Region:Central and South America

Author(s):Rebecca

Product Code:KRAB6386

Pages:98

Published On:October 2025

Market.png)

By Type:

The market is segmented into various types, including Managed Detection and Response (MDR), Security Operations Center (SOC), Threat Intelligence Services, Incident Response Services, Vulnerability Management Services, Compliance Management Services, and Others. Among these, Managed Detection and Response (MDR) is the leading sub-segment, driven by the increasing need for proactive threat detection and response capabilities. Organizations are increasingly opting for MDR services to enhance their security posture and mitigate risks associated with cyber threats. The demand for SOC services is also significant, as businesses seek to establish dedicated teams for continuous monitoring and incident management.

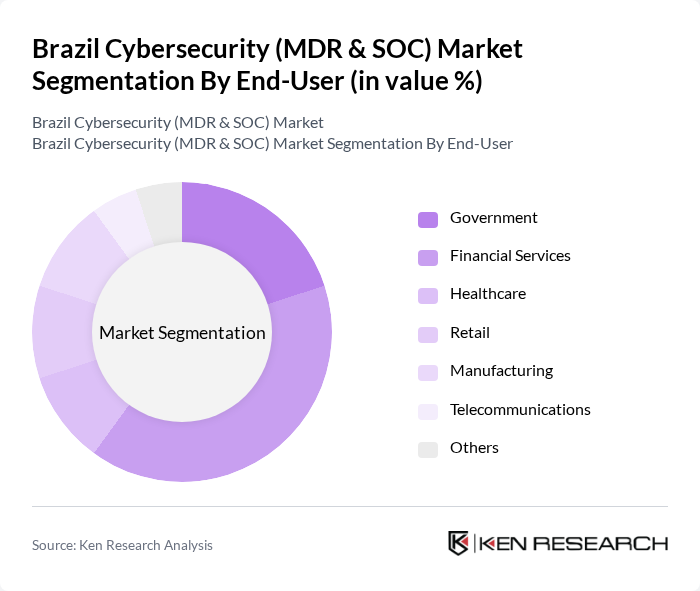

By End-User:

The end-user segmentation includes Government, Financial Services, Healthcare, Retail, Manufacturing, Telecommunications, and Others. The Financial Services sector is the dominant end-user, as financial institutions face heightened regulatory scrutiny and are prime targets for cyberattacks. This sector's significant investment in cybersecurity solutions is driven by the need to protect sensitive customer data and maintain trust. The Government sector also plays a crucial role, with increasing investments in cybersecurity to protect national infrastructure and sensitive information.

The Brazil Cybersecurity (MDR & SOC) Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Security, Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., McAfee Corp., Trend Micro Incorporated, FireEye, Inc., CrowdStrike Holdings, Inc., Splunk Inc., Rapid7, Inc., Secureworks Corp., Proofpoint, Inc., Bitdefender LLC, Kaspersky Lab contribute to innovation, geographic expansion, and service delivery in this space.

As Brazil continues to navigate the complexities of the digital landscape, the demand for cybersecurity solutions, particularly MDR and SOC services, is expected to grow significantly. The increasing sophistication of cyber threats and the need for compliance with stringent regulations will drive organizations to adopt advanced technologies. Furthermore, the integration of artificial intelligence and automation in cybersecurity practices will enhance threat detection and response capabilities, positioning Brazil as a key player in the global cybersecurity market.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed Detection and Response (MDR) Security Operations Center (SOC) Threat Intelligence Services Incident Response Services Vulnerability Management Services Compliance Management Services Others |

| By End-User | Government Financial Services Healthcare Retail Manufacturing Telecommunications Others |

| By Industry Vertical | Banking and Financial Services Energy and Utilities Education Transportation and Logistics Information Technology Others |

| By Service Model | On-Premises Cloud-Based Hybrid |

| By Deployment Type | Public Sector Private Sector |

| By Security Type | Network Security Endpoint Security Application Security Data Security |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Payment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity | 100 | Chief Information Security Officers, IT Security Managers |

| Healthcare Sector Cybersecurity | 80 | IT Directors, Compliance Officers |

| Retail Industry Cybersecurity | 70 | Security Analysts, Operations Managers |

| Government Cybersecurity Initiatives | 60 | Policy Makers, Cybersecurity Advisors |

| Telecommunications Cybersecurity | 90 | Network Security Engineers, Risk Management Officers |

The Brazil Cybersecurity (MDR & SOC) Market is valued at approximately USD 1.5 billion, driven by increasing cyber threats, regulatory compliance needs, and digital transformation initiatives across various sectors.