoring Order Management Reporting and Analytics Asset Tracking Stock Replenishment & Forecasting |

| By Sales Channel | Direct Sales Online Sales Resellers and Distributors |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Retail Operations Directors |

| Manufacturing Supply Chain Software | 80 | Supply Chain Managers, Production Planners |

| Warehouse Management Systems | 60 | Warehouse Managers, Logistics Coordinators |

| E-commerce Inventory Solutions | 90 | E-commerce Managers, Fulfillment Specialists |

| Small Business Inventory Tools | 50 | Small Business Owners, IT Consultants |

The UK Inventory Management Software Market is valued at approximately USD 165 million, reflecting a growing demand for solutions that optimize supply chain operations, reduce costs, and enhance customer satisfaction, particularly in the context of rising e-commerce and real-time inventory tracking needs.