Region:Middle East

Author(s):Rebecca

Product Code:KRAA6521

Pages:89

Published On:January 2026

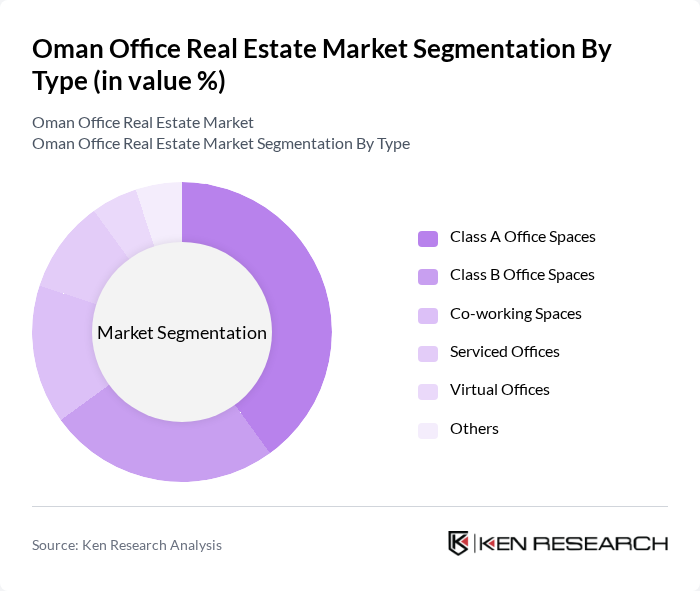

By Type:The office real estate market can be segmented into various types, including Class A Office Spaces, Class B Office Spaces, Co-working Spaces, Serviced Offices, Virtual Offices, and Others. Class A office spaces are typically the most sought after due to their prime locations and high-quality amenities, appealing to multinational corporations and high-profile tenants. Co-working spaces have gained popularity, especially among startups and freelancers, as they offer flexibility and cost-effectiveness.

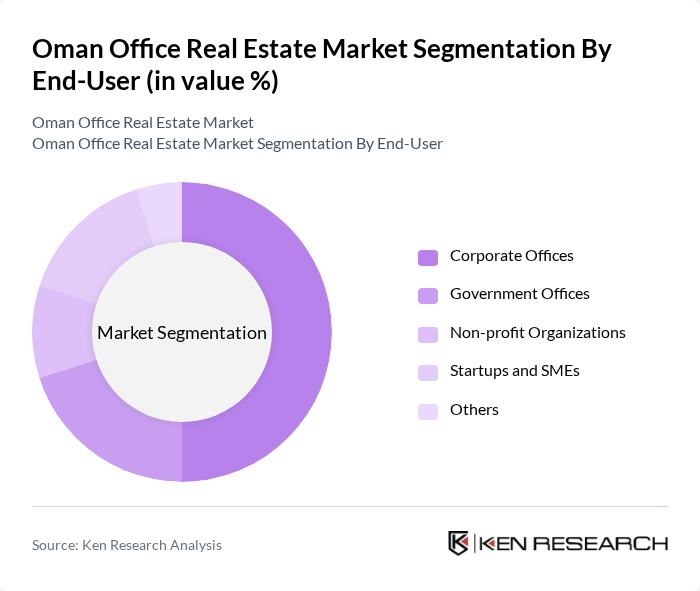

By End-User:The end-user segmentation includes Corporate Offices, Government Offices, Non-profit Organizations, Startups and SMEs, and Others. Corporate offices represent the largest segment, driven by the presence of multinational companies and local enterprises seeking premium office spaces, with corporate and SME occupiers accounting for 88.65% of the market. Startups and SMEs are increasingly opting for co-working spaces, reflecting a trend towards flexibility and cost efficiency in office leasing.

The Oman Office Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Real Estate Company, Muscat Hills Development, Al Habib Real Estate, Alizz Islamic Bank, Majan Development, Oman Investment Corporation, Al Jazeera Real Estate, Muscat Grand Mall, Al Batinah Development, Oman National Engineering, Al Madina Investment, Muscat Municipality, Oman Tourism Development Company, Al Noor Real Estate, Oman Housing Bank contribute to innovation, geographic expansion, and service delivery in this space.

The Oman office real estate market is poised for significant transformation as it adapts to evolving work patterns and economic conditions. The rise of hybrid work models is expected to reshape demand for office spaces, with businesses seeking flexible solutions. Additionally, the integration of technology in office design will enhance operational efficiency. As sustainability becomes a priority, developers will increasingly focus on green certifications, aligning with global trends and government regulations aimed at promoting environmentally friendly practices in real estate development.

| Segment | Sub-Segments |

|---|---|

| By Type | Class A Office Spaces Class B Office Spaces Co-working Spaces Serviced Offices Virtual Offices Others |

| By End-User | Corporate Offices Government Offices Non-profit Organizations Startups and SMEs Others |

| By Location | Muscat Salalah Sohar Nizwa Others |

| By Lease Type | Long-term Leases Short-term Leases Flexible Leases Others |

| By Size | Small Offices (up to 1,000 sq ft) Medium Offices (1,000 - 5,000 sq ft) Large Offices (5,000 sq ft and above) Others |

| By Ownership Type | Owned Properties Leased Properties Managed Properties Others |

| By Amenities Offered | Basic Amenities Premium Amenities Eco-friendly Features Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Space Users | 120 | Office Managers, Facility Coordinators |

| Real Estate Developers | 60 | Project Managers, Business Development Heads |

| Property Management Firms | 50 | Property Managers, Asset Managers |

| Corporate Tenants | 100 | Chief Financial Officers, Real Estate Executives |

| Industry Experts and Analysts | 40 | Market Analysts, Economic Advisors |

The Oman office real estate market is valued at approximately USD 750 million, driven by factors such as increasing foreign investments, urbanization, and a growing demand for modern office spaces, as outlined in the Vision 2040 diversification agenda.