Region:Africa

Author(s):Shubham

Product Code:KRAA0932

Pages:86

Published On:August 2025

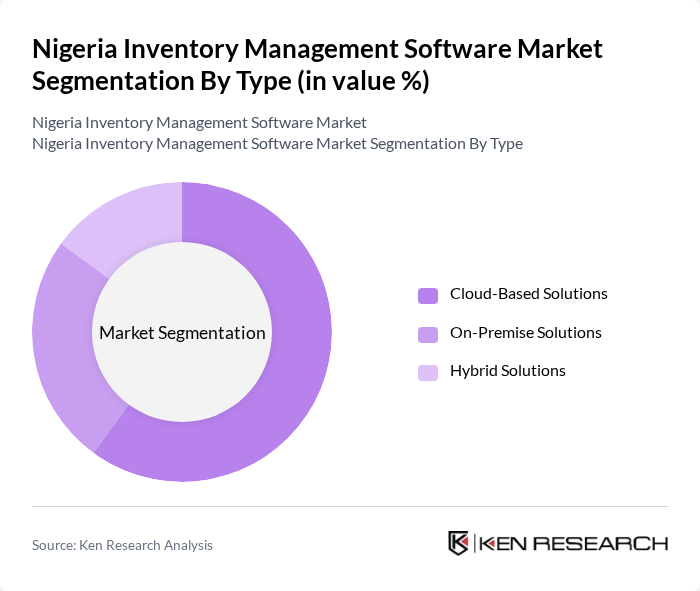

By Type:The market is segmented into three main types: Cloud-Based Solutions, On-Premise Solutions, and Hybrid Solutions. Each of these sub-segments caters to different business needs and preferences, with cloud-based solutions gaining significant traction due to their flexibility and cost-effectiveness .

The Cloud-Based Solutions segment is dominating the market due to the increasing preference for remote access and the ability to scale operations without significant upfront investments. Businesses are increasingly adopting these solutions for their flexibility, ease of integration, and lower maintenance costs. The trend towards digital transformation in Nigeria has further accelerated the adoption of cloud-based inventory management systems, making them the preferred choice for many enterprises .

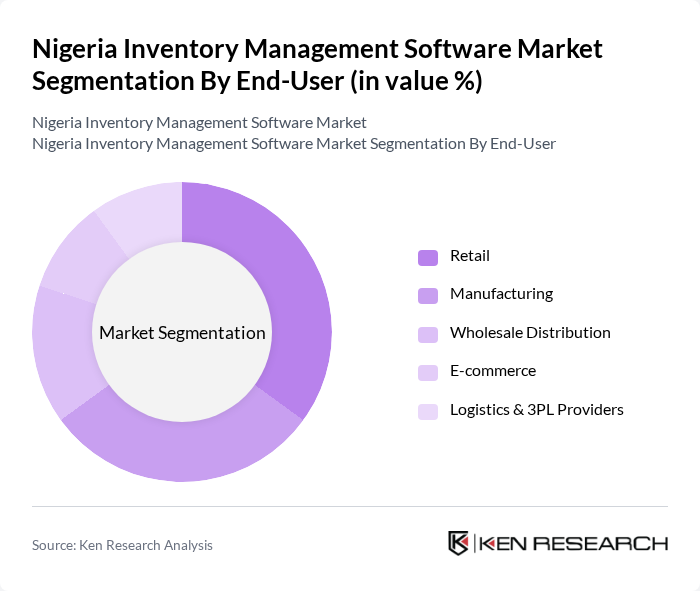

By End-User:The market is segmented by end-users into Retail, Manufacturing, Wholesale Distribution, E-commerce, and Logistics & 3PL Providers. Each segment has unique requirements and challenges that inventory management software addresses .

The Retail segment is leading the market, driven by the rapid growth of retail businesses and the need for efficient inventory management to meet consumer demands. Retailers are increasingly adopting inventory management software to streamline operations, manage stock levels, and enhance customer satisfaction. The rise of e-commerce has also contributed to the growth of this segment, as online retailers require robust inventory solutions to manage their operations effectively .

The Nigeria Inventory Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP Nigeria, Oracle Nigeria, Zoho Inventory, Odoo Nigeria, QuickBooks (Intuit), Unleashed Software, NetSuite (Oracle), TradeDepot, Inflow Inventory, Vend (Lightspeed), SkuVault, Brightpearl, Vexsys Solutions, Sysnova Information Systems, eSoft Response contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's inventory management software market appears promising, driven by technological advancements and increasing digital transformation across industries. As businesses seek to enhance operational efficiency, the integration of artificial intelligence and machine learning into inventory systems is expected to gain traction. Additionally, the growing emphasis on sustainability will likely influence software development, with companies prioritizing eco-friendly practices in their inventory management processes, thereby aligning with global trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions |

| By End-User | Retail Manufacturing Wholesale Distribution E-commerce Logistics & 3PL Providers |

| By Industry Vertical | Food and Beverage Pharmaceuticals Electronics Apparel Automotive & Spare Parts |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Sales Channel | Direct Sales Resellers Online Marketplaces |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Model |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Store Operations Heads |

| Manufacturing Supply Chain | 80 | Production Managers, Supply Chain Analysts |

| Logistics and Distribution | 70 | Logistics Coordinators, Warehouse Supervisors |

| E-commerce Fulfillment | 60 | E-commerce Operations Managers, IT Specialists |

| Technology Adoption in SMEs | 50 | Small Business Owners, IT Consultants |

The Nigeria Inventory Management Software Market is valued at approximately USD 30 million, reflecting a significant growth trend driven by technological adoption in supply chain management and the rise of e-commerce.