Region:Middle East

Author(s):Rebecca

Product Code:KRAA6522

Pages:80

Published On:January 2026

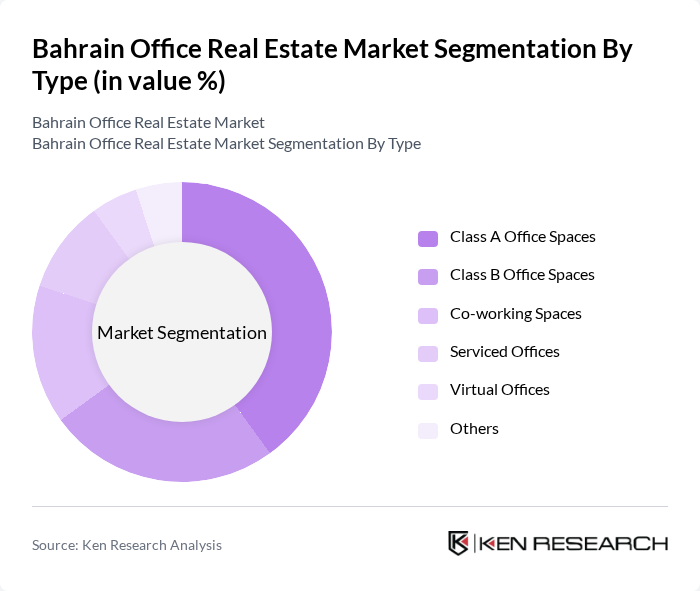

By Type:The office real estate market can be segmented into various types, including Class A Office Spaces, Class B Office Spaces, Co-working Spaces, Serviced Offices, Virtual Offices, and Others. Class A office spaces are typically the most sought after due to their prime locations and modern amenities, attracting high-profile tenants. Co-working spaces have gained popularity, especially among startups and freelancers, due to their flexibility and cost-effectiveness.

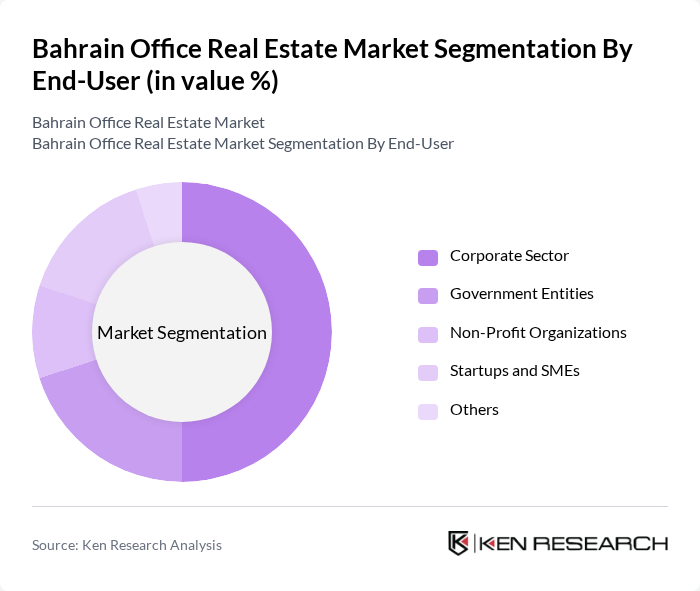

By End-User:The end-user segmentation includes the Corporate Sector, Government Entities, Non-Profit Organizations, Startups and SMEs, and Others. The Corporate Sector is the dominant user of office spaces, driven by the need for professional environments that enhance productivity and collaboration. Startups and SMEs are increasingly opting for flexible office solutions, such as co-working spaces, to minimize overhead costs while maintaining a professional image.

The Bahrain Office Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Real Estate Investment Company (Edamah), Gulf Finance House, Diyar Al Muharraq, Al Salam Bank, Bahrain Bay Development, Seef Properties, Manama Real Estate, Al Khaleej Development Company (Tameer), Naseej, APM Terminals Bahrain, Bahrain Commercial Facilities Company, Almoayyed Contracting Group, Kooheji Contractors, Al-Hilal Group, BMMI contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain office real estate market is poised for growth, driven by ongoing economic diversification and increased foreign investment. As businesses adapt to hybrid work models, demand for flexible office spaces is expected to rise. Additionally, the government's commitment to infrastructure development will enhance the attractiveness of office locations. With a focus on sustainability and smart building technologies, the market is likely to evolve, presenting new opportunities for developers and investors in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Class A Office Spaces Class B Office Spaces Co-working Spaces Serviced Offices Virtual Offices Others |

| By End-User | Corporate Sector Government Entities Non-Profit Organizations Startups and SMEs Others |

| By Location | Central Business Districts Suburban Areas Emerging Business Hubs Others |

| By Lease Type | Long-term Leases Short-term Leases Flexible Leasing Options Others |

| By Building Age | New Developments Recently Renovated Older Buildings Others |

| By Amenities Offered | High-Speed Internet Conference Facilities Parking Facilities Fitness Centers Others |

| By Sustainability Features | LEED Certified Buildings Energy-Efficient Designs Green Roofs and Walls Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Market | 120 | Homeowners, Real Estate Agents |

| Commercial Leasing Trends | 100 | Commercial Property Managers, Business Owners |

| Industrial Real Estate Development | 80 | Developers, Investors |

| Foreign Investment in Real Estate | 70 | Investment Analysts, Financial Advisors |

| Market Sentiment Analysis | 100 | Real Estate Consultants, Market Researchers |

The Bahrain Office Real Estate Market is valued at approximately USD 1.4 billion, reflecting a steady growth driven by increasing demand for office spaces from local and international businesses, as well as government initiatives to enhance the business environment.