Region:Middle East

Author(s):Rebecca

Product Code:KRAB6401

Pages:82

Published On:October 2025

Market.png)

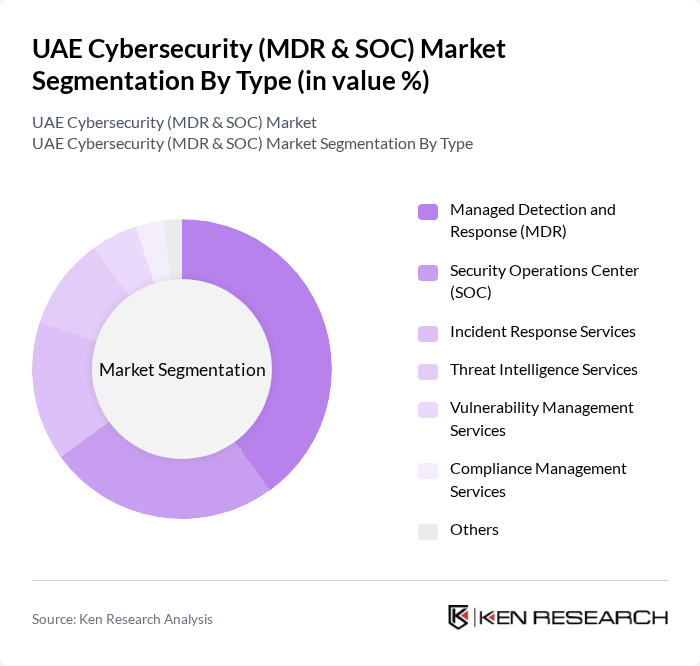

By Type:

The market is segmented into various types, including Managed Detection and Response (MDR), Security Operations Center (SOC), Incident Response Services, Threat Intelligence Services, Vulnerability Management Services, Compliance Management Services, and Others. Among these, Managed Detection and Response (MDR) is the leading sub-segment, driven by the increasing need for proactive threat detection and response capabilities. Organizations are increasingly adopting MDR services to enhance their security posture and mitigate risks associated with cyber threats. The growing complexity of cyberattacks and the shortage of skilled cybersecurity professionals further contribute to the demand for MDR solutions.

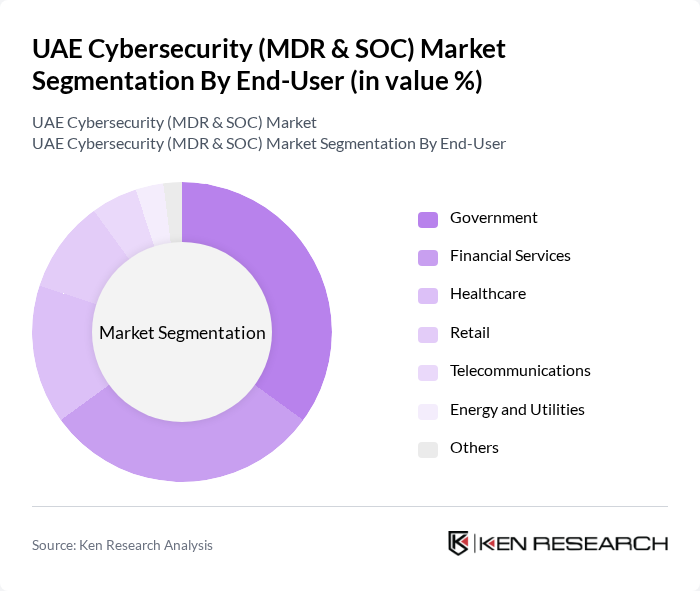

By End-User:

The end-user segmentation includes Government, Financial Services, Healthcare, Retail, Telecommunications, Energy and Utilities, and Others. The Government sector is the dominant end-user, driven by the need to protect sensitive data and critical infrastructure from cyber threats. The increasing digitization of government services and the implementation of national cybersecurity strategies have led to a surge in demand for cybersecurity solutions in this sector. Financial services also represent a significant portion of the market, as they require robust security measures to safeguard customer data and comply with regulatory requirements.

The UAE Cybersecurity (MDR & SOC) Market is characterized by a dynamic mix of regional and international players. Leading participants such as DarkMatter, Help AG, Paladion Networks, CyberKnight Technologies, Secureworks, IBM Security, Cisco Systems, Fortinet, Check Point Software Technologies, McAfee, Trend Micro, FireEye, Palo Alto Networks, CrowdStrike, Kaspersky Lab contribute to innovation, geographic expansion, and service delivery in this space.

As the UAE continues to prioritize digital transformation, the cybersecurity landscape is expected to evolve significantly. The integration of artificial intelligence and machine learning into cybersecurity solutions will enhance threat detection and response capabilities. Additionally, the increasing focus on data privacy regulations will drive organizations to adopt more robust security measures. The collaboration between local firms and international cybersecurity experts will further strengthen the market, fostering innovation and resilience against emerging threats.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed Detection and Response (MDR) Security Operations Center (SOC) Incident Response Services Threat Intelligence Services Vulnerability Management Services Compliance Management Services Others |

| By End-User | Government Financial Services Healthcare Retail Telecommunications Energy and Utilities Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Model | Consulting Services Managed Services Professional Services |

| By Industry Vertical | BFSI Government and Defense IT and Telecom Manufacturing Education Others |

| By Geographic Presence | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time Payment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 100 | Chief Information Security Officers, IT Security Managers |

| Healthcare Cybersecurity Solutions | 80 | Healthcare IT Directors, Compliance Officers |

| Government Cybersecurity Initiatives | 70 | Government IT Officials, Cybersecurity Policy Makers |

| Retail Sector Cybersecurity Practices | 60 | Retail IT Managers, Risk Management Officers |

| Telecommunications Cybersecurity Strategies | 90 | Network Security Engineers, Operations Managers |

The UAE Cybersecurity (MDR & SOC) Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing cyber threats, digital transformation initiatives, and heightened awareness of cybersecurity among businesses and government entities.