Region:Asia

Author(s):Rebecca

Product Code:KRAB2977

Pages:83

Published On:October 2025

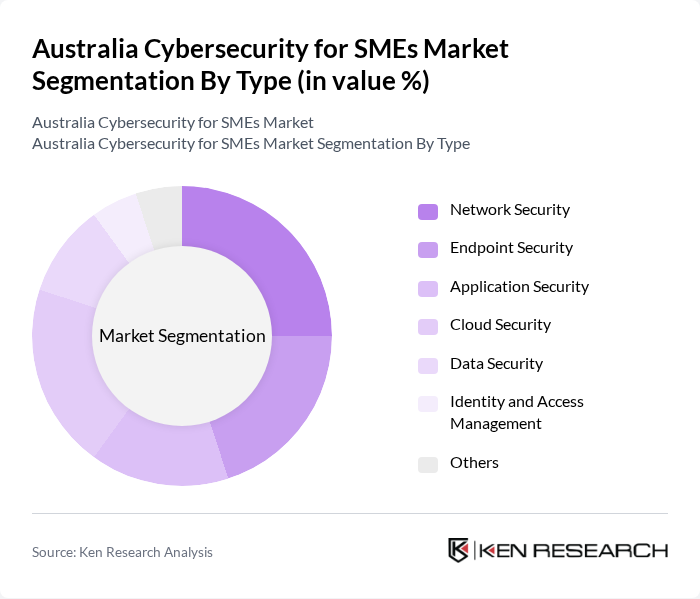

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these segments plays a critical role in addressing specific security needs of SMEs, with varying levels of adoption based on industry requirements and threat landscapes.

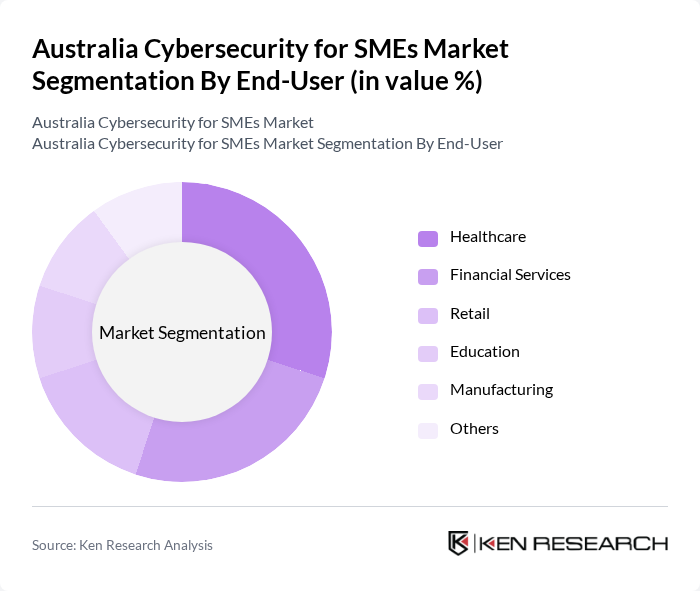

By End-User:The end-user segmentation includes Healthcare, Financial Services, Retail, Education, Manufacturing, and Others. Each sector has unique cybersecurity needs driven by regulatory requirements, data sensitivity, and the nature of operations, influencing the adoption of specific cybersecurity solutions.

The Australia Cybersecurity for SMEs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telstra Corporation Limited, Optus Pty Limited, CyberCX, Secureworks, Trustwave, McAfee Corp., Palo Alto Networks, Fortinet, Check Point Software Technologies, Sophos Group plc, Trend Micro Incorporated, Cisco Systems, Inc., IBM Corporation, CrowdStrike Holdings, Inc., NortonLifeLock Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity landscape for SMEs in Australia appears promising, driven by increasing investments in technology and a heightened focus on regulatory compliance. As businesses adapt to evolving cyber threats, the integration of advanced technologies such as artificial intelligence and machine learning will enhance threat detection and response capabilities. Furthermore, the growing emphasis on data privacy regulations will compel SMEs to adopt more robust cybersecurity measures, ensuring they remain competitive and secure in a digital-first economy.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Healthcare Financial Services Retail Education Manufacturing Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Managed Services Training and Education |

| By Industry Vertical | Government Telecommunications Energy and Utilities Transportation |

| By Company Size | Micro Enterprises Small Enterprises Medium Enterprises |

| By Geographic Region | New South Wales Victoria Queensland Western Australia South Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Cybersecurity Practices | 100 | IT Managers, Security Officers |

| Healthcare SMEs Cybersecurity Compliance | 80 | Compliance Officers, IT Directors |

| Financial Services Cybersecurity Strategies | 90 | Risk Managers, Cybersecurity Analysts |

| Manufacturing Sector Cybersecurity Investments | 70 | Operations Managers, IT Administrators |

| Technology Startups Cybersecurity Awareness | 60 | Founders, CTOs |

The Australia Cybersecurity for SMEs market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increasing cyber threats and the rising adoption of digital technologies among small and medium enterprises.