Region:Asia

Author(s):Rebecca

Product Code:KRAB6404

Pages:93

Published On:October 2025

Market.png)

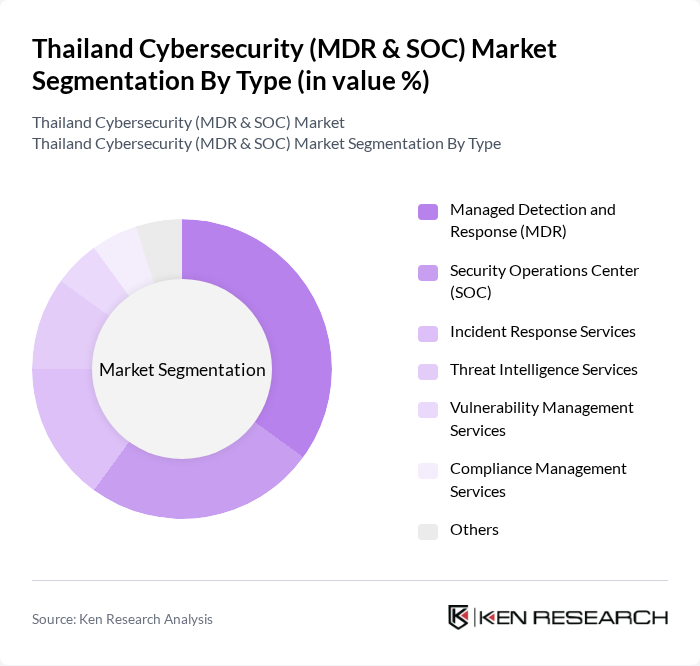

By Type:The market is segmented into various types, including Managed Detection and Response (MDR), Security Operations Center (SOC), Incident Response Services, Threat Intelligence Services, Vulnerability Management Services, Compliance Management Services, and Others. Among these, Managed Detection and Response (MDR) is gaining significant traction due to its proactive approach in identifying and mitigating threats in real-time. Organizations are increasingly opting for MDR services to enhance their security posture without the need for extensive in-house resources.

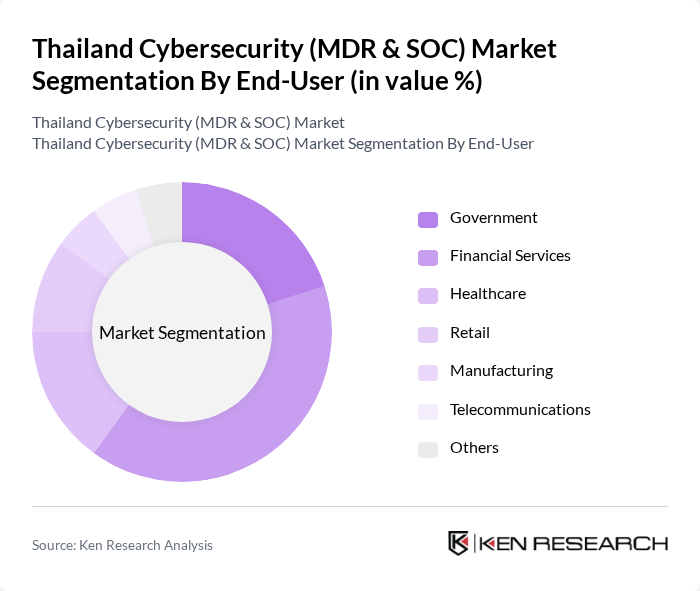

By End-User:The end-user segmentation includes Government, Financial Services, Healthcare, Retail, Manufacturing, Telecommunications, and Others. The Financial Services sector is the leading end-user, driven by the need for stringent security measures to protect sensitive financial data and comply with regulatory requirements. The increasing digitization of banking services and online transactions further fuels the demand for advanced cybersecurity solutions in this sector.

The Thailand Cybersecurity (MDR & SOC) Market is characterized by a dynamic mix of regional and international players. Leading participants such as CyberArk Software Inc., Palo Alto Networks Inc., Fortinet Inc., Check Point Software Technologies Ltd., IBM Security, McAfee Corp., Trend Micro Inc., FireEye Inc., Cisco Systems Inc., Splunk Inc., RSA Security LLC, CrowdStrike Holdings Inc., Zscaler Inc., Proofpoint Inc., Darktrace Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

As Thailand continues to navigate the complexities of the digital landscape, the demand for cybersecurity solutions is expected to intensify. The integration of artificial intelligence and machine learning into cybersecurity frameworks will enhance threat detection and response capabilities. Furthermore, the government's commitment to strengthening cybersecurity regulations will drive compliance efforts among businesses. This evolving landscape presents opportunities for innovation and investment, particularly in managed security services and cloud-based security solutions, positioning Thailand as a regional cybersecurity hub.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed Detection and Response (MDR) Security Operations Center (SOC) Incident Response Services Threat Intelligence Services Vulnerability Management Services Compliance Management Services Others |

| By End-User | Government Financial Services Healthcare Retail Manufacturing Telecommunications Others |

| By Industry Vertical | Banking, Financial Services, and Insurance (BFSI) Energy and Utilities Education Transportation and Logistics Information Technology Others |

| By Service Model | On-Premises Cloud-Based Hybrid |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time Payment |

| By Geographic Presence | Urban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 100 | IT Security Managers, Risk Assessment Officers |

| Healthcare Cybersecurity Solutions | 80 | Chief Information Officers, Compliance Officers |

| Manufacturing Sector Cyber Defense | 70 | Operations Managers, IT Directors |

| Government Cybersecurity Initiatives | 60 | Policy Makers, Cybersecurity Advisors |

| Retail Sector Cybersecurity Practices | 90 | Security Analysts, IT Managers |

The Thailand Cybersecurity (MDR & SOC) Market is valued at approximately USD 1.2 billion, driven by increasing cyber threats, digital transformation initiatives, and heightened awareness of data privacy regulations among businesses.