Region:Asia

Author(s):Rebecca

Product Code:KRAA5330

Pages:86

Published On:September 2025

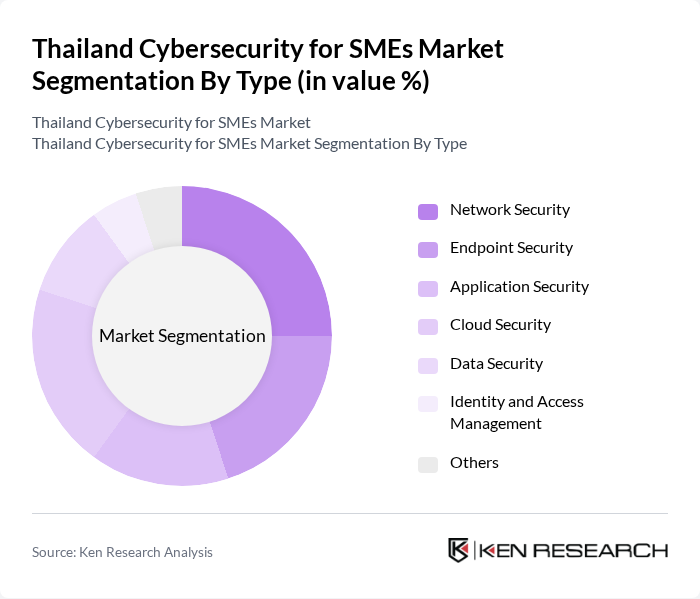

By Type:The market can be segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these segments plays a crucial role in addressing specific security needs of SMEs.

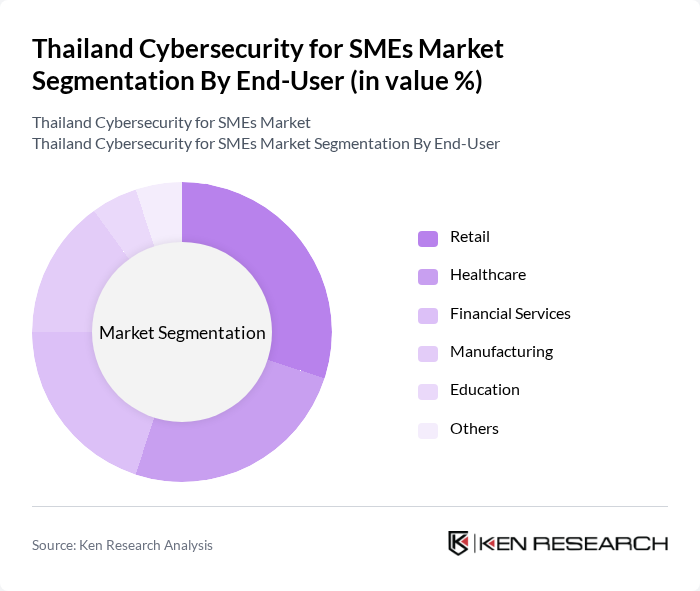

By End-User:The end-user segmentation includes various industries such as Retail, Healthcare, Financial Services, Manufacturing, Education, and Others. Each sector has unique cybersecurity requirements based on the nature of their operations and the sensitivity of the data they handle.

The Thailand Cybersecurity for SMEs Market is characterized by a dynamic mix of regional and international players. Leading participants such as CyberTech Solutions, SecureNet Technologies, InfoGuard Systems, Thai Cybersecurity Group, Digital Shield Co., Ltd., CyberSafe Solutions, TechDefend Ltd., SecureSphere Technologies, CyberDefense Corp., ShieldPro Technologies, DataProtect Solutions, GuardIT Technologies, CyberGuardians Ltd., SafeNet Solutions, SecureWave Technologies contribute to innovation, geographic expansion, and service delivery in this space.

As Thailand's digital landscape continues to evolve, the demand for cybersecurity solutions among SMEs is expected to grow significantly. The increasing reliance on digital platforms and cloud services will drive the adoption of advanced cybersecurity technologies. Furthermore, the government's commitment to enhancing cybersecurity infrastructure will create a supportive environment for SMEs. In future, it is anticipated that SMEs will increasingly integrate cybersecurity into their overall business strategies, ensuring a more resilient approach to managing cyber risks and protecting sensitive information.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Retail Healthcare Financial Services Manufacturing Education Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Managed Services Training and Education |

| By Industry Vertical | Government Telecommunications Transportation Energy |

| By Company Size | Micro Enterprises Small Enterprises Medium Enterprises |

| By Geographic Region | Central Region Northern Region Northeastern Region Southern Region Eastern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Cybersecurity Practices | 100 | IT Managers, Operations Directors |

| Retail Sector Cybersecurity Awareness | 80 | Business Owners, Store Managers |

| Financial Services Cybersecurity Measures | 70 | Compliance Officers, Risk Managers |

| Healthcare Sector Data Protection Strategies | 60 | IT Security Officers, Healthcare Administrators |

| Technology Startups Cybersecurity Adoption | 90 | Founders, CTOs |

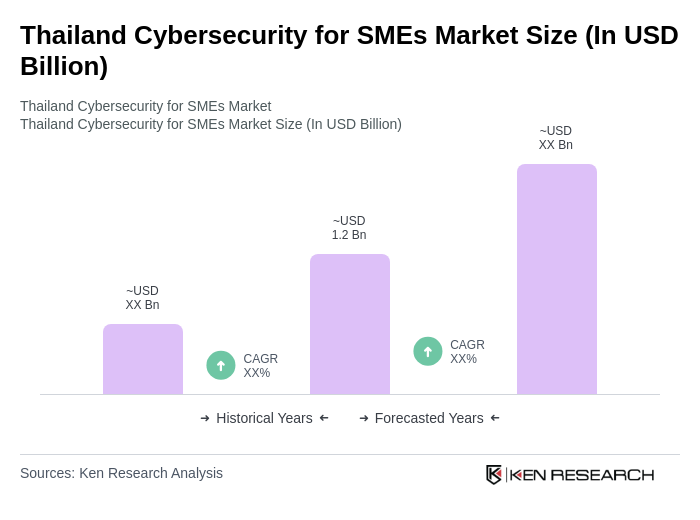

The Thailand Cybersecurity for SMEs Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing cyber threats, heightened awareness among SMEs, and government initiatives promoting digital transformation.