Region:Global

Author(s):Rebecca

Product Code:KRAA6525

Pages:83

Published On:January 2026

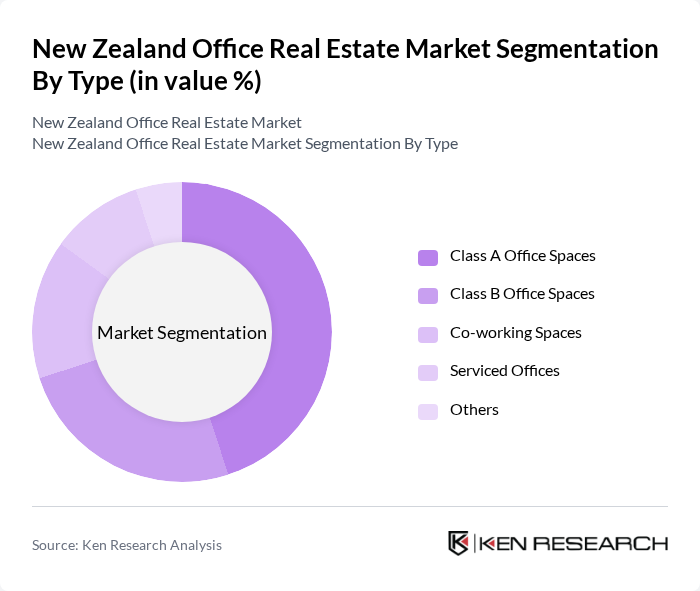

By Type:The office real estate market is segmented into various types, including Class A Office Spaces, Class B Office Spaces, Co-working Spaces, Serviced Offices, and Others. Class A office spaces dominate the market due to their premium location, modern amenities, and higher rental yields, appealing to high-profile tenants, with prime grade stock showing modest net effective rent growth. The demand for co-working spaces has also surged, driven by the rise of startups and the gig economy, which prefer flexible leasing options.

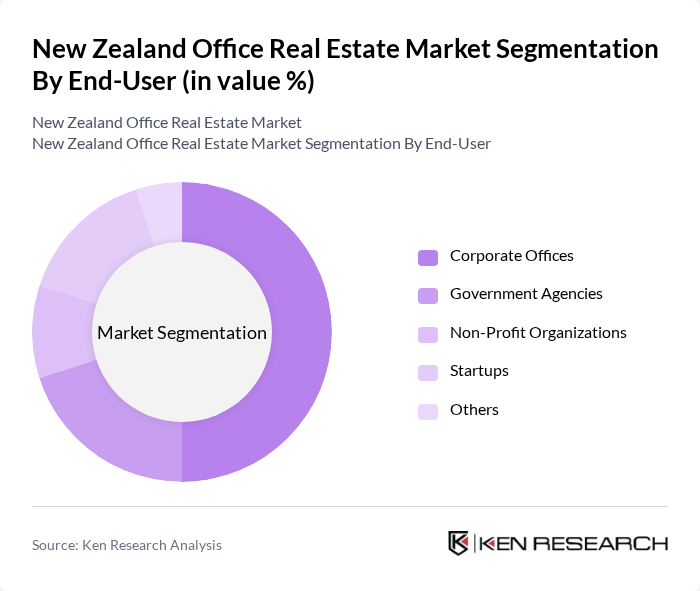

By End-User:The end-user segmentation includes Corporate Offices, Government Agencies, Non-Profit Organizations, Startups, and Others. Corporate offices represent the largest segment, driven by the need for dedicated spaces that enhance productivity and collaboration. Startups are increasingly opting for flexible office solutions, contributing to the growth of co-working spaces, while government agencies require specific facilities that comply with regulatory standards.

The New Zealand Office Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Colliers International, CBRE Group, JLL (Jones Lang LaSalle), Knight Frank, Savills, Bayleys Real Estate, NAI Harcourts, Cushman & Wakefield, Property Brokers, First National Real Estate, Ray White, Barfoot & Thompson, Harcourts, LJ Hooker, Real Estate Institute of New Zealand (REINZ) contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand office real estate market is poised for transformation as it adapts to evolving work patterns and sustainability demands. The shift towards hybrid work models is expected to redefine office space requirements, with an emphasis on flexibility and wellness. Additionally, the integration of smart technologies will enhance operational efficiency and tenant experience. As urbanization continues, the demand for sustainable and innovative office solutions will likely drive investment and development in the sector, fostering a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Class A Office Spaces Class B Office Spaces Co-working Spaces Serviced Offices Others |

| By End-User | Corporate Offices Government Agencies Non-Profit Organizations Startups Others |

| By Location | Central Business Districts Suburban Areas Regional Towns Others |

| By Lease Type | Short-term Leases Long-term Leases Flexible Leases Others |

| By Building Age | New Developments Renovated Buildings Historical Buildings Others |

| By Amenities Offered | High-Speed Internet Parking Facilities Conference Rooms Others |

| By Investment Source | Domestic Investors Foreign Direct Investment Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Tenants | 120 | Real Estate Managers, Facility Directors |

| Commercial Property Owners | 100 | Property Developers, Asset Managers |

| Real Estate Brokers | 80 | Commercial Agents, Leasing Specialists |

| Investment Analysts | 70 | Financial Analysts, Portfolio Managers |

| Urban Planners | 60 | City Planners, Policy Advisors |

The New Zealand office real estate market is valued at approximately USD 15 billion, driven by increasing demand for flexible workspaces, urbanization, and a robust economy. This growth reflects a significant rise in investment, particularly in major cities like Auckland, Wellington, and Christchurch.