Region:Europe

Author(s):Geetanshi

Product Code:KRAA2048

Pages:84

Published On:August 2025

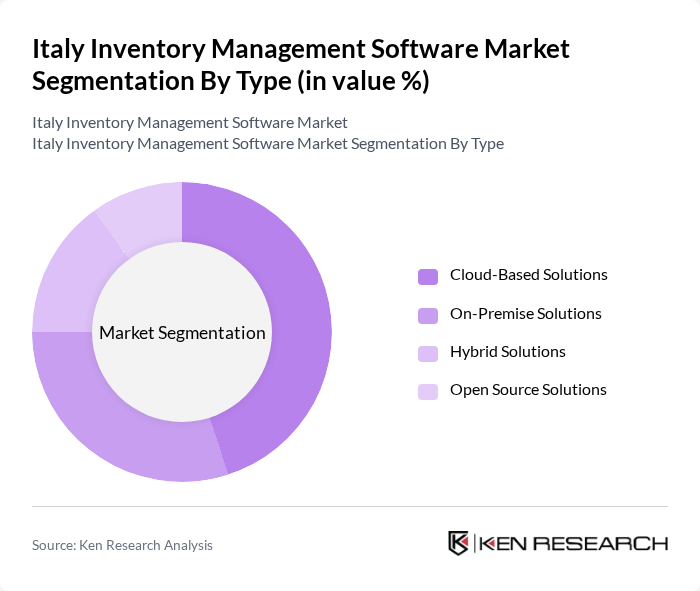

By Type:The market is segmented into various types of inventory management software solutions, includingCloud-Based Solutions, On-Premise Solutions, Hybrid Solutions, and Open Source Solutions. Each type caters to different business needs and preferences, influencing their adoption rates across various sectors. Cloud-based solutions are preferred by businesses seeking scalability and remote access, while on-premise solutions are chosen for greater control and data security. Hybrid and open-source solutions offer flexibility and customization for niche requirements .

TheCloud-Based Solutionssegment is leading the market due to its flexibility, scalability, and cost-effectiveness. Businesses are increasingly opting for cloud solutions to manage their inventory as they allow for real-time data access, seamless integration with other cloud-based applications, and collaboration across multiple locations. The reduced need for on-site IT infrastructure and the ability to support remote operations further enhance their appeal. As companies accelerate digital transformation, the demand for cloud-based inventory management solutions continues to grow rapidly .

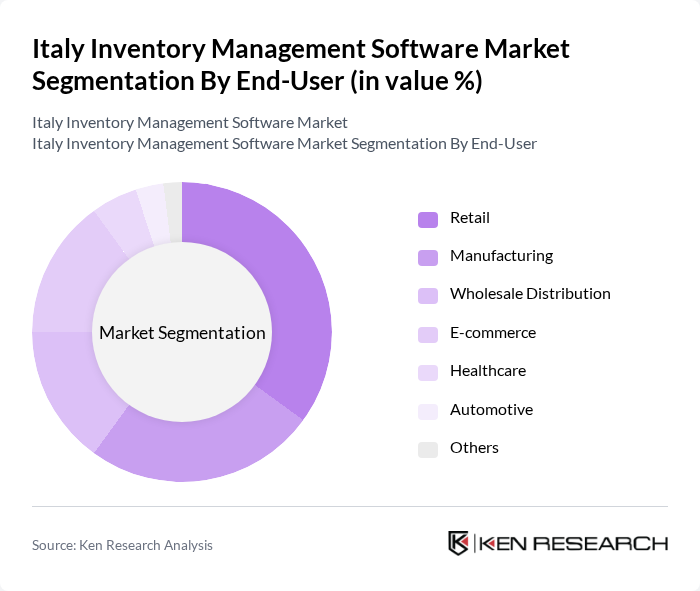

By End-User:The market is segmented by end-users, includingRetail, Manufacturing, Wholesale Distribution, E-commerce, Healthcare, Automotive, and Others. Each sector has unique inventory management needs, influencing the adoption of specific software solutions. Retail and e-commerce sectors require real-time tracking and omnichannel integration, while manufacturing and automotive focus on production efficiency and supply chain visibility. Healthcare emphasizes compliance and traceability, and wholesale distribution prioritizes bulk inventory control .

TheRetailsegment dominates the market due to the increasing demand for efficient inventory management solutions to handle diverse product ranges and high transaction volumes. Retailers leverage inventory management software to optimize stock levels, reduce shrinkage, and enhance customer satisfaction through improved product availability. The rapid growth of e-commerce and omnichannel retailing has further accelerated the need for robust inventory solutions that integrate seamlessly with online platforms, making retail the leading end-user in the inventory management software market .

The Italy Inventory Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Corporation, Infor, Zucchetti S.p.A., TeamSystem S.p.A., IBM Corporation, Fishbowl Inventory, Sme.UP S.p.A., Datalogic S.p.A., NetSuite (Oracle NetSuite), Odoo S.A., Passepartout S.p.A., Zucchetti Centro Sistemi S.p.A., Invent Analytics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inventory management software market in Italy appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly prioritize efficiency and real-time data access, the demand for innovative solutions is expected to rise. Additionally, the integration of artificial intelligence and machine learning will enhance predictive analytics capabilities, allowing companies to optimize inventory levels and reduce waste. This trend will likely lead to a more streamlined supply chain, fostering growth and competitiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Open Source Solutions |

| By End-User | Retail Manufacturing Wholesale Distribution E-commerce Healthcare Automotive Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Functionality | Inventory Tracking Order Management Reporting and Analytics Demand Forecasting Barcode/RFID Integration Others |

| By Industry Vertical | Food and Beverage Pharmaceuticals Electronics Fashion & Apparel Logistics & Transportation Others |

| By Sales Channel | Direct Sales Online Sales Distributors |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Usage-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 120 | Inventory Managers, Retail Operations Managers |

| Manufacturing Supply Chain Solutions | 100 | Production Managers, Supply Chain Analysts |

| Logistics and Distribution Software | 80 | Logistics Coordinators, Warehouse Supervisors |

| Food and Beverage Inventory Control | 60 | Quality Assurance Managers, Procurement Specialists |

| Pharmaceutical Inventory Systems | 50 | Regulatory Affairs Managers, Supply Chain Managers |

The Italy Inventory Management Software Market is valued at approximately USD 1.3 billion, driven by the increasing need for efficient inventory control, the rise of e-commerce, and the adoption of advanced technologies like AI and IoT in supply chain management.