Region:Asia

Author(s):Rebecca

Product Code:KRAB6411

Pages:97

Published On:October 2025

Market.png)

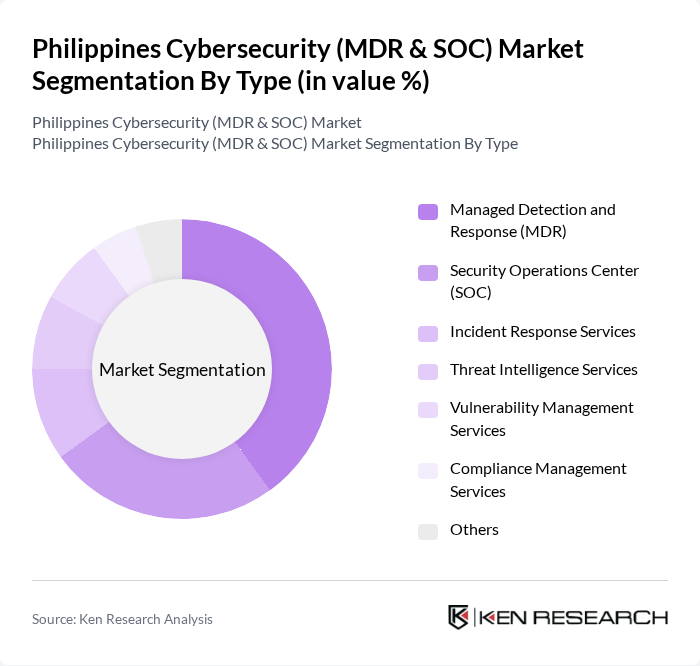

By Type:The market is segmented into various types, including Managed Detection and Response (MDR), Security Operations Center (SOC), Incident Response Services, Threat Intelligence Services, Vulnerability Management Services, Compliance Management Services, and Others. Among these, Managed Detection and Response (MDR) is the leading sub-segment due to its proactive approach in identifying and mitigating threats in real-time, which is increasingly favored by organizations looking to enhance their cybersecurity defenses.

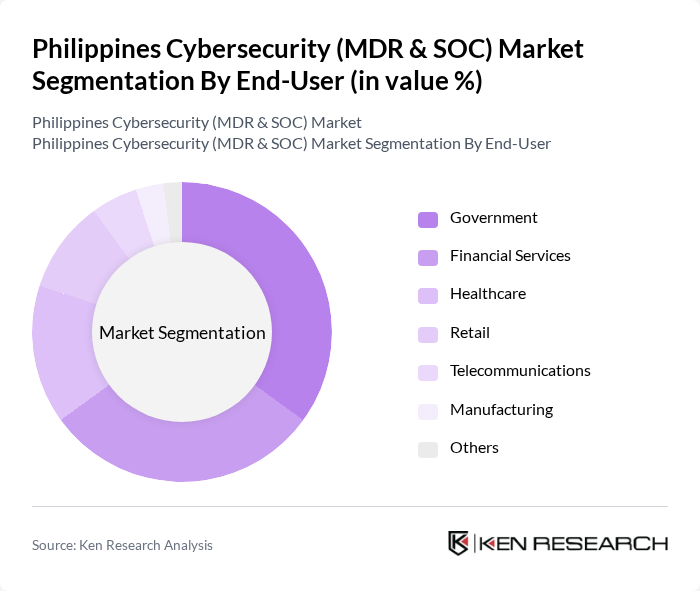

By End-User:The end-user segmentation includes Government, Financial Services, Healthcare, Retail, Telecommunications, Manufacturing, and Others. The Government sector is the largest end-user, driven by the need for enhanced security measures to protect sensitive data and critical infrastructure from cyber threats. Financial Services also represent a significant portion of the market due to stringent regulatory requirements and the high value of financial data.

The Philippines Cybersecurity (MDR & SOC) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trend Micro Incorporated, Palo Alto Networks, Inc., Fortinet, Inc., IBM Corporation, Cisco Systems, Inc., Check Point Software Technologies Ltd., McAfee Corp., CrowdStrike Holdings, Inc., FireEye, Inc., Sophos Group plc, Kaspersky Lab, RSA Security LLC, CyberArk Software Ltd., Proofpoint, Inc., Zscaler, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines cybersecurity market is poised for significant transformation, driven by technological advancements and increasing regulatory pressures. As businesses continue to embrace digital transformation, the demand for sophisticated cybersecurity solutions will rise. The integration of artificial intelligence and machine learning into security protocols is expected to enhance threat detection capabilities. Furthermore, the growing emphasis on compliance with data protection regulations will compel organizations to invest in more robust cybersecurity frameworks, ensuring a safer digital landscape for all stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed Detection and Response (MDR) Security Operations Center (SOC) Incident Response Services Threat Intelligence Services Vulnerability Management Services Compliance Management Services Others |

| By End-User | Government Financial Services Healthcare Retail Telecommunications Manufacturing Others |

| By Industry Vertical | BFSI Energy and Utilities Education Transportation and Logistics IT and Telecom Others |

| By Service Model | On-Premises Cloud-Based Hybrid |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud |

| By Sales Channel | Direct Sales Channel Partners Online Sales |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity Practices | 100 | IT Security Managers, Compliance Officers |

| Healthcare Cybersecurity Solutions | 80 | Chief Information Officers, Data Protection Officers |

| Government Cybersecurity Initiatives | 70 | Policy Makers, Cybersecurity Program Directors |

| Retail Sector Cyber Threat Management | 60 | Operations Managers, Risk Management Officers |

| Telecommunications Cybersecurity Strategies | 90 | Network Security Engineers, IT Directors |

The Philippines Cybersecurity (MDR & SOC) Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing cyber threats, digital technology adoption, and heightened awareness of cybersecurity among businesses and government entities.