Region:Asia

Author(s):Rebecca

Product Code:KRAC9635

Pages:83

Published On:November 2025

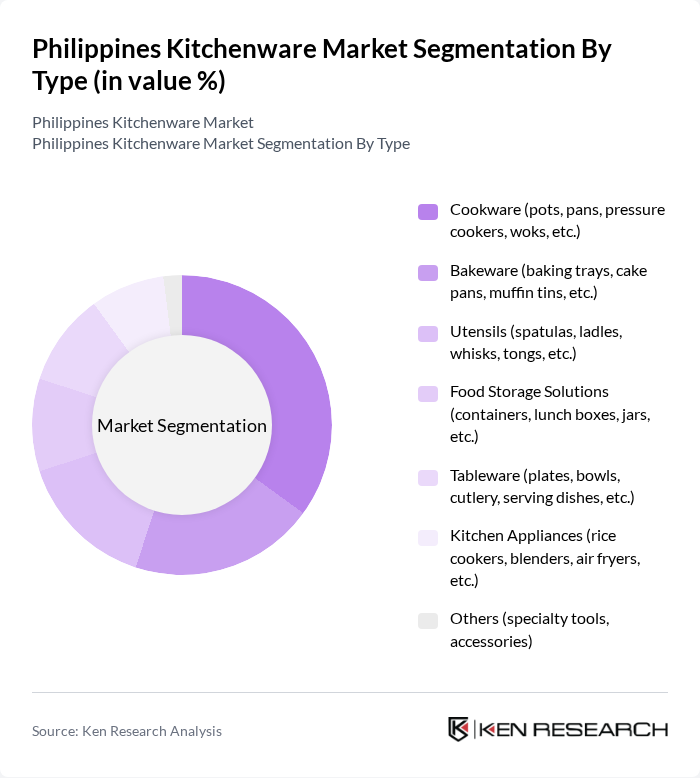

By Type:The kitchenware market can be segmented into various types, including cookware, bakeware, utensils, food storage solutions, tableware, kitchen appliances, and others. Among these, cookware is the leading segment, driven by the increasing popularity of home cooking and the demand for durable, versatile, and non-stick cooking tools. Consumers are increasingly investing in high-quality cookware that enhances their cooking experience, with a notable shift towards energy-efficient and easy-to-clean products. Kitchen appliances, particularly small and multifunctional devices, are also gaining traction due to urbanization and changing dietary preferences .

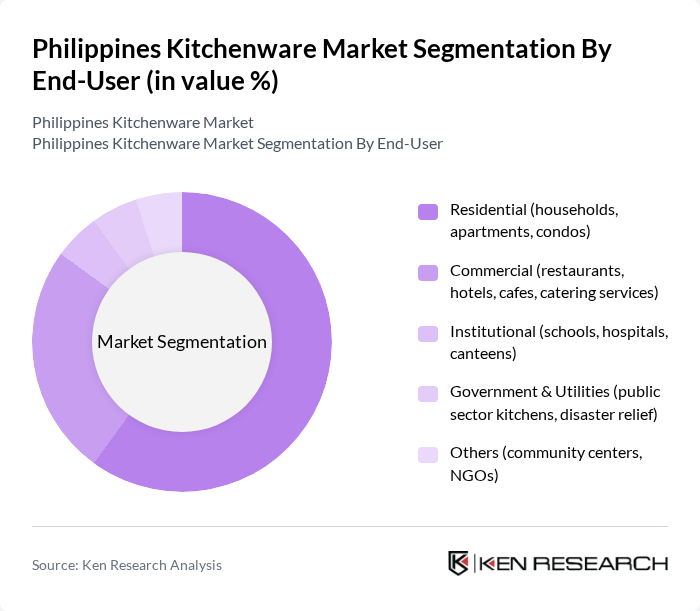

By End-User:The kitchenware market is segmented by end-user into residential, commercial, institutional, government & utilities, and others. The residential segment dominates the market, driven by the increasing number of households, urbanization, and the trend of home cooking. Consumers are investing in kitchenware to enhance their cooking experience, with a strong preference for products that are functional, safe, and easy to maintain. The commercial segment, including restaurants, hotels, and catering services, is also expanding due to the growth of the foodservice and hospitality industries .

The Philippines Kitchenware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hanabishi Appliances, Kyowa Philippines, Imarflex Philippines, La Germania Philippines, American Heritage, Tough Mama Appliances, Philips Philippines, Panasonic Philippines, Tefal Philippines, Lock & Lock Philippines, Corelle Brands Philippines, Cuisinart Philippines, KitchenAid Philippines, OXO Philippines, Zojirushi Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines kitchenware market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As disposable incomes rise, consumers are likely to invest in higher-quality kitchen products. The trend towards eco-friendly materials and smart kitchenware will shape product development, with manufacturers focusing on sustainability and innovation. Additionally, the expansion of e-commerce platforms will facilitate access to a broader range of kitchenware, enhancing consumer choice and convenience in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cookware (pots, pans, pressure cookers, woks, etc.) Bakeware (baking trays, cake pans, muffin tins, etc.) Utensils (spatulas, ladles, whisks, tongs, etc.) Food Storage Solutions (containers, lunch boxes, jars, etc.) Tableware (plates, bowls, cutlery, serving dishes, etc.) Kitchen Appliances (rice cookers, blenders, air fryers, etc.) Others (specialty tools, accessories) |

| By End-User | Residential (households, apartments, condos) Commercial (restaurants, hotels, cafes, catering services) Institutional (schools, hospitals, canteens) Government & Utilities (public sector kitchens, disaster relief) Others (community centers, NGOs) |

| By Material | Stainless Steel Plastic Glass Ceramic Silicone Aluminum Others (wood, bamboo, composite) |

| By Distribution Channel | Online Retail (e-commerce platforms, brand websites) Offline Retail (department stores, supermarkets, specialty stores) Wholesale (B2B suppliers, distributors) Direct Sales (brand outlets, pop-up stores) Others (TV shopping, catalog sales) |

| By Price Range | Mass/Budget Mid-Priced Premium Luxury Others |

| By Brand Loyalty | Brand-Loyal Customers Price-Sensitive Customers Quality-Conscious Customers Others |

| By Usage Frequency | Daily Use Occasional Use Seasonal Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Kitchenware Sales | 120 | Store Managers, Category Buyers |

| Manufacturing Insights | 80 | Production Managers, Quality Control Supervisors |

| Consumer Preferences | 150 | Household Decision Makers, Kitchen Enthusiasts |

| Online Kitchenware Sales | 100 | E-commerce Managers, Digital Marketing Specialists |

| Market Trends Analysis | 60 | Market Analysts, Industry Experts |

The Philippines Kitchenware Market is valued at approximately USD 5 billion, driven by increased consumer spending on home improvement and a growing trend towards cooking at home, particularly during and after the pandemic.