Region:Asia

Author(s):Rebecca

Product Code:KRAA6517

Pages:97

Published On:January 2026

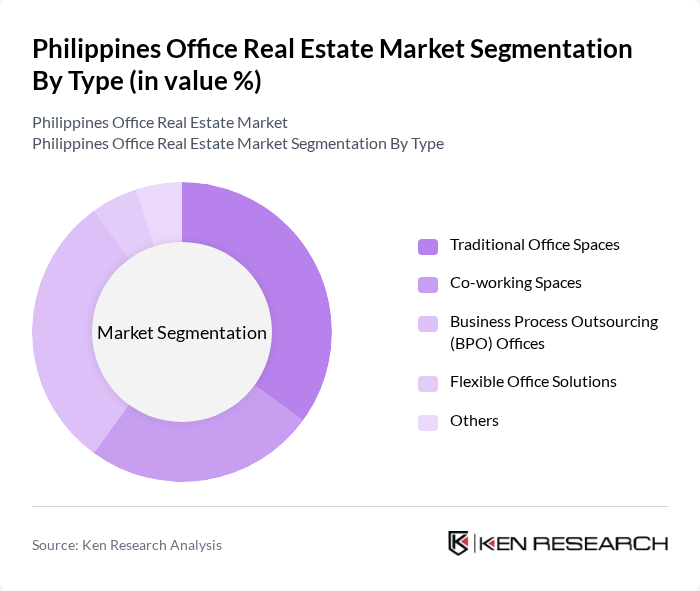

By Type:The office real estate market can be segmented into various types, including Traditional Office Spaces, Co-working Spaces, Business Process Outsourcing (BPO) Offices, Flexible Office Solutions, and Others. Traditional office spaces remain a staple for many corporations, while co-working spaces have gained popularity due to the rise of startups and freelancers amid hybrid work models. BPO offices continue to dominate due to the Philippines' strong outsourcing industry, and flexible office solutions are increasingly sought after for their adaptability, including shorter leases and tech-enabled infrastructure.

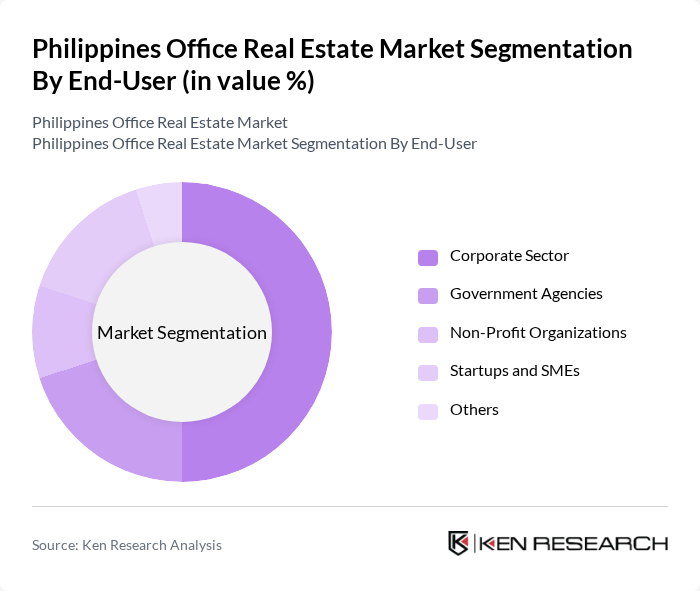

By End-User:The end-user segmentation includes the Corporate Sector, Government Agencies, Non-Profit Organizations, Startups and SMEs, and Others. The corporate sector is the largest consumer of office spaces, driven by the need for dedicated work environments. Government agencies also require office spaces for their operations, while non-profit organizations and startups are increasingly opting for flexible and co-working spaces to reduce overhead costs.

The Philippines Office Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ayala Land, Inc., Megaworld Corporation, SM Prime Holdings, Inc., Robinsons Land Corporation, DM Wenceslao and Associates, Inc., Filinvest Development Corporation, Vista Land & Lifescapes, Inc., DoubleDragon Properties Corp., Century Properties Group, Inc., Rockwell Land Corporation, Greenfield Development Corporation, Eton Properties Philippines, Inc., Federal Land, Inc., Aboitiz InfraCapital, Inc., Ortigas & Company, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines office real estate market is poised for a dynamic evolution in the coming years, driven by the increasing adoption of hybrid work models and the growing emphasis on sustainability. As companies adapt to new work environments, demand for flexible and eco-friendly office spaces is expected to rise. Furthermore, advancements in smart building technologies will enhance operational efficiency, attracting tenants seeking modern amenities. Overall, the market is likely to experience a transformation that aligns with global trends in workplace design and environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Office Spaces Co-working Spaces Business Process Outsourcing (BPO) Offices Flexible Office Solutions Others |

| By End-User | Corporate Sector Government Agencies Non-Profit Organizations Startups and SMEs Others |

| By Location | Metro Manila Cebu Davao Emerging Cities Others |

| By Lease Type | Long-term Leases Short-term Leases Flexible Leasing Options Others |

| By Building Class | Class A Buildings Class B Buildings Class C Buildings Others |

| By Investment Type | Direct Investments Real Estate Investment Trusts (REITs) Joint Ventures Others |

| By Market Segment | High-end Market Mid-range Market Budget Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Space Demand | 120 | Real Estate Managers, Facility Directors |

| Co-working Space Utilization | 80 | Co-working Space Operators, Freelancers |

| Office Leasing Trends | 100 | Leasing Agents, Property Developers |

| Tenant Satisfaction and Preferences | 60 | Office Tenants, HR Managers |

| Impact of Remote Work on Office Space | 70 | Business Owners, IT Managers |

The Philippines Office Real Estate Market is valued at approximately USD 8 billion, driven by increasing demand from sectors like Business Process Outsourcing (BPO) and technology firms, with significant net absorption rates indicating robust growth.