Region:Europe

Author(s):Geetanshi

Product Code:KRAB3326

Pages:80

Published On:October 2025

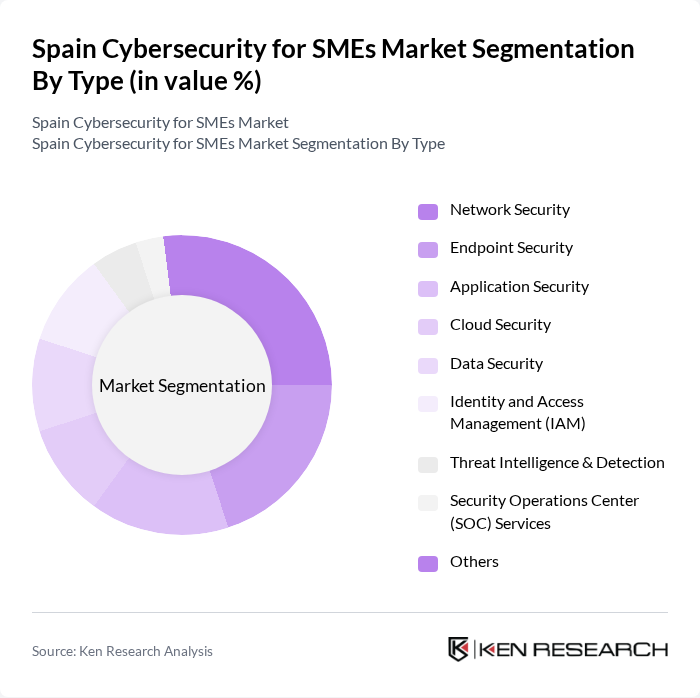

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management (IAM), Threat Intelligence & Detection, Security Operations Center (SOC) Services, and Others. Each of these sub-segments plays a crucial role in addressing specific security needs of SMEs. Network Security and Endpoint Security remain the most widely adopted, driven by the need to protect distributed workforces and remote access points. Cloud Security and IAM are rapidly growing segments, reflecting the shift to cloud-based operations and the need for robust access controls .

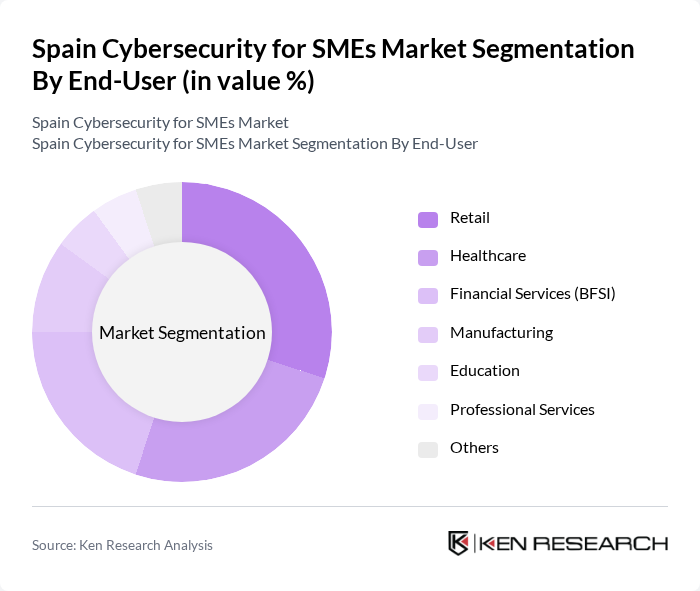

By End-User:The end-user segmentation includes Retail, Healthcare, Financial Services (BFSI), Manufacturing, Education, Professional Services, and Others. Each sector has unique cybersecurity requirements, influenced by the nature of their operations and the sensitivity of the data they handle. Retail and Healthcare are particularly prominent due to the high volume of personal and payment data processed, while Financial Services are driven by strict regulatory compliance. Manufacturing and Education are increasingly investing in cybersecurity as digitalization and remote learning expand their risk profiles .

The Spain Cybersecurity for SMEs Market is characterized by a dynamic mix of regional and international players. Leading participants such as S21Sec, Entelgy Innotec Security, Telefónica Tech (ElevenPaths), GMV, Tarlogic Security, Ackcent Cybersecurity, Panda Security (WatchGuard), Deloitte Spain (Cyber Risk), Accenture Security, IBM Security, Cisco Systems, Fortinet, Check Point Software Technologies, Palo Alto Networks, CrowdStrike, Kaspersky Lab, Trend Micro, Sophos, Proofpoint, CyberArk, Darktrace, Mimecast contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cybersecurity market for SMEs in Spain appears promising, driven by increasing investments in technology and a heightened focus on data protection. As digital transformation accelerates, SMEs will likely prioritize cybersecurity to safeguard their operations. Additionally, the collaboration between private sectors and government initiatives will foster innovation and enhance the overall security landscape, ensuring that SMEs can effectively combat emerging cyber threats while complying with regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management (IAM) Threat Intelligence & Detection Security Operations Center (SOC) Services Others |

| By End-User | Retail Healthcare Financial Services (BFSI) Manufacturing Education Professional Services Others |

| By Company Size | Micro Enterprises (1-9 employees) Small Enterprises (10-49 employees) Medium Enterprises (50-249 employees) Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Managed Security Services (MSSP) Security Training and Awareness Incident Response & Forensics Vulnerability Assessment & Penetration Testing Others |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain Canary Islands & Balearic Islands |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Payment Freemium/Trial Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing SMEs Cybersecurity Practices | 100 | IT Managers, Operations Directors |

| Retail SMEs Cybersecurity Awareness | 60 | Business Owners, Store Managers |

| Service Sector SMEs Cybersecurity Investments | 50 | Finance Managers, IT Consultants |

| Healthcare SMEs Cybersecurity Compliance | 40 | Compliance Officers, IT Security Leads |

| Technology Startups Cybersecurity Strategies | 70 | Founders, CTOs |

The Spain Cybersecurity for SMEs Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by increasing cyber threats, digital transformation, and regulatory compliance requirements among small and medium enterprises.