Region:Asia

Author(s):Rebecca

Product Code:KRAA6512

Pages:86

Published On:January 2026

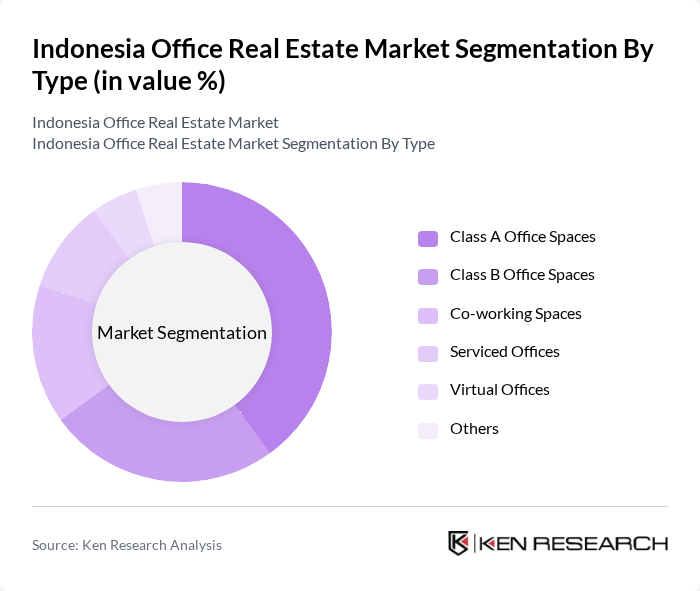

By Type:The office real estate market can be segmented into various types, including Class A Office Spaces, Class B Office Spaces, Co-working Spaces, Serviced Offices, Virtual Offices, and Others. Class A office spaces are typically the most sought after due to their prime locations and modern amenities, appealing to high-profile tenants. Co-working spaces have gained popularity, especially among startups and freelancers, due to their flexibility and cost-effectiveness.

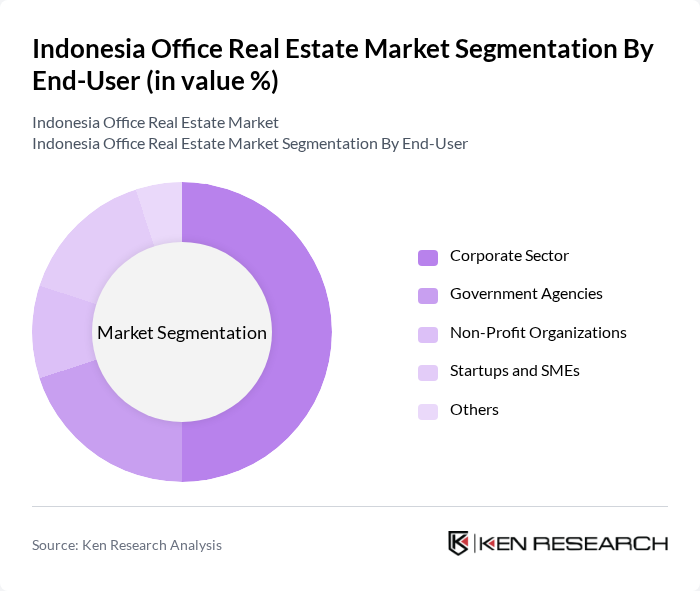

By End-User:The end-user segmentation includes Corporate Sector, Government Agencies, Non-Profit Organizations, Startups and SMEs, and Others. The corporate sector is the dominant end-user, driven by the need for professional office environments that enhance productivity and collaboration. Startups and SMEs are increasingly opting for flexible office solutions, such as co-working spaces, to minimize overhead costs while maintaining a professional image.

The Indonesia Office Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lippo Group, Agung Podomoro Land, Sinar Mas Land, Ciputra Development, Pakuwon Jati, JLL Indonesia, Colliers International Indonesia, Savills Indonesia, Knight Frank Indonesia, Cushman & Wakefield Indonesia, DTZ Indonesia, BCA Finance, Bank Mandiri, Trisula Corporation, Intiland Development contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's office real estate market appears promising, driven by ongoing urbanization and a growing economy. As businesses adapt to hybrid work models, demand for flexible office spaces is expected to rise. Additionally, the government's commitment to infrastructure development will enhance urban connectivity, further attracting investments. The focus on sustainability and smart building technologies will likely shape the market, creating opportunities for innovative real estate solutions that meet evolving tenant needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Class A Office Spaces Class B Office Spaces Co-working Spaces Serviced Offices Virtual Offices Others |

| By End-User | Corporate Sector Government Agencies Non-Profit Organizations Startups and SMEs Others |

| By Location | Jakarta Surabaya Bandung Medan Others |

| By Lease Type | Long-term Leases Short-term Leases Flexible Leases Others |

| By Building Age | New Developments Mid-aged Buildings Older Buildings Others |

| By Amenities Offered | Basic Amenities Premium Amenities Smart Building Features Others |

| By Sustainability Certification | LEED Certified BREEAM Certified Green Building Council Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Space Users | 120 | Real Estate Managers, Facility Directors |

| Real Estate Developers | 80 | Project Managers, Development Executives |

| Property Management Firms | 60 | Property Managers, Leasing Agents |

| Co-working Space Operators | 50 | Community Managers, Operations Directors |

| Investment Analysts in Real Estate | 50 | Investment Managers, Financial Analysts |

The Indonesia Office Real Estate Market is valued at approximately USD 13 billion, driven by urbanization, foreign investments, and the demand for modern office spaces in key cities like Jakarta, Surabaya, and Bandung.