Malaysia Office Real Estate Market Overview

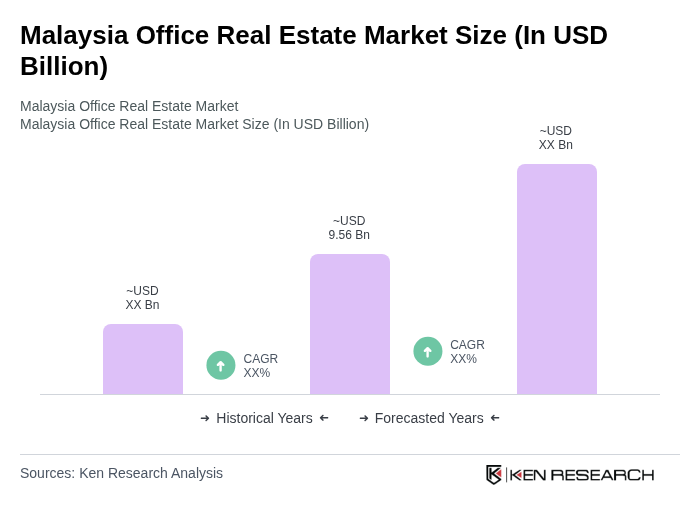

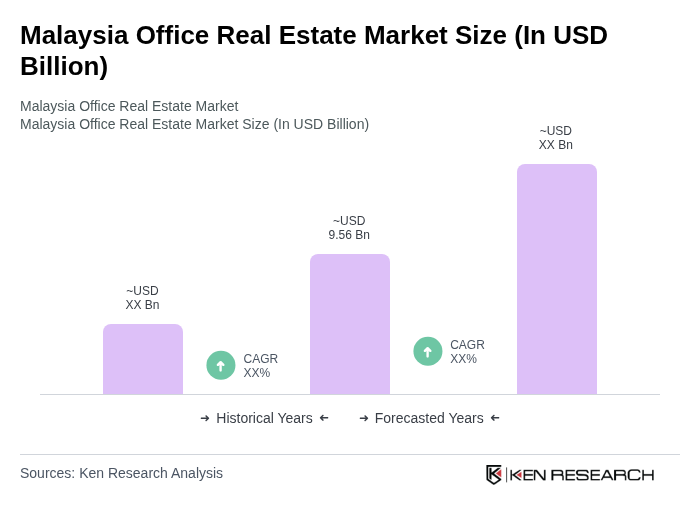

- The Malaysia Office Real Estate Market is valued at approximately USD 9.56 billion, based on current market analysis. This growth is primarily driven by urbanization, increasing foreign direct investment, and a growing demand for flexible workspaces. The market has seen a shift towards modern office solutions, with a focus on sustainability and technology integration, which has further fueled its expansion. Grade-A, green-certified towers near mass transit continue to attract premium-rent absorption, while corporates and SMEs absorbed 74.54% of gross floor demand, sourcing expansion space for cloud engineering labs, finance back offices, and advanced-manufacturing lines.

- Key cities dominating this market include Kuala Lumpur, Penang, and Johor Bahru. Kuala Lumpur stands out due to its status as the capital and a financial hub, attracting multinational corporations and businesses, with 57.24 million square feet of office stock. Penang and Johor Bahru benefit from their strategic locations and growing industrial sectors, making them attractive for office developments and investments. Johor, in particular, is experiencing accelerated growth through the Johor-Singapore Special Economic Zone, with commercial transactions up 33% since the SEZ launch, and is forecast to lift Rest-of-Malaysia revenue at a 9.43% CAGR.

- Malaysia's commercial real estate sector operates under a comprehensive regulatory framework designed to enhance transparency and efficiency. The regulatory environment supports sustainable urban development and encourages investments in modern office spaces through government initiatives that promote ESG-certified developments and hybrid-work policies that favor hub-and-spoke footprints.

