Region:Middle East

Author(s):Dev

Product Code:KRAB4868

Pages:96

Published On:October 2025

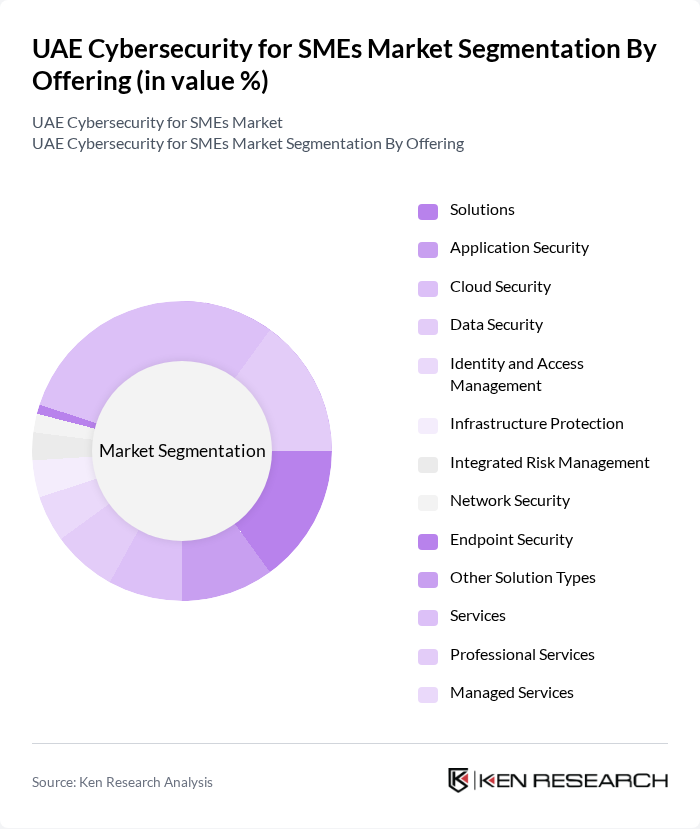

By Offering:The offerings in the UAE Cybersecurity for SMEs Market include a comprehensive range of solutions and services designed to protect businesses from evolving cyber threats. The solutions segment covers application security, cloud security, data security, identity and access management, infrastructure protection, integrated risk management, network security, endpoint security, and other specialized solution types. The services segment is critical for SMEs lacking in-house expertise and includes professional services (consulting, integration, support) and managed services (outsourced monitoring, incident response, and ongoing management).

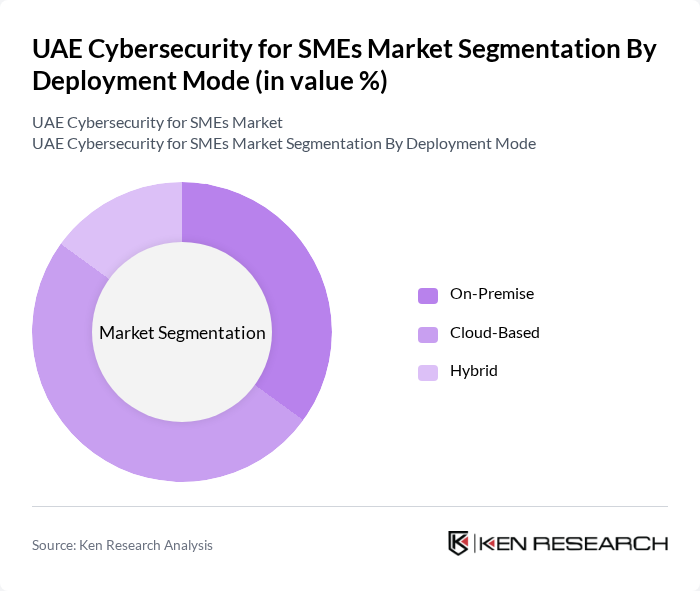

By Deployment Mode:The deployment modes in the UAE Cybersecurity for SMEs Market include on-premise, cloud-based, and hybrid solutions. On-premise solutions are preferred by SMEs seeking greater control over their data and security infrastructure. Cloud-based solutions are increasingly adopted for their scalability, cost-effectiveness, and ease of integration with digital transformation initiatives. Hybrid models are gaining traction as they allow businesses to balance the benefits of both on-premise and cloud environments, catering to diverse operational and compliance requirements.

The UAE Cybersecurity for SMEs Market is characterized by a dynamic mix of regional and international players. Leading participants such as DarkMatter, Help AG, Paladion Networks (an Atos company), CyberKnight Technologies, Spire Solutions, Digital14, Trend Micro, Fortinet, Check Point Software Technologies, Cisco Systems, IBM Security, Palo Alto Networks, Kaspersky, Sophos, Secureworks contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE cybersecurity market for SMEs appears promising, driven by increasing digital transformation and government support. As SMEs continue to adopt advanced technologies, the demand for tailored cybersecurity solutions will grow. Furthermore, the integration of artificial intelligence and machine learning into cybersecurity practices is expected to enhance threat detection and response capabilities, making it essential for SMEs to stay ahead of evolving cyber threats while ensuring compliance with data protection regulations.

| Segment | Sub-Segments |

|---|---|

| By Offering | Solutions Application Security Cloud Security Data Security Identity and Access Management Infrastructure Protection Integrated Risk Management Network Security Endpoint Security Other Solution Types Services Professional Services Managed Services |

| By Deployment Mode | On-Premise Cloud-Based Hybrid |

| By Organization Size | Small Enterprises Medium Enterprises Micro Enterprises |

| By End-User Industry | BFSI (Banking, Financial Services & Insurance) Healthcare and Life Sciences IT and Telecom Industrial and Defense Retail and E-commerce Energy and Utilities Manufacturing Government Others |

| By Service Type | Consulting Services Managed Services Training and Education |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Cybersecurity Needs | 60 | IT Managers, Business Owners |

| Healthcare SMEs Cybersecurity Practices | 50 | Compliance Officers, IT Security Leads |

| Financial Services Cybersecurity Strategies | 40 | Risk Managers, IT Directors |

| Manufacturing Sector Cybersecurity Challenges | 45 | Operations Managers, IT Administrators |

| Hospitality Industry Cybersecurity Awareness | 55 | General Managers, IT Support Staff |

The UAE Cybersecurity for SMEs Market is valued at approximately USD 620 million, reflecting significant growth driven by increasing cyber threats and heightened awareness of cybersecurity among small and medium enterprises.