Brazil Cybersecurity for SMEs Market Overview

- The Brazil Cybersecurity for SMEs Market is valued at USD 1.3 billion, based on a five-year historical analysis. This growth is primarily driven by the escalating volume and sophistication of cyber threats targeting small and medium enterprises, as well as heightened awareness among business owners about the critical importance of cybersecurity. The rapid digital transformation of SMEs, adoption of cloud platforms, and increased remote work have further accelerated the demand for robust cybersecurity solutions to protect sensitive data and maintain customer trust. Recent years have also seen a surge in investments in AI-driven security and managed security services, reflecting a shift toward proactive threat detection and response .

- Key cities dominating the market include São Paulo, Rio de Janeiro, and Brasília. São Paulo, as the financial and business hub, has a high concentration of SMEs that require advanced cybersecurity solutions. Rio de Janeiro and Brasília also contribute significantly due to their expanding tech ecosystems and government initiatives aimed at strengthening cybersecurity infrastructure, making them attractive markets for cybersecurity providers. The finance, e-commerce, and healthcare sectors in these cities are particularly active in adopting advanced security measures .

- The General Data Protection Law (Lei Geral de Proteção de Dados Pessoais – LGPD), established by Law No. 13,709/2018 and enforced by the National Data Protection Authority (ANPD), mandates that companies, including SMEs, implement stringent data protection and privacy measures. The LGPD applies to all organizations processing personal data in Brazil, requiring compliance with standards for data collection, processing, storage, and breach notification. Non-compliance can result in significant administrative penalties, compelling SMEs to invest in cybersecurity solutions to meet legal requirements and protect consumer privacy .

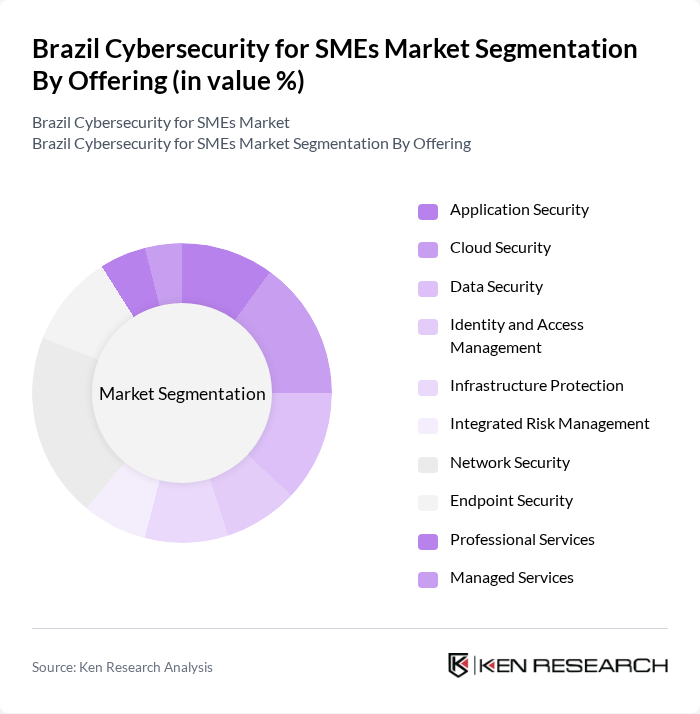

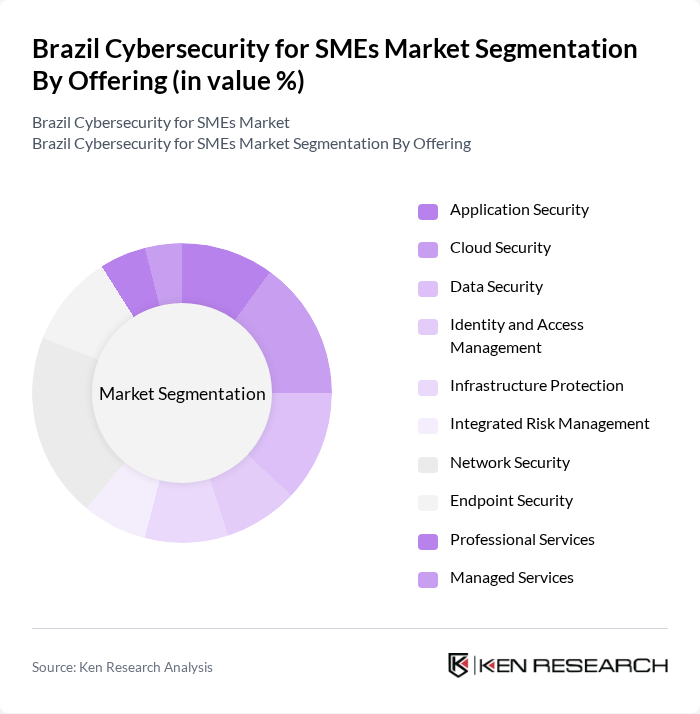

Brazil Cybersecurity for SMEs Market Segmentation

By Offering:The offerings in the cybersecurity market for SMEs include a diverse range of solutions designed to protect digital assets. The subsegments include Application Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Protection, Integrated Risk Management, Network Security, Endpoint Security, Professional Services, and Managed Services. Among these, Network Security remains the leading subsegment, driven by the increasing frequency of network-based cyberattacks and the need for SMEs to secure distributed workforces and cloud environments. Cloud Security and Data Security are also experiencing rapid adoption as SMEs migrate to cloud platforms and prioritize data protection .