Malaysia Office Real Estate Market Segmentation

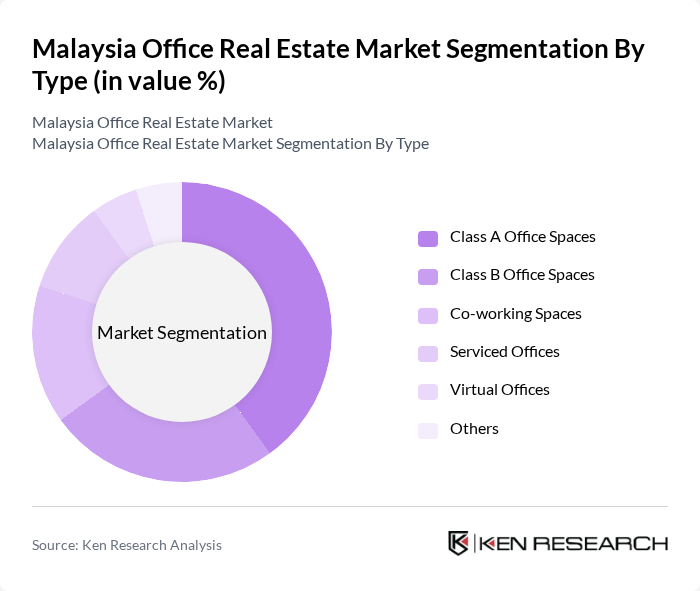

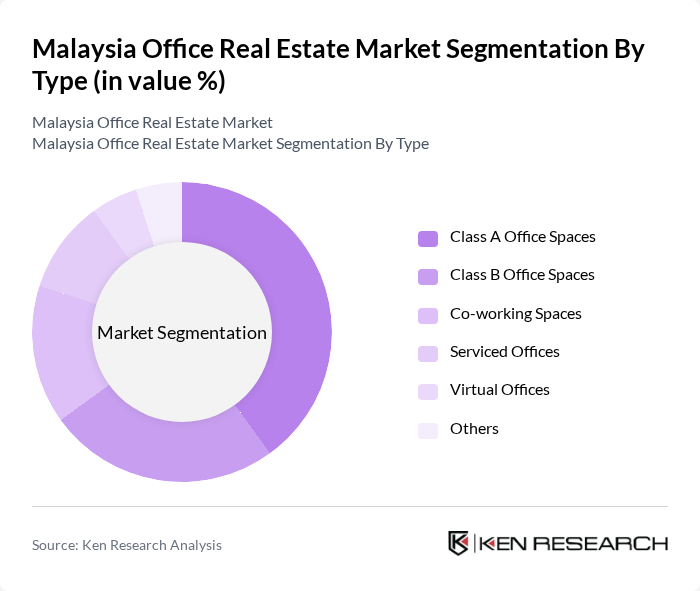

By Type:The office real estate market can be segmented into various types, including Class A Office Spaces, Class B Office Spaces, Co-working Spaces, Serviced Offices, Virtual Offices, and Others. Class A office spaces are typically the most sought after due to their prime locations and modern amenities, attracting high-profile tenants. Co-working spaces have gained popularity, especially among startups and freelancers, due to their flexibility and cost-effectiveness. Offices held 34.65% of Malaysia's commercial real estate market share, underscoring Kuala Lumpur's status as the nation's corporate nerve center, with Grade-A demand concentrating in transit-linked and ESG-certified towers.

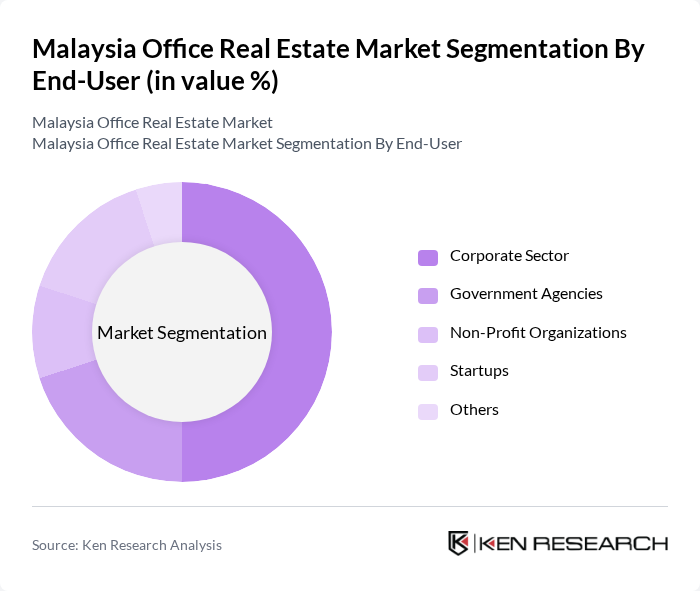

By End-User:The end-user segmentation includes the Corporate Sector, Government Agencies, Non-Profit Organizations, Startups, and Others. The corporate sector is the largest end-user, driven by the demand for premium office spaces that enhance productivity and employee satisfaction. Startups are increasingly opting for flexible office solutions, such as co-working spaces, to minimize overhead costs while fostering collaboration. Corporates and SMEs together represent the dominant market force, with multinationals inside the Johor-Singapore SEZ seizing 5% tax windows, further inflating the corporate leasing pipeline.

Malaysia Office Real Estate Market Competitive Landscape

The Malaysia Office Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sunway Real Estate Investment Trust, KLCC Property Holdings Berhad, UEM Sunrise Berhad, IOI Properties Group Berhad, Mah Sing Group Berhad, Eco World Development Group Berhad, Pavilion Real Estate Investment Trust, Axis Real Estate Investment Trust, MRCB-Quill REIT, S P Setia Berhad, Gamuda Berhad, Berjaya Land Berhad, YTL Corporation Berhad, Tropicana Corporation Berhad, WCT Holdings Berhad contribute to innovation, geographic expansion, and service delivery in this space.

Malaysia Office Real Estate Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Malaysia's urban population is projected to reach 80% in the future, up from 75% in 2020, according to the World Bank. This rapid urbanization drives demand for office spaces, particularly in metropolitan areas like Kuala Lumpur. The influx of people into cities creates a need for more commercial real estate, with an estimated 1.5 million square meters of office space required to accommodate this growth. This trend is expected to significantly boost the office real estate market.

- Rising Demand for Flexible Workspaces:The flexible workspace sector in Malaysia is anticipated to grow by 20% annually, driven by the increasing adoption of hybrid work models. As of 2023, approximately 30% of companies in Malaysia have adopted flexible work arrangements, leading to a surge in demand for co-working spaces. This shift is supported by the growing number of startups and SMEs, which prefer flexible leasing options to manage costs effectively in a dynamic market environment.

- Government Initiatives for Infrastructure Development:The Malaysian government has allocated RM 50 billion for infrastructure projects in the future, focusing on enhancing connectivity and urban development. This investment is expected to improve access to key business districts, thereby increasing the attractiveness of office spaces in these areas. Enhanced infrastructure will facilitate business operations and attract foreign investments, further stimulating the office real estate market in Malaysia.

Market Challenges

- Economic Uncertainty:Malaysia's GDP growth is projected to slow to 4.2% in the future, down from 5.5% in 2023, according to the IMF. This economic uncertainty can lead to reduced corporate spending on office space, as businesses may delay expansion plans or downsize. The fluctuating economic environment creates challenges for landlords and developers, as high vacancy rates could persist in certain areas, impacting rental income and investment returns.

- High Vacancy Rates in Certain Areas:As of 2023, Kuala Lumpur's office vacancy rate stands at 22%, significantly above the regional average of 15%. This oversupply of office space, particularly in less desirable locations, poses a challenge for property owners. The high vacancy rates can lead to increased competition among landlords, forcing them to lower rents or offer incentives, which can negatively impact overall market profitability.

Malaysia Office Real Estate Market Future Outlook

The Malaysia office real estate market is poised for transformation as it adapts to evolving work patterns and sustainability demands. The shift towards hybrid work models will continue to influence office space design and utilization, with an emphasis on flexibility and collaboration. Additionally, the government's commitment to infrastructure development will enhance connectivity, making office locations more attractive. As businesses increasingly prioritize sustainability, the demand for green buildings is expected to rise, creating new opportunities for developers and investors in the future.

Market Opportunities

- Growth in E-commerce and Logistics:The e-commerce sector in Malaysia is projected to reach RM 50 billion in the future, driving demand for logistics and distribution centers. This growth presents opportunities for office real estate developers to create spaces that cater to e-commerce businesses, including fulfillment centers and administrative offices, thereby capitalizing on the expanding digital economy.

- Demand for Green Buildings:With the Malaysian government targeting a 40% reduction in carbon emissions by 2030, the demand for green buildings is expected to surge. Developers who invest in sustainable office spaces can benefit from tax incentives and increased tenant interest, as businesses seek to enhance their corporate social responsibility profiles and reduce operational costs through energy-efficient designs.