By Deployment Mode:The deployment modes for cybersecurity solutions in the SME sector are primarily categorized into Cloud-Based and On-Premises solutions. Cloud-Based solutions are gaining significant traction due to their scalability, cost-effectiveness, and ease of implementation. SMEs are increasingly opting for cloud-based cybersecurity services, which offer enhanced flexibility, real-time threat monitoring, and simplified management, especially as remote and hybrid work models become more prevalent .

Brazil Cybersecurity for SMEs Market Competitive Landscape

The Brazil Cybersecurity for SMEs Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Security, Cisco Systems, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Trend Micro Incorporated, McAfee Corp., Sophos Ltd., CrowdStrike Holdings, Inc., Kaspersky Lab, Bitdefender LLC, CyberArk Software Ltd., Proofpoint, Inc., Zscaler, Inc., Tempest Security Intelligence, Clavis Segurança da Informação, Stefanini Group, Cipher (Prosegur), ISH Tecnologia, and Módulo Security Solutions contribute to innovation, geographic expansion, and service delivery in this space .

Brazil Cybersecurity for SMEs Market Industry Analysis

Growth Drivers

- Increasing Cyber Threats:The Brazilian cybersecurity landscape is significantly influenced by the rise in cyber threats, with reported incidents increasing by 25% in the future. According to the Brazilian National Cybersecurity Strategy, over 65% of SMEs experienced at least one cyber attack last year. This alarming trend has prompted SMEs to prioritize cybersecurity investments, leading to an estimated increase in spending on cybersecurity solutions to reach BRL 6 billion in the future, reflecting a growing recognition of the need for robust defenses.

- Government Initiatives for Cybersecurity:The Brazilian government has implemented various initiatives to bolster cybersecurity, including the National Cybersecurity Strategy launched in the future. This strategy aims to enhance the resilience of SMEs against cyber threats, with a budget allocation of BRL 1.5 billion for cybersecurity programs in the future. Additionally, the government is promoting public-private partnerships to facilitate knowledge sharing and resource allocation, which is expected to further stimulate the cybersecurity market for SMEs.

- Rising Awareness Among SMEs:Awareness of cybersecurity risks among Brazilian SMEs has surged, with 80% of business owners acknowledging the importance of cybersecurity in the future, up from 55%. This shift is driven by high-profile data breaches and increased media coverage. As a result, SMEs are more inclined to invest in cybersecurity solutions, with an estimated 45% planning to allocate more than BRL 120,000 towards cybersecurity measures in the future, reflecting a proactive approach to risk management.

Market Challenges

- Limited Budget for Cybersecurity:Many SMEs in Brazil face financial constraints that hinder their ability to invest in comprehensive cybersecurity solutions. A survey conducted in the future revealed that 70% of SMEs allocate less than BRL 60,000 annually for cybersecurity, which is insufficient given the increasing complexity of cyber threats. This limited budget restricts their access to advanced technologies and services, leaving them vulnerable to attacks and undermining their overall security posture.

- Lack of Skilled Professionals:The cybersecurity sector in Brazil is grappling with a significant skills gap, with an estimated shortage of 350,000 cybersecurity professionals in the future. This shortage hampers SMEs' ability to implement effective cybersecurity measures, as many lack the expertise to manage and respond to cyber threats. Consequently, SMEs often rely on external providers, which can be costly and may not always align with their specific needs, further complicating their cybersecurity efforts.

Brazil Cybersecurity for SMEs Market Future Outlook

As Brazil's cybersecurity landscape evolves, SMEs are expected to increasingly adopt managed security services, driven by the need for cost-effective solutions. The integration of artificial intelligence in cybersecurity tools will enhance threat detection and response capabilities, making them more accessible to SMEs. Additionally, the focus on data privacy regulations will compel businesses to invest in compliance solutions, fostering a more secure digital environment. Overall, the market is poised for significant transformation as SMEs prioritize cybersecurity in their operational strategies.

Market Opportunities

- Growth of E-commerce:The rapid expansion of e-commerce in Brazil, projected to reach BRL 250 billion in the future, presents a significant opportunity for cybersecurity providers. As SMEs increasingly engage in online transactions, the demand for secure payment systems and data protection solutions will rise, creating a lucrative market for cybersecurity services tailored to e-commerce platforms.

- Increased Investment in IT Infrastructure:With the Brazilian government investing BRL 15 billion in IT infrastructure development in the future, SMEs will have greater access to advanced technologies. This investment will facilitate the adoption of robust cybersecurity measures, as businesses seek to protect their digital assets and ensure compliance with evolving regulations, thereby driving growth in the cybersecurity market